Form Boe-863-Ift - Special Taxes And Fees And The Ifta, International Fuel Tax Agreement - State Of California

ADVERTISEMENT

STATE OF CALIFORNIA

STATE BOARD OF EQUALIZATION

BETTY T. YEE

First District, San Francisco

PROPERTY AND SPECIAL TAXES DEPARTMENT

450 N STREET, SACRAMENTO, CALIFORNIA

SEN. GEORGE RUNNER (Ret.)

PO BOX 942879, SACRAMENTO, CALIFORNIA 94279-0065

Second District, Lancaster

800-400-7115 (TTY:711)

FAX 916-373-3070

MICHELLE STEEL

Third District, Orange County

JEROME E. HORTON

Fourth District, Los Angeles

JOHN CHIANG

State Controller

CYNTHIA BRIDGES

Executive Director

Account Number:

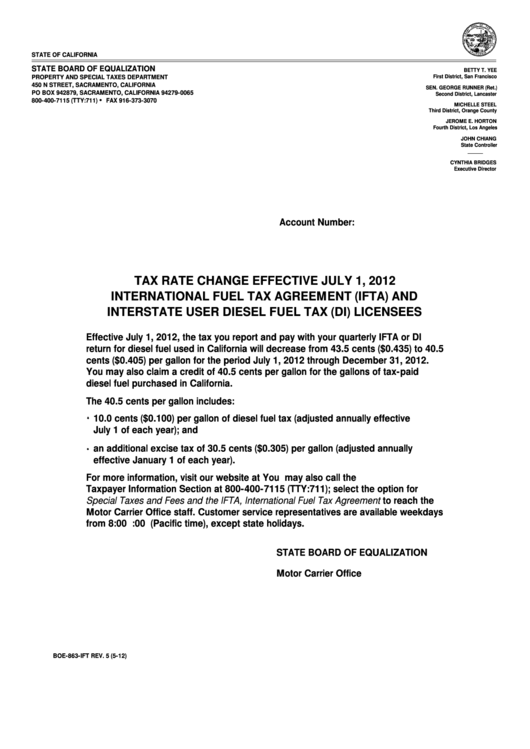

TAX RATE CHANGE EFFECTIVE JULY 1, 2012

INTERNATIONAL FUEL TAX AGREEMENT (IFTA) AND

INTERSTATE USER DIESEL FUEL TAX (DI) LICENSEES

Effective July 1, 2012, the tax you report and pay with your quarterly IFTA or DI

return for diesel fuel used in California will decrease from 43.5 cents ($0.435) to 40.5

cents ($0.405) per gallon for the period July 1, 2012 through December 31, 2012.

You may also claim a credit of 40.5 cents per gallon for the gallons of tax-paid

diesel fuel purchased in California.

The 40.5 cents per gallon includes:

10.0 cents ($0.100) per gallon of diesel fuel tax (adjusted annually effective

July 1 of each year); and

an additional excise tax of 30.5 cents ($0.305) per gallon (adjusted annually

effective January 1 of each year).

For more information, visit our website at . You may also call the

Taxpayer Information Section at 800-400-7115 (TTY:711); select the option for

Special Taxes and Fees and the IFTA, International Fuel Tax Agreement to reach the

Motor Carrier Office staff. Customer service representatives are available weekdays

from 8:00 a.m. to 5:00 p.m. (Pacific time), except state holidays.

STATE BOARD OF EQUALIZATION

Motor Carrier Office

BOE-863-IFT REV. 5 (5-12)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1