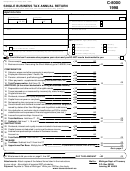

Form C-8000 - Single Business Tax Annual Return - 1999 Page 2

ADVERTISEMENT

Federal Employer Identification Number

TAX BASE

.00

34

What amount did you enter on line 32 or 33 (whichever applies)?

34

ADJUSTMENTS

.00

35

Capital acquisition deduction (C-8000D, line 7 or 8, whichever applies)

35

.00

36

Recapture of capital acquisition deduction (from form C-8000D, line 26)

36

.00

37

Net capital acquisition deduction. Subtract line 36 from line 35

37

NOTE: A negative amount on line 37 will increase your tax base.

38

ADJUSTED TAX BASE BEFORE loss deduction and statutory exemption.

.00

Subtract (if negative add) line 37 from line 34

38

If negative, this is a business loss carryforward; do not complete lines 39 through 50.

.00

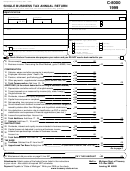

39

Business loss deduction

39

.00

Adjusted Tax Base Before Statutory Exemption. Subtract line 39 from line 38

40

40

STATUTORY EXEMPTION Complete and attach the Statutory Exemption Schedule (form C-8043).

.00

41

Allowable statutory exemption (from form C-8043, line 16)

41

a

.00

42

Adjusted Tax Base. Subtract line 41 from line 40. Check if C-8000G is attached

42

REDUCTIONS, CREDITS, TAX

.00

43

Reduction to adjusted tax base, if applicable (see instructions for form C-8000S)

43

44

Taxable base. Subtract line 43 from line 42. If you used the gross receipts short-method,

.00

enter the amount from form C-8000S, line 14

44

.00

45

Tax Before Credits. Multiply line 44 by 2.2% (.022). Fiscal or short period filers see page 3

45

The small business and contribution credits are computed on form C-8000C, and/or C-8009 . Complete the C-8000C

and/or C-8009 before continuing. If you are not filing a C-8000C or C-8009, enter the amount from line 45 on line 46.

.00

46

Enter the amount from form C-8000, line 45, C-8000C, line 19, 26 or 36, or C-8009, line 33 or 34

46

.00

47

Unincorporated/S-corp. credit. Multiply line 46 by percent from page 14

47

.00

48

Nonrefundable credits from C-8000MC, line 66 or 72

48

.00

49

Add lines 47 and 48

49

.00

50

Tax After Nonrefundable Credits. Subtract line 49 from line 46

50

PAYMENTS AND TAX DUE

.00

51

Overpayment credited from 1998

51

.00

52

Estimated tax payments

52

.00

53

Tax paid with request for extension

53

.00

54

Refundable credits from C-8000MC, line 10

54

.00

55

Total. Add lines 51 - 54

55

.00

56

TAX DUE. Subtract line 55 from line 50. If less than zero, leave blank

56

.00

57

Underpaid estimate penalty and interest from form C-8020, line 28 or 38 whichever applies

57

.00

.00

.00

58

Annual return penalty at

% =

and interest =

58

.00

59

Payment Due. Add lines 56 - 58. Enter this amount on page 1, line 63

59

YOUR REFUND or OVERPAYMENT

.00

60

Overpayment. Subtract line 50 (and any penalty and interest due on lines 57 and 58) from line 55

60

.00

61

How much of the amount on line 60 do you want refunded to you?

61

.00

62

How much of the amount on line 60 do you want credited forward?

62

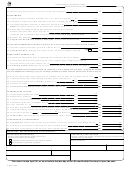

SIGNATURE, DECLARATION AND AUTHORIZATION

TAXPAYER'S DECLARATION

PREPARER'S DECLARATION

I declare, under penalty of perjury, that this return is true

I declare, under penalty of perjury, that this return is based on all information

and correct to the best of my knowledge.

of which I have any knowledge.

Preparer's Signature

I authorize Treasury to discuss my return with my preparer.

Do not discuss my return with my preparer.

Taxpayer's Signature

Print or Type Preparer's Name

Date

Date

Print or Type Taxpayer's Name

Business Address, Phone and Identification Number

Title

This return is due April 30, or on or before the last day of the 4th month after the close of your tax year.

C-8000 1999

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2