Instructions For Form 5434 - Application For Enrollment

ADVERTISEMENT

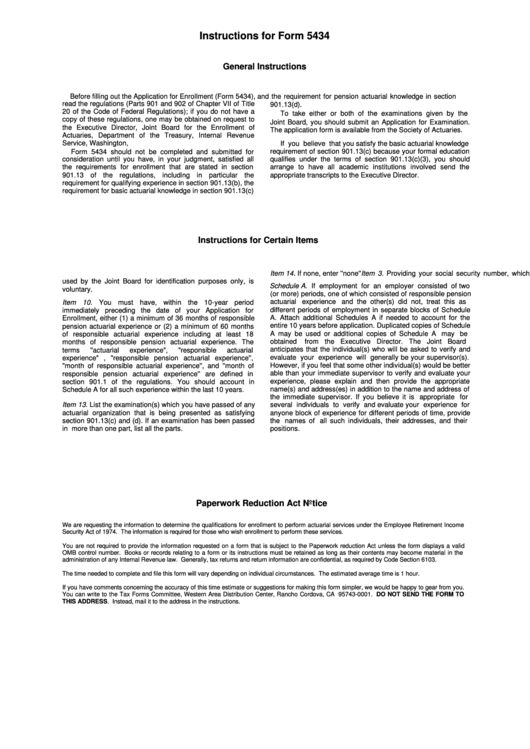

Instructions for Form 5434

General Instructions

Before filling out the Application for Enrollment (Form 5434),

and the requirement for pension actuarial knowledge in section

read the regulations (Parts 901 and 902 of Chapter VII of Title

901.13(d).

20 of the Code of Federal Regulations); if you do not have a

To take either or both of the examinations given by the

copy of these regulations, one may be obtained on request to

Joint Board, you should submit an Application for Examination.

the Executive Director, Joint Board for the Enrollment of

The application form is available from the Society of Actuaries.

Actuaries, Department of the Treasury, Internal Revenue

Service, Washington, D.C. 20224.

If you believe that you satisfy the basic actuarial knowledge

requirement of section 901.13(c) because your formal education

Form 5434 should not be completed and submitted for

consideration until you have, in your judgment, satisfied all

qualifies under the terms of section 901.13(c)(3), you should

the requirements for enrollment that are stated in section

arrange to have all academic institutions involved send the

901.13 of the regulations, including in particular the

appropriate transcripts to the Executive Director.

requirement for qualifying experience in section 901.13(b), the

requirement for basic actuarial knowledge in section 901.13(c)

Instructions for Certain Items

Item 3. Providing your social security number, which will be

Item 14. If none, enter ''none''

used by the Joint Board for identification purposes only, is

Schedule A. If employment for an employer consisted of two

voluntary.

(or more) periods, one of which consisted of responsible pension

actuarial

experience

and the other(s) did not, treat this as

Item 10. You must have, within the 10-year period

different periods of employment in separate blocks of Schedule

immediately preceding the date of your Application for

A. Attach additional Schedules A if needed to account for the

Enrollment, either (1) a minimum of 36 months of responsible

entire 10 years before application. Duplicated copies of Schedule

pension actuarial experience or (2) a minimum of 60 months

A may be used or additional copies of Schedule A may be

of responsible actuarial experience including at least 18

obtained

from the Executive Director. The Joint Board

months of responsible pension actuarial experience. The

anticipates that the individual(s) who will be asked to verify and

terms

''actuarial

experience",

"responsible

actuarial

evaluate your experience will generally be your supervisor(s).

experience" , "responsible pension actuarial experience'',

However, if you feel that some other individual(s) would be better

"month of responsible actuarial experience'', and ''month of

able than your immediate supervisor to verify and evaluate your

responsible pension actuarial experience'' are defined in

experience, please explain and then provide the appropriate

section 901.1 of the regulations. You should account in

name(s) and address(es) in addition to the name and address of

Schedule A for all such experience within the last 10 years.

the immediate supervisor. If you believe it is appropriate for

Item 13. List the examination(s) which you have passed of any

several individuals to verify and evaluate your experience for

actuarial organization that is being presented as satisfying

anyone block of experience for different periods of time, provide

section 901.13(c) and (d). If an examination has been passed

the names of all such individuals, their addresses, and their

in more than one part, list all the parts.

positions.

Paperwork Reduction Act Notice

We are requesting the information to determine the qualifications for enrollment to perform actuarial services under the Employee Retirement Income

Security Act of 1974. The information is required for those who wish enrollment to perform these services.

You are not required to provide the information requested on a form that is subject to the Paperwork reduction Act unless the form displays a valid

OMB control number. Books or records relating to a form or its instructions must be retained as long as their contents may become material in the

administration of any Internal Revenue law. Generally, tax returns and return information are confidential, as required by Code Section 6103.

The time needed to complete and file this form will vary depending on individual circumstances. The estimated average time is 1 hour.

If you have comments concerning the accuracy of this time estimate or suggestions for making this form simpler, we would be happy to gear from you.

You can write to the Tax Forms Committee, Western Area Distribution Center, Rancho Cordova, CA 95743-0001. DO NOT SEND THE FORM TO

THIS ADDRESS. Instead, mail it to the address in the instructions.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1