Print

Clear

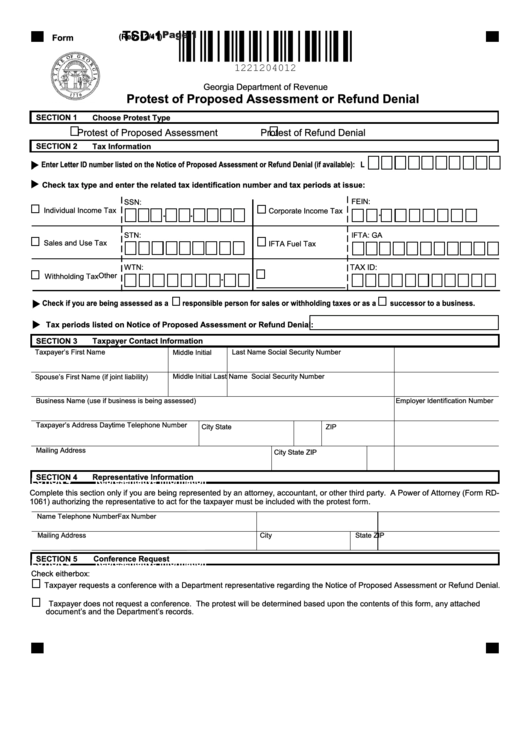

TSD-1

Page 1

(Rev. 12/11)

Form

Georgia Department of Revenue

Protest of Proposed Assessment or Refund Denial

ECTION 2

Choose protest t pe

SECTION 1

Choose Protest Type

Protest of Proposed Assessment

Protest of Refund Denial

ECTION 3

T

SECTION 2

Tax Information

Enter Letter ID number listed on the Notice of Proposed Assessment or Refund Denial (if available): L

Check tax type and enter the related tax identification number and tax periods at issue:

FEIN:

SSN:

-

Individual Income Tax

Corporate Income Tax

-

-

STN:

IFTA: GA

Sales and Use Tax

IFTA Fuel Tax

TAX ID:

WTN:

-

Other

Withholding Tax

Check if you are being assessed as a

responsible person for sales or withholding taxes or as a

successor to a business.

Tax periods listed on Notice of Proposed Assessment or Refund Denial:

ECTION 1

SECTION 3

Taxpayer Contact Information

axpayer

ntact Information

Taxpayer’s First Name

Middle Initial

Last Name

Social Security Number

Middle Initial

Last Name

Social Security Number

Spouse’s First Name (if joint liability)

Business Name (use if business is being assessed)

Employer Identification Number

Taxpayer’s Address

Daytime Telephone Number

City

State

ZIP

Mailing Address

City

State

ZIP

SECTION 4

Representative Information

ECTION 4

Representative Information

Complete this section only if you are being represented by an attorney, accountant, or other third party. A Power of Attorney (Form RD-

1061) authorizing the representative to act for the taxpayer must be included with the protest form.

Name

Telephone Number

Fax Number

Mailing Address

City

State

ZIP

SECTION 5

Conference Request

ECTION 4

Representative Information

Check either box:

Taxpayer requests a conference with a Department representative regarding the Notice of Proposed Assessment or Refund Denial.

Taxpayer does not request a conference. The protest will be determined based upon the contents of this form, any attached

document’s and the Department’s records.

1

1 2

2