Form Rp-305-R - Agricultural Assessment Renewal Application - Nys Board Of Real Property Services

ADVERTISEMENT

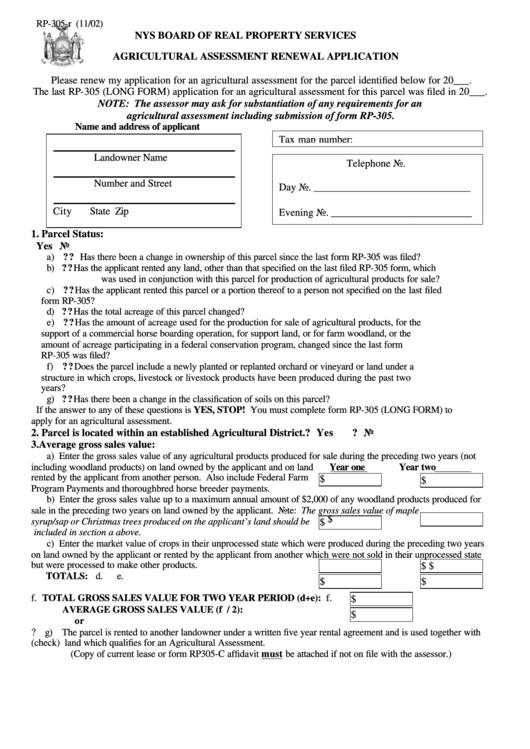

RP-305-r (11/02)

NYS BOARD OF REAL PROPERTY SERVICES

AGRICULTURAL ASSESSMENT RENEWAL APPLICATION

Please renew my application for an agricultural assessment for the parcel identified below for 20___.

The last RP-305 (LONG FORM) application for an agricultural assessment for this parcel was filed in 20___.

NOTE: The assessor may ask for substantiation of any requirements for an

agricultural assessment including submission of form RP-305.

Name and address of applicant

Tax map number:

Landowner Name

Telephone No.

Number and Street

Day No. ______________________________

City

State

Zip

Evening No. ___________________________

1. Parcel Status:

Yes No

a) ?

?

Has there been a change in ownership of this parcel since the last form RP -305 was filed?

b) ?

?

Has the applicant rented any la nd, other than that specified on the last filed RP-305 form, which

was used in conjunction with this parcel for production of agricultural products for sale?

c) ?

?

Has the applicant rented this parcel or a portion thereof to a person not specified on the last filed

form RP-305?

d) ?

?

Has the total acreage of this parcel changed?

e) ?

?

Has the amount of acreage used for the production for sale of agricultural products, for the

support of a commercial horse boarding operation, for support land, or for farm woodland, or the

amount of acreage participating in a federal conservation program, changed since the last form

RP-305 was filed?

f) ?

?

Does the parcel include a newly planted or replanted orchard or vineyard or land under a

structure in which crops, livestock or livestock products have been produced during the past two

years?

g) ?

?

Has there been a change in the classification of soils on this parcel?

If the answer to any of these questions is YES, STOP! You must complete form RP-305 (LONG FORM) to

apply for an agricultural assessment.

2. Parcel is located within an established Agricultural District.

? Yes

? No

3. Average gross sales value:

a) Enter the gross sales value of any agricultural products produced for sale during the preceding two years (not

including woodland products) on land owned by the applicant and on land

Year one

Year two

rented by the applicant from another person. Also include Federal Farm

$

$

Program Payments and thoroughbred horse breeder payments.

b) Enter the gross sales value up to a maximum annual amount of $2,000 of any woodland products produced for

sale in the preceding two years on land owned by the applicant. Note: The gross sales value of maple

$

syrup/sap or Christmas trees produced on the applicant’s land should be

$

included in section a above.

c) Enter the market value of crops in their unprocessed state which were produced during the preceding two years

on land owned by the applicant or rented by the applicant from another which were not sold in their unprocessed state

but were processed to make other products.

$

$

TOTALS:

d.

e.

$

$

f. TOTAL GROSS SALES VALUE FOR TWO YEAR PERIOD (d+e):

f.

$

AVERAGE GROSS SALES VALUE (f / 2):

$

or

?

g) The parcel is rented to another landowner under a written five year rental agreement and is used together with

(check) land which qualifies for an Agricultural Assessment.

(Copy of current lease or form RP305-C affidavit must be attached if not on file with the assessor.)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2