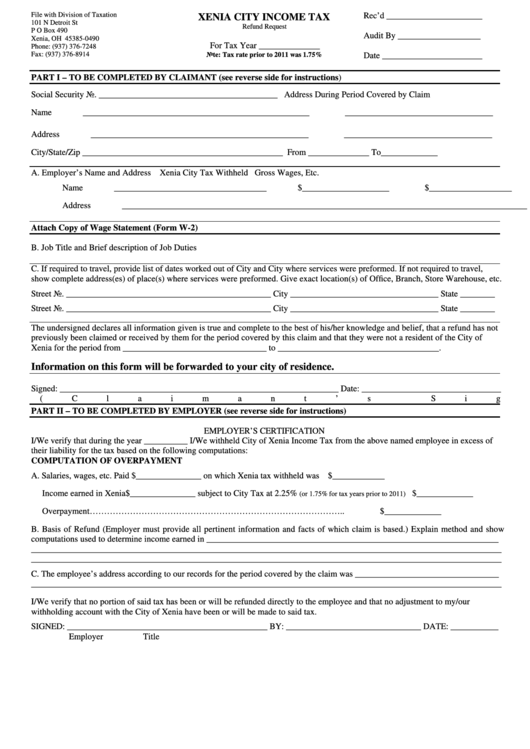

File with Division of Taxation

Rec’d ______________________

XENIA CITY INCOME TAX

101 N Detroit St

Refund Request

P O Box 490

Audit By ___________________

Xenia, OH 45385-0490

For Tax Year ______________

Phone: (937) 376-7248

Fax: (937) 376-8914

Note: Tax rate prior to 2011 was 1.75%

Date _______________________

PART I – TO BE COMPLETED BY CLAIMANT (see reverse side for instructions)

Social Security No. _________________________________________

Address During Period Covered by Claim

Name ____________________________________________________

__________________________________

Address __________________________________________________

__________________________________

City/State/Zip ______________________________________________

From ______________ To_____________

A. Employer’s Name and Address

Xenia City Tax Withheld

Gross Wages, Etc.

Name ___________________________________

$____________________

$___________________

Address _____________________________________________________________________________________________

Attach Copy of Wage Statement (Form W-2)

B. Job Title and Brief description of Job Duties

C. If required to travel, provide list of dates worked out of City and City where services were preformed. If not required to travel,

show complete address(es) of place(s) where services were preformed. Give exact location(s) of Office, Branch, Store Warehouse, etc.

Street No. _______________________________________________ City __________________________________ State ________

Street No. _______________________________________________ City __________________________________ State ________

The undersigned declares all information given is true and complete to the best of his/her knowledge and belief, that a refund has not

previously been claimed or received by them for the period covered by this claim and that they were not a resident of the City of

Xenia for the period from _________________________________ to _____________________________________.

Information on this form will be forwarded to your city of residence.

Signed: ________________________________________________________________ Date: ________________________________

(Claimant’s Signature)

PART II – TO BE COMPLETED BY EMPLOYER (see reverse side for instructions)

EMPLOYER’S CERTIFICATION

I/We verify that during the year __________ I/We withheld City of Xenia Income Tax from the above named employee in excess of

their liability for the tax based on the following computations:

COMPUTATION OF OVERPAYMENT

A. Salaries, wages, etc. Paid $_______________

on which Xenia tax withheld was

$____________

Income earned in Xenia$_______________ subject to City Tax at 2.25%

$_____________

(or 1.75% for tax years prior to 2011)

Overpayment……………………………………………………………………………..

$_____________

B. Basis of Refund (Employer must provide all pertinent information and facts of which claim is based.) Explain method and show

computations used to determine income earned in ___________________________________________________________________

____________________________________________________________________________________________________________

____________________________________________________________________________________________________________

C. The employee’s address according to our records for the period covered by the claim was _________________________________

____________________________________________________________________________________________________________

I/We verify that no portion of said tax has been or will be refunded directly to the employee and that no adjustment to my/our

withholding account with the City of Xenia have been or will be made to said tax.

SIGNED: ______________________________________________ BY: _______________________________ DATE: ___________

Employer

Title

1

1 2

2