Mississippi Registration Application Forms And Instructions

ADVERTISEMENT

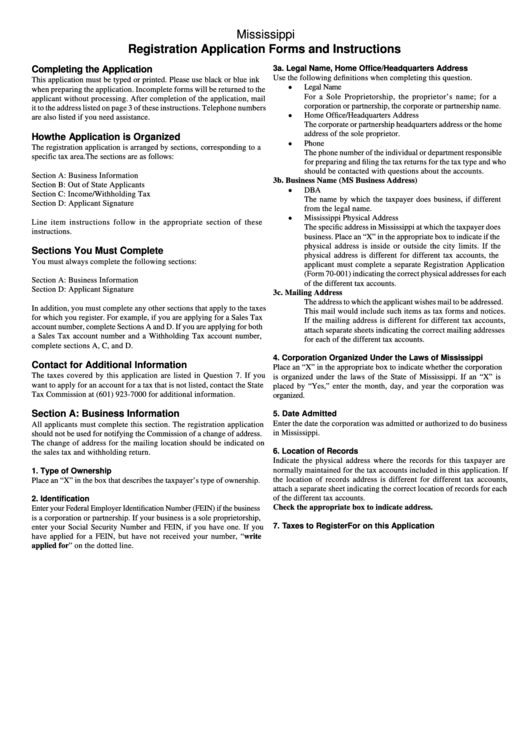

Mississippi

Registration Application Forms and Instructions

Completing the Application

3a. Legal Name, Home Office/Headquarters Address

Use the following definitions when completing this question.

This application must be typed or printed. Please use black or blue ink

c

Legal Name

when preparing the application. Incomplete forms will be returned to the

For a Sole Proprietorship, the proprietor’s name; for a

applicant without processing. After completion of the application, mail

corporation or partnership, the corporate or partnership name.

it to the address listed on page 3 of these instructions. Telephone numbers

c

Home Office/Headquarters Address

are also listed if you need assistance.

The corporate or partnership headquarters address or the home

address of the sole proprietor.

How the Application is Organized

c

Phone

The registration application is arranged by sections, corresponding to a

The phone number of the individual or department responsible

specific tax area. The sections are as follows:

for preparing and filing the tax returns for the tax type and who

should be contacted with questions about the accounts.

Section A: Business Information

3b. Business Name (MS Business Address)

Section B: Out of State Applicants

c

DBA

Section C: Income/Withholding Tax

The name by which the taxpayer does business, if different

Section D: Applicant Signature

from the legal name.

c

Mississippi Physical Address

Line item instructions follow in the appropriate section of these

The specific address in Mississippi at which the taxpayer does

instructions.

business. Place an “X” in the appropriate box to indicate if the

physical address is inside or outside the city limits. If the

Sections You Must Complete

physical address is different for different tax accounts, the

You must always complete the following sections:

applicant must complete a separate Registration Application

(Form 70-001) indicating the correct physical addresses for each

Section A: Business Information

of the different tax accounts.

Section D: Applicant Signature

3c. Mailing Address

The address to which the applicant wishes mail to be addressed.

In addition, you must complete any other sections that apply to the taxes

This mail would include such items as tax forms and notices.

for which you register. For example, if you are applying for a Sales Tax

If the mailing address is different for different tax accounts,

account number, complete Sections A and D. If you are applying for both

attach separate sheets indicating the correct mailing addresses

a Sales Tax account number and a Withholding Tax account number,

for each of the different tax accounts.

complete sections A, C, and D.

4. Corporation Organized Under the Laws of Mississippi

Contact for Additional Information

Place an “X” in the appropriate box to indicate whether the corporation

The taxes covered by this application are listed in Question 7. If you

is organized under the laws of the State of Mississippi. If an “X” is

want to apply for an account for a tax that is not listed, contact the State

placed by “Yes,” enter the month, day, and year the corporation was

Tax Commission at (601) 923-7000 for additional information.

organized.

Section A: Business Information

5. Date Admitted

Enter the date the corporation was admitted or authorized to do business

All applicants must complete this section. The registration application

in Mississippi.

should not be used for notifying the Commission of a change of address.

The change of address for the mailing location should be indicated on

6. Location of Records

the sales tax and withholding return.

Indicate the physical address where the records for this taxpayer are

normally maintained for the tax accounts included in this application. If

1. Type of Ownership

the location of records address is different for different tax accounts,

Place an “X” in the box that describes the taxpayer’s type of ownership.

attach a separate sheet indicating the correct location of records for each

of the different tax accounts.

2. Identification

Check the appropriate box to indicate address.

Enter your Federal Employer Identification Number (FEIN) if the business

is a corporation or partnership. If your business is a sole proprietorship,

7. Taxes to Register For on this Application

enter your Social Security Number and FEIN, if you have one. If you

have applied for a FEIN, but have not received your number, “write

applied for” on the dotted line.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3