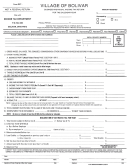

WEST UNION INCOME TAX RETURN - 2009

Page 2

2012

22 Taxable Income Not Reported on a W-2 Form .......................................... (Attach copy of Federal Tax Document)

23 Net Profit (Loss) from Business or Profession ............................................. (Attach copy of Federal Tax Schedule)

24 Net Profit (Loss) from Rental Property ........................................................... (Attach copy of Federal Schedule E)

25 Businesses Loss Total from Previous Year(s) ………...…..…....…………….(Maximum Carried Forward 3 Years)

26 Nontaxable Income (Identify Source - Provide appropriate Federal Tax Forms)

$0.00

7 2

T

o

a t

( l

A

d d

L

n i

s e

2 2

o t

2

) 6

E

t n

r e

o t

l a t

n o

i L

e n

2

f o

a P

e g

1

Note: Losses for businesses and rental activities cannot be used to reduce taxable wages.

INSTRUCTIONS

Taxable income is all wages, salaries and other compensation paid to an individual for work or services performed prior to deduction of any

kind (except Section 125 deductions), the net profits from any business or profession located inside the Village of West Union or conducting

business inside West Union and/or the net profits from the rental of real estate property. Military income is not subject to West Union tax.

Additional instructions and forms can be obtained at:

Income

Line 1 Add Total Taxable Wages from all W-2 and 1099-Misc forms and enter total on Line 1. Use the larger amount from Box 18, Box 5,

or Box 1 from each W-2 form whichever amount is larger. Income received from Social Security, retirement, interest income, disability

or similar non-employment income is not subject to the West Union Income Tax.

INCLUDE ALL W-2 AND 1099 FORMS WITH RETURN.

Line 2 Enter the additional net taxable income from Line 27, Page 2. Note: Losses from business and rental activities cannot be used to reduce

taxable wages reported on W-2 forms, but can be used to offset other business forms or carried forward up to three (3) years.

Line 3 Add amounts on Line 1 and Line 2 and enter on Line 3.

Tax and Credits

Line 4 Multiply amount on Line 3 times tax rate of 1% (.01) and enter amount on Line 4.

Line 5 Enter the amount of estimated tax paid directly to West Union during 2009 for your 2009 tax liability. Do not include any payments

2012

2012

made in 2009 that were for the balance due for 2008.

2012

2011

Line 6 Enter the amount of Tax withheld for the Village of West Union in 2009 by your employers. If the city indicated in Box 20 of a W-2

2012

form indicates West Union, enter the total amount indicated in Box 19 from each appropriate W-2 form.

Line 7 Indicate any overpayment from your 2008 tax return that was credited to 2009.

2011

2012

Line 8 Enter the Maximum Credit allowed for local tax paid to another city or village in 2009. To calculate the credit, multiply the taxable

p

y

g

,

p

y

2012

wages subject to another city/village from each W-2 form (Box 18) by 1% (.01) then enter the smaller amount from the actual

amount listed in Box 19 or the amount from the calculation.

EXCESS TAXES PAID TO ANOTHER CITY ARE NOT REFUNDABLE.

Line 9 Add the amounts in Lines 5 through 8 and enter on Line 9.

Refund/Credit

Line 10 If the amount on Line 9 is larger than the amount on Line 4, subtract Line 4 from Line 9 and enter the difference on Line 10.

Line 11 Enter the amount from Line 10 (if any) that is to be credited towards your 2010 tax liability.

2013

Line 12 Enter the amount from Line 10 (if any) that is to be refunded. REFUNDS OF LESS THAN $5.00 WILL NOT BE ISSUED.

Tax Due

Line 13 If the amount on Line 4 is larger than the amount on Line 9, subtract Line 9 from Line 4 and enter the amount due on Line 13.

Line 14 Enter the amount of Penalties for Late File, Late Pay Late Estimate and Interest charges. Contact Income Tax Office for amounts.

Declaration of Estimate

(If after subtracting Lines 5 and 7 from Line 4 the amount is less than $100, you may skip to Line 21.)

6

8

Line 15 Estimate the amount of total income expected in 2010. (Use amount indicated in Box 5 from all 2009 W-2 forms.)

2013

2012

Line 16 Multiply amount indicated on Line 15 by tax rate of 1% (.01) and enter on Line 16.

Line 17 Enter estimated amount of taxes to be withheld for West Union or for another city or village up to 1% (.01) of wages per W-2 form.

Line 18 Enter the amount indicated on Line 11 that is to be applied to your 2010 tax liability.

2013

Line 19 Subtract the amount from Line 17 and Line 18 from amount indicated on Line 16.

Line 20 Multiple the amount on Line 19 by 25% (.25).

Amount You Owe

Line 21 Add amounts on Line 13, Line 14 and Line 20 and enter on Line 21. Make check payable to: Village of West Union

NOTE: UNLESS ACCOMPANIED WITH PAYMENT OF ANY TAX DUE (LINE 21) A RETURN IS NOT CONSIDERED FINAL

TAX PAYMENT SCHEDULE

ON OR BEFORE

ON OR BEFORE

ON OR BEFORE

ON OR BEFORE

ON OR BEFORE

4/15/2010

7/31/2010

10/31/2010

1/31/2011

4/15/2011

2013

2013

2013

2014

2014

FILE 2009 TAX RETURN

PAY 2ND QUARTER

PAY 3RD QUARTER

PAY 4TH QUARTER

FILE 2010 TAX RETURN

2012

2013

PAY TAX DUE

2010 ESTIMATED TAX

2010 ESTIMATED TAX

2010 ESTIMATED TAX

PAY TAX DUE

2013

2013

2013

1

1 2

2