Form Ct-1120esa - Connecticut Corporation Business Tax

ADVERTISEMENT

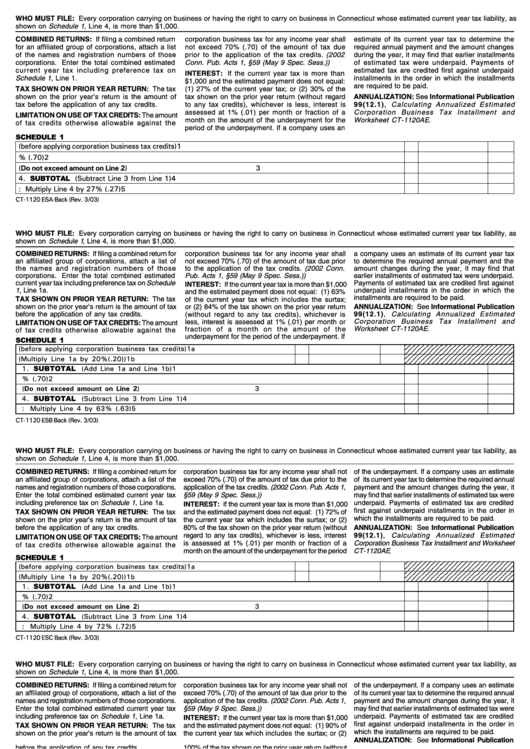

WHO MUST FILE: Every corporation carrying on business or having the right to carry on business in Connecticut whose estimated current year tax liability, as

shown on Schedule 1 , Line 4, is more than $1,000.

COMBINED RETURNS: If filing a combined return

corporation business tax for any income year shall

estimate of its current year tax to determine the

for an affiliated group of corporations, attach a list

not exceed 70% (.70) of the amount of tax due

required annual payment and the amount changes

of the names and registration numbers of those

prior to the application of the tax credits. (2002

during the year, it may find that earlier installments

Conn. Pub. Acts 1, §59 (May 9 Spec. Sess.))

corporations. Enter the total combined estimated

of estimated tax were underpaid. Payments of

current year tax including preference tax on

estimated tax are credited first against underpaid

INTEREST: If the current year tax is more than

Schedule 1 , Line 1.

installments in the order in which the installments

$1,000 and the estimated payment does not equal:

are required to be paid.

TAX SHOWN ON PRIOR YEAR RETURN: The tax

(1) 27% of the current year tax; or (2) 30% of the

shown on the prior year’s return is the amount of

tax shown on the prior year return (without regard

ANNUALIZATION: See Informational Publication

tax before the application of any tax credits.

to any tax credits), whichever is less, interest is

99(12.1), Calculating Annualized Estimated

assessed at 1% (.01) per month or fraction of a

Corporation Business Tax Installment and

LIMITATION ON USE OF TAX CREDITS: The amount

month on the amount of the underpayment for the

Worksheet CT-1120AE .

of tax credits otherwise allowable against the

period of the underpayment. If a company uses an

SCHEDULE 1

1. Estimated current year tax (before applying corporation business tax credits)

1

2. Multiply Line 1 by 70% (.70)

2

3. Estimated corporation business tax credits (Do not exceed amount on Line 2)

3

SUBTOTAL

4.

(Subtract Line 3 from Line 1)

4

5. Current year first installment: Multiply Line 4 by 27% (.27)

5

CT-1120 ESA Back (Rev. 3/03)

WHO MUST FILE: Every corporation carrying on business or having the right to carry on business in Connecticut whose estimated current year tax liability, as

shown on Schedule 1 , Line 4, is more than $1,000.

COMBINED RETURNS: If filing a combined return for

corporation business tax for any income year shall

a company uses an estimate of its current year tax

an affiliated group of corporations, attach a list of

not exceed 70% (.70) of the amount of tax due prior

to determine the required annual payment and the

to the application of the tax credits. (2002 Conn.

the names and registration numbers of those

amount changes during the year, it may find that

corporations. Enter the total combined estimated

Pub. Acts 1, §59 (May 9 Spec. Sess.))

earlier installments of estimated tax were underpaid.

current year tax including preference tax on Schedule

Payments of estimated tax are credited first against

INTEREST: If the current year tax is more than $1,000

1 , Line 1a.

underpaid installments in the order in which the

and the estimated payment does not equal: (1) 63%

installments are required to be paid.

TAX SHOWN ON PRIOR YEAR RETURN: The tax

of the current year tax which includes the surtax;

shown on the prior year’s return is the amount of tax

ANNUALIZATION: See Informational Publication

or (2) 84% of the tax shown on the prior year return

before the application of any tax credits.

