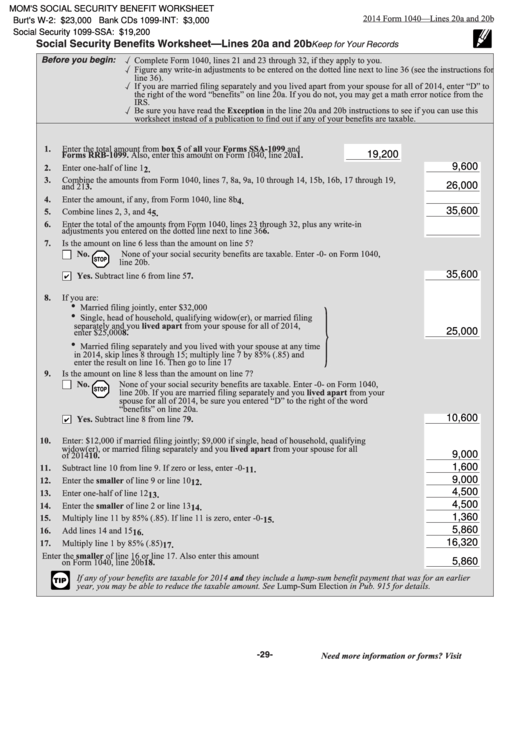

MOM'S SOCIAL SECURITY BENEFIT WORKSHEET

2014 Form 1040—Lines 20a and 20b

Burt's W-2: $23,000 Bank CDs 1099-INT: $3,000

Social Security 1099-SSA: $19,200

Social Security Benefits Worksheet—Lines 20a and 20b

Keep for Your Records

Before you begin:

Complete Form 1040, lines 21 and 23 through 32, if they apply to you.

Figure any write-in adjustments to be entered on the dotted line next to line 36 (see the instructions for

line 36).

If you are married filing separately and you lived apart from your spouse for all of 2014, enter “D” to

the right of the word “benefits” on line 20a. If you do not, you may get a math error notice from the

IRS.

Be sure you have read the Exception in the line 20a and 20b instructions to see if you can use this

worksheet instead of a publication to find out if any of your benefits are taxable.

1.

Enter the total amount from box 5 of all your Forms SSA-1099 and

19,200

Forms RRB-1099. Also, enter this amount on Form 1040, line 20a . . . .

1.

9,600

2.

Enter one-half of line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2.

3.

Combine the amounts from Form 1040, lines 7, 8a, 9a, 10 through 14, 15b, 16b, 17 through 19,

26,000

and 21 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3.

4.

Enter the amount, if any, from Form 1040, line 8b . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4.

35,600

5.

Combine lines 2, 3, and 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5.

6.

Enter the total of the amounts from Form 1040, lines 23 through 32, plus any write-in

adjustments you entered on the dotted line next to line 36 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6.

7.

Is the amount on line 6 less than the amount on line 5?

No.

None of your social security benefits are taxable. Enter -0- on Form 1040,

STOP

line 20b.

35,600

Yes. Subtract line 6 from line 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7.

8.

If you are:

Married filing jointly, enter $32,000

Single, head of household, qualifying widow(er), or married filing

separately and you lived apart from your spouse for all of 2014,

25,000

enter $25,000

. . . . . . . . . . . . . . .

8.

Married filing separately and you lived with your spouse at any time

in 2014, skip lines 8 through 15; multiply line 7 by 85% (.85) and

enter the result on line 16. Then go to line 17

9.

Is the amount on line 8 less than the amount on line 7?

No.

None of your social security benefits are taxable. Enter -0- on Form 1040,

STOP

line 20b. If you are married filing separately and you lived apart from your

spouse for all of 2014, be sure you entered “D” to the right of the word

“benefits” on line 20a.

Yes. Subtract line 8 from line 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9.

10,600

10.

Enter: $12,000 if married filing jointly; $9,000 if single, head of household, qualifying

widow(er), or married filing separately and you lived apart from your spouse for all

9,000

of 2014 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10.

11.

Subtract line 10 from line 9. If zero or less, enter -0- . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11.

1,600

12.

Enter the smaller of line 9 or line 10 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12.

9,000

4,500

13.

Enter one-half of line 12 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13.

4,500

14.

Enter the smaller of line 2 or line 13 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14.

1,360

15.

Multiply line 11 by 85% (.85). If line 11 is zero, enter -0- . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15.

5,860

16.

Add lines 14 and 15 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16.

16,320

17.

Multiply line 1 by 85% (.85) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17.

18.

Taxable social security benefits. Enter the smaller of line 16 or line 17. Also enter this amount

5,860

on Form 1040, line 20b . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18.

If any of your benefits are taxable for 2014 and they include a lump-sum benefit payment that was for an earlier

TIP

year, you may be able to reduce the taxable amount. See Lump-Sum Election in Pub. 915 for details.

-29-

Need more information or forms? Visit IRS.gov.

1

1