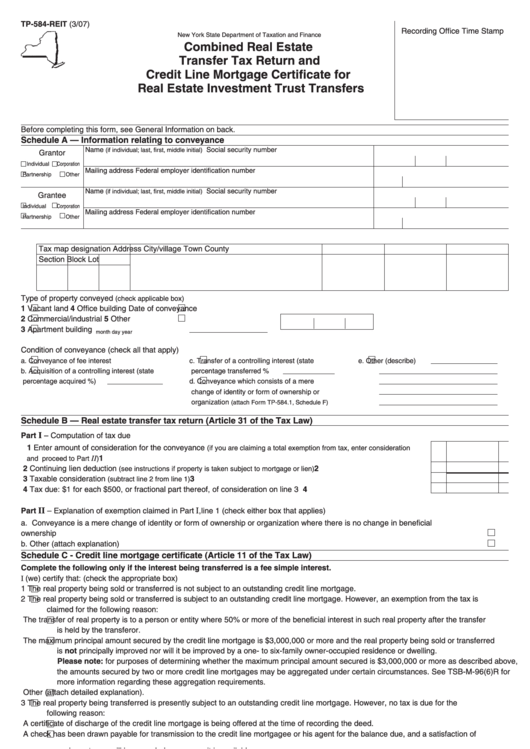

TP-584-REIT (3/07)

Recording Office Time Stamp

New York State Department of Taxation and Finance

Combined Real Estate

Transfer Tax Return and

Credit Line Mortgage Certificate for

Real Estate Investment Trust Transfers

Before completing this form, see General Information on back.

Schedule A — Information relating to conveyance

Name

Social security number

(if individual; last, first, middle initial)

Grantor

Individual

Corporation

Mailing address

Federal employer identification number

Partnership

Other

Name

Social security number

(if individual; last, first, middle initial)

Grantee

Individual

Corporation

Mailing address

Federal employer identification number

Partnership

Other

Tax map designation

Address

City/village

Town

County

Section

Block

Lot

Type of property conveyed

(check applicable box)

1

Vacant land

4

Office building

Date of conveyance

2

Commercial/industrial

5

Other

3

Apartment building

month

day

year

Condition of conveyance (check all that apply)

a.

Conveyance of fee interest

c.

Transfer of a controlling interest (state

e.

Other (describe)

b.

Acquisition of a controlling interest (state

percentage transferred

%

percentage acquired

%)

d.

Conveyance which consists of a mere

change of identity or form of ownership or

organization

(attach Form TP-584.1, Schedule F)

Schedule B — Real estate transfer tax return (Article 31 of the Tax Law)

I

Part

– Computation of tax due

1 Enter amount of consideration for the conveyance

(if you are claiming a total exemption from tax, enter consideration

1

...............................................................................................................................................

and proceed to Part

II

)

2 Continuing lien deduction

2

................................................

(see instructions if property is taken subject to mortgage or lien)

3 Taxable consideration

..........................................................................................................

3

(subtract line 2 from line 1)

4 Tax due: $1 for each $500, or fractional part thereof, of consideration on line 3 .........................................................

4

II

Part

I

– Explanation of exemption claimed in Part

, line 1 (check either box that applies)

a. Conveyance is a mere change of identity or form of ownership or organization where there is no change in beneficial

ownership ............................................................................................................................................................................................ a.

b. Other (attach explanation) ................................................................................................................................................................... b.

Schedule C - Credit line mortgage certificate (Article 11 of the Tax Law)

Complete the following only if the interest being transferred is a fee simple interest.

I (we) certify that: (check the appropriate box)

1

The real property being sold or transferred is not subject to an outstanding credit line mortgage.

2

The real property being sold or transferred is subject to an outstanding credit line mortgage. However, an exemption from the tax is

claimed for the following reason:

The transfer of real property is to a person or entity where 50% or more of the beneficial interest in such real property after the transfer

is held by the transferor.

The maximum principal amount secured by the credit line mortgage is $3,000,000 or more and the real property being sold or transferred

is not principally improved nor will it be improved by a one- to six-family owner-occupied residence or dwelling.

Please note: for purposes of determining whether the maximum principal amount secured is $3,000,000 or more as described above,

the amounts secured by two or more credit line mortgages may be aggregated under certain circumstances. See TSB-M-96(6)R for

more information regarding these aggregation requirements.

Other (attach detailed explanation).

3

The real property being transferred is presently subject to an outstanding credit line mortgage. However, no tax is due for the

following reason:

A certificate of discharge of the credit line mortgage is being offered at the time of recording the deed.

A check has been drawn payable for transmission to the credit line mortgagee or his agent for the balance due, and a satisfaction of

such mortgage will be recorded as soon as it is available.

4

The real property being transferred is subject to an outstanding credit line mortgage recorded in

(insert liber and page or reel or other identification of the mortgage). The maximum principal amount secured in the mortgage

is

. No exemption from tax is claimed and the tax of

is being paid herewith. (Make check payable to county clerk where deed will be recorded or, if the recording is to take place in New York

City, make check payable to the NYC Department of Finance.)

For recording officer’s use

Amount

Date received

Transaction number

received

1

1 2

2