Form L-1040es - Estimated Tax Declaration-Voucher - City Of Lapeer

ADVERTISEMENT

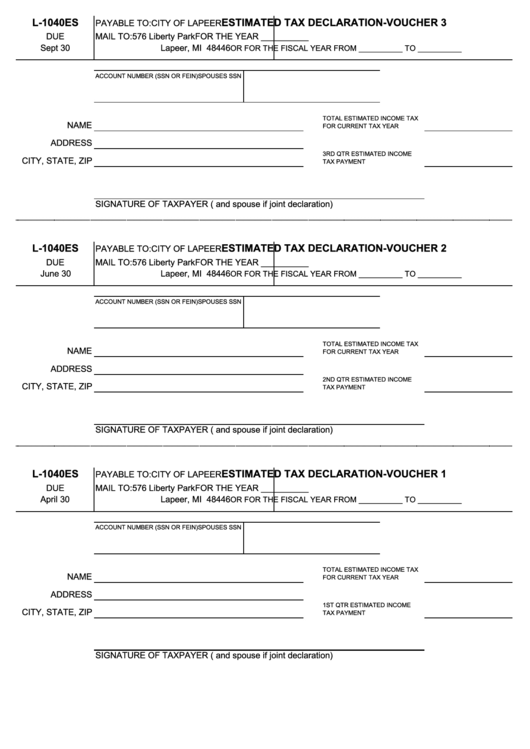

L-1040ES

ESTIMATED TAX DECLARATION-VOUCHER 3

PAYABLE TO: CITY OF LAPEER

DUE

MAIL TO:

576 Liberty Park

FOR THE YEAR __________

Sept 30

Lapeer, MI 48446

OR FOR THE FISCAL YEAR FROM __________ TO __________

ACCOUNT NUMBER (SSN OR FEIN)

SPOUSES SSN

TOTAL ESTIMATED INCOME TAX

NAME

FOR CURRENT TAX YEAR

ADDRESS

3RD QTR ESTIMATED INCOME

CITY, STATE, ZIP

TAX PAYMENT

SIGNATURE OF TAXPAYER ( and spouse if joint declaration)

L-1040ES

ESTIMATED TAX DECLARATION-VOUCHER 2

PAYABLE TO: CITY OF LAPEER

DUE

MAIL TO:

576 Liberty Park

FOR THE YEAR __________

June 30

Lapeer, MI 48446

OR FOR THE FISCAL YEAR FROM __________ TO __________

ACCOUNT NUMBER (SSN OR FEIN)

SPOUSES SSN

TOTAL ESTIMATED INCOME TAX

NAME

FOR CURRENT TAX YEAR

ADDRESS

2ND QTR ESTIMATED INCOME

CITY, STATE, ZIP

TAX PAYMENT

SIGNATURE OF TAXPAYER ( and spouse if joint declaration)

L-1040ES

ESTIMATED TAX DECLARATION-VOUCHER 1

PAYABLE TO: CITY OF LAPEER

DUE

MAIL TO:

576 Liberty Park

FOR THE YEAR __________

April 30

Lapeer, MI 48446

OR FOR THE FISCAL YEAR FROM __________ TO __________

ACCOUNT NUMBER (SSN OR FEIN)

SPOUSES SSN

TOTAL ESTIMATED INCOME TAX

NAME

FOR CURRENT TAX YEAR

ADDRESS

1ST QTR ESTIMATED INCOME

CITY, STATE, ZIP

TAX PAYMENT

SIGNATURE OF TAXPAYER ( and spouse if joint declaration)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2