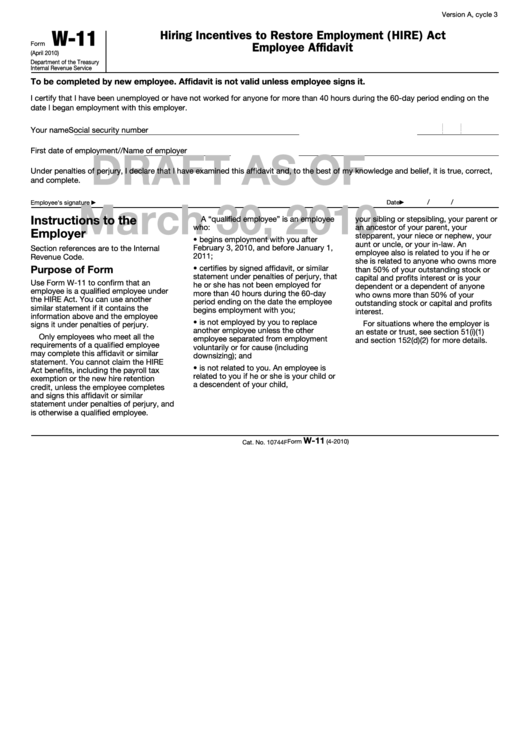

Form W-11 Draft - Hiring Incentives To Restore Employment (Hire) Act Employee Affidavit

ADVERTISEMENT

Version A, cycle 3

W-11

Hiring Incentives to Restore Employment (HIRE) Act

Form

Employee Affidavit

(April 2010)

Department of the Treasury

Internal Revenue Service

To be completed by new employee. Affidavit is not valid unless employee signs it.

I certify that I have been unemployed or have not worked for anyone for more than 40 hours during the 60-day period ending on the

date I began employment with this employer.

Your name

Social security number

DRAFT AS OF

First date of employment

/

/

Name of employer

Under penalties of perjury, I declare that I have examined this affidavit and, to the best of my knowledge and belief, it is true, correct,

and complete.

March 30, 2010

/

/

Date

Employee's signature

▶

▶

Instructions to the

A “qualified employee” is an employee

your sibling or stepsibling, your parent or

who:

an ancestor of your parent, your

Employer

stepparent, your niece or nephew, your

• begins employment with you after

aunt or uncle, or your in-law. An

February 3, 2010, and before January 1,

Section references are to the Internal

employee also is related to you if he or

2011;

Revenue Code.

she is related to anyone who owns more

Purpose of Form

• certifies by signed affidavit, or similar

than 50% of your outstanding stock or

statement under penalties of perjury, that

capital and profits interest or is your

Use Form W-11 to confirm that an

he or she has not been employed for

dependent or a dependent of anyone

employee is a qualified employee under

more than 40 hours during the 60-day

who owns more than 50% of your

the HIRE Act. You can use another

period ending on the date the employee

outstanding stock or capital and profits

similar statement if it contains the

begins employment with you;

interest.

information above and the employee

• is not employed by you to replace

For situations where the employer is

signs it under penalties of perjury.

another employee unless the other

an estate or trust, see section 51(i)(1)

Only employees who meet all the

employee separated from employment

and section 152(d)(2) for more details.

requirements of a qualified employee

voluntarily or for cause (including

may complete this affidavit or similar

downsizing); and

statement. You cannot claim the HIRE

• is not related to you. An employee is

Act benefits, including the payroll tax

related to you if he or she is your child or

exemption or the new hire retention

a descendent of your child,

credit, unless the employee completes

and signs this affidavit or similar

statement under penalties of perjury, and

is otherwise a qualified employee.

W-11

Form

(4-2010)

Cat. No. 10744F

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1