Form Rp-462 - Application For Exemption From Real Property Taxes For Property Used As Residence Of Officiating Clergy ("Parsonage" Or "Manse") - Nys Board Of Real Property Services

ADVERTISEMENT

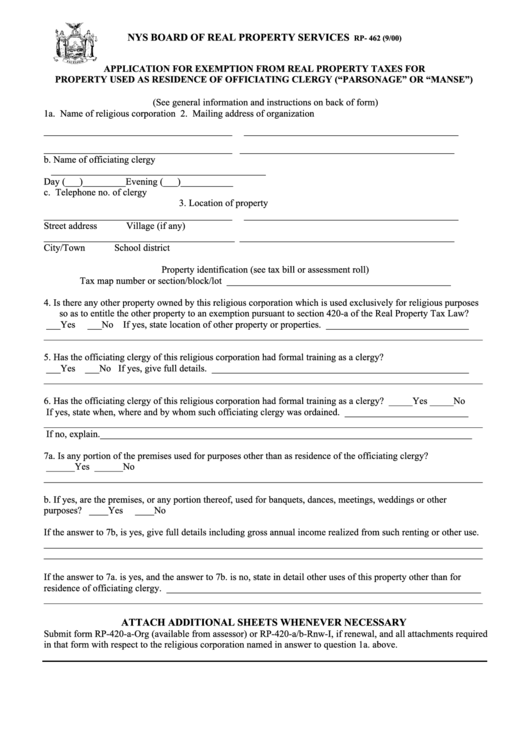

NYS BOARD OF REAL PROPERTY SERVICES

RP- 462 (9/00)

APPLICATION FOR EXEMPTION FROM REAL PROPERTY TAXES FOR

PROPERTY USED AS RESIDENCE OF OFFICIATING CLERGY (“PARSONAGE” OR “MANSE”)

(See general information and instructions on back of form)

1a. Name of religious corporation

2. Mailing address of organization

____________________________________

_________________________________________

____________________________________

_________________________________________

b. Name of officiating clergy

_____________________________________________

Day (___)_________Evening (___)___________

c. Telephone no. of clergy

3. Location of property

____________________________________

_________________________________________

Street address

Village (if any)

________________________________________

_____________________________________________

City/Town

School district

Property identification (see tax bill or assessment roll)

Tax map number or section/block/lot _______________________________________________

4. Is there any other property owned by this religious corporation which is used exclusively for religious purposes

so as to entitle the other property to an exemption pursuant to section 420-a of the Real Property Tax Law?

___Yes

___No If yes, state location of other property or properties. ______________________________

____________________________________________________________________________________________

5. Has the officiating clergy of this religious corporation had formal training as a clergy?

___Yes ___No If yes, give full details. ______________________________________________________

____________________________________________________________________________________________

6. Has the officiating clergy of this religious corporation had formal training as a clergy? _____Yes _____No

If yes, state when, where and by whom such officiating clergy was ordained. __________________________

____________________________________________________________________________________________

If no, explain.______________________________________________________________________________

7a. Is any portion of the premises used for purposes other than as residence of the officiating clergy?

______Yes ______No

____________________________________________________________________________________________

b.

If yes, are the premises, or any portion thereof, used for banquets, dances, meetings, weddings or other

purposes? ____Yes

____No

If the answer to 7b, is yes, give full details including gross annual income realized from such renting or other use.

____________________________________________________________________________________________

____________________________________________________________________________________________

If the answer to 7a. is yes, and the answer to 7b. is no, state in detail other uses of this property other than for

residence of officiating clergy. __________________________________________________________________

____________________________________________________________________________________________

ATTACH ADDITIONAL SHEETS WHENEVER NECESSARY

Submit form RP-420-a-Org (available from assessor) or RP-420-a/b-Rnw-I, if renewal, and all attachments required

in that form with respect to the religious corporation named in answer to question 1a. above.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2