99(12.1), Calculating Annualized Estimated

(without regard to any tax credits), whichever is

Corporation Business Tax Installment and

less, interest is assessed at 1% (.01) per month or

LIMITATION ON USE OF TAX CREDITS: The amount

Worksheet CT-1120AE .

fraction of a month on the amount of the

of tax credits otherwise allowable against the

underpayment for the period of the underpayment. If

SCHEDULE 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1a. Estimated current year tax (before applying corporation business tax credits) 1a

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1b. Surtax (Multiply Line 1a by 20%(.20))

1b

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1. SUBTOTAL (Add Line 1a and Line 1b)

1

2. Multiply Line 1 by 70% (.70)

2

3. Estimated corporation business tax credits (Do not exceed amount on Line 2)

3

4. SUBTOTAL (Subtract Line 3 from Line 1)

4

5. Current year second installment: Multiply Line 4 by 63% (.63)

5

CT-1120 ESB Back (Rev. 3/03)

WHO MUST FILE: Every corporation carrying on business or having the right to carry on business in Connecticut whose estimated current year tax liability, as

shown on Schedule 1 , Line 4, is more than $1,000.

COMBINED RETURNS: If filing a combined return for

corporation business tax for any income year shall not

of the underpayment. If a company uses an estimate

an affiliated group of corporations, attach a list of the

exceed 70% (.70) of the amount of tax due prior to the

of its current year tax to determine the required annual

names and registration numbers of those corporations.

application of the tax credits. (2002 Conn. Pub. Acts 1,

payment and the amount changes during the year, it

Enter the total combined estimated current year tax

§59 (May 9 Spec. Sess.))

may find that earlier installments of estimated tax were

including preference tax on Schedule 1 , Line 1a.

underpaid. Payments of estimated tax are credited

INTEREST: If the current year tax is more than $1,000

first against underpaid installments in the order in

TAX SHOWN ON PRIOR YEAR RETURN: The tax

and the estimated payment does not equal: (1) 72% of

which the installments are required to be paid.

shown on the prior year’s return is the amount of tax

the current year tax which includes the surtax; or (2)

before the application of any tax credits.

80% of the tax shown on the prior year return (without

ANNUALIZATION: See Informational Publication

regard to any tax credits), whichever is less, interest

99(12.1), Calculating Annualized Estimated

LIMITATION ON USE OF TAX CREDITS: The amount

is assessed at 1% (.01) per month or fraction of a

Corporation Business Tax Installment and Worksheet

of tax credits otherwise allowable against the

CT-1120AE .

month on the amount of the underpayment for the period

SCHEDULE 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1a. Estimated current year tax (before applying corporation business tax credits) 1a

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1b. Surtax (Multiply Line 1a by 20%(.20))

1b

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1. SUBTOTAL (Add Line 1a and Line 1b)

1

2. Multiply Line 1 by 70% (.70)

2

3. Estimated corporation business tax credits (Do not exceed amount on Line 2)

3

4. SUBTOTAL (Subtract Line 3 from Line 1)

4

5. Current year third installment: Multiply Line 4 by 72% (.72)

5

CT-1120 ESC Back (Rev. 3/03)

WHO MUST FILE: Every corporation carrying on business or having the right to carry on business in Connecticut whose estimated current year tax liability, as

shown on Schedule 1 , Line 4, is more than $1,000.

COMBINED RETURNS: If filing a combined return for

corporation business tax for any income year shall not

of the underpayment. If a company uses an estimate

an affiliated group of corporations, attach a list of the

exceed 70% (.70) of the amount of tax due prior to the

of its current year tax to determine the required annual

application of the tax credits. (2002 Conn. Pub. Acts 1,

names and registration numbers of those corporations.

payment and the amount changes during the year, it

Enter the total combined estimated current year tax

§59 (May 9 Spec. Sess.))

may find that earlier installments of estimated tax were

including preference tax on Schedule 1 , Line 1a.

underpaid. Payments of estimated tax are credited

INTEREST: If the current year tax is more than $1,000

first against underpaid installments in the order in

TAX SHOWN ON PRIOR YEAR RETURN: The tax

and the estimated payment does not equal: (1) 90% of

which the installments are required to be paid.

shown on the prior year’s return is the amount of tax

the current year tax which includes the surtax; or (2)

ANNUALIZATION: See Informational Publication

before the application of any tax credits.

100% of the tax shown on the prior year return (without

99(12.1), Calculating Annualized Estimated

regard to any tax credits), whichever is less, interest

LIMITATION ON USE OF TAX CREDITS: The amount

Corporation Business Tax Installment and Worksheet

is assessed at 1% (.01) per month or fraction of a

of tax credits otherwise allowable against the

CT-1120AE .

month on the amount of the underpayment for the period

SCHEDULE 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1a. Estimated current year tax (before applying corporation business tax credits) 1a

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1b. Surtax (Multiply Line 1a by 20%(.20))

1b

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1. SUBTOTAL (Add Line 1a and Line 1b)

1

2. Multiply Line 1 by 70% (.70)

2

3. Estimated corporation business tax credits (Do not exceed amount on Line 2)

3

4. SUBTOTAL (Subtract Line 3 from Line 1)

4

5. Current year fourth installment: Multiply Line 4 by 90% (.90)

5

CT-1120 ESD Back (Rev. 3/03)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1