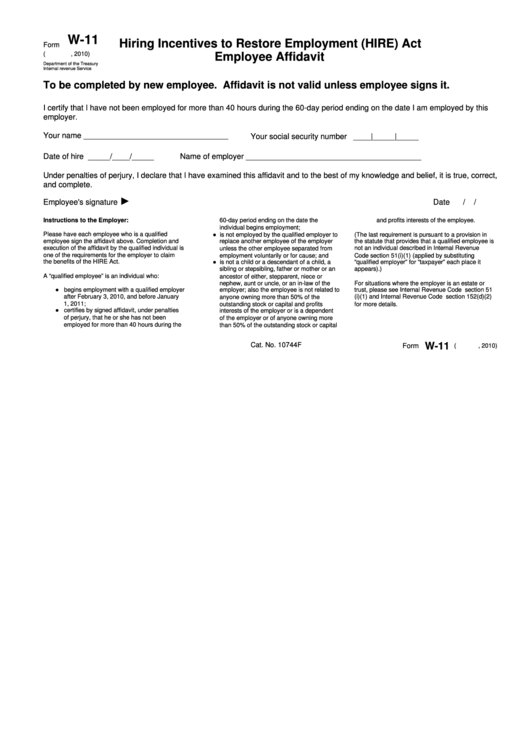

W-11

Hiring Incentives to Restore Employment (HIRE) Act

Form

(

, 2010)

Employee Affidavit

Department of the Treasury

Internal revenue Service

To be completed by new employee. Affidavit is not valid unless employee signs it.

I certify that I have not been employed for more than 40 hours during the 60-day period ending on the date I am employed by this

employer.

Your name _________________________________

Your social security number ____|_____|_____

Name of employer ________________________________________

Date of hire _____/____/_____

Under penalties of perjury, I declare that I have examined this affidavit and to the best of my knowledge and belief, it is true, correct,

and complete.

►

Employee's signature

Date

/

/

Instructions to the Employer:

60-day period ending on the date the

and profits interests of the employee.

individual begins employment;

● is not employed by the qualified employer to

Please have each employee who is a qualified

(The last requirement is pursuant to a provision in

employee sign the affidavit above. Completion and

the statute that provides that a qualified employee is

replace another employee of the employer

execution of the affidavit by the qualified individual is

unless the other employee separated from

not an individual described in Internal Revenue

one of the requirements for the employer to claim

employment voluntarily or for cause; and

Code section 51(i)(1) (applied by substituting

● is not a child or a descendant of a child, a

the benefits of the HIRE Act.

“qualified employer” for “taxpayer” each place it

sibling or stepsibling, father or mother or an

appears).)

A “qualified employee” is an individual who:

ancestor of either, stepparent, niece or

For situations where the employer is an estate or

nephew, aunt or uncle, or an in-law of the

● begins employment with a qualified employer

trust, please see Internal Revenue Code section 51

employer; also the employee is not related to

after February 3, 2010, and before January

(i)(1) and Internal Revenue Code section 152(d)(2)

anyone owning more than 50% of the

1, 2011;

outstanding stock or capital and profits

for more details.

● certifies by signed affidavit, under penalties

interests of the employer or is a dependent

of perjury, that he or she has not been

of the employer or of anyone owning more

employed for more than 40 hours during the

than 50% of the outstanding stock or capital

W-11

Cat. No. 10744F

(

, 2010)

Form

1

1