Worksheet Viii - Taxable Social Security Benefits For Form 2

ADVERTISEMENT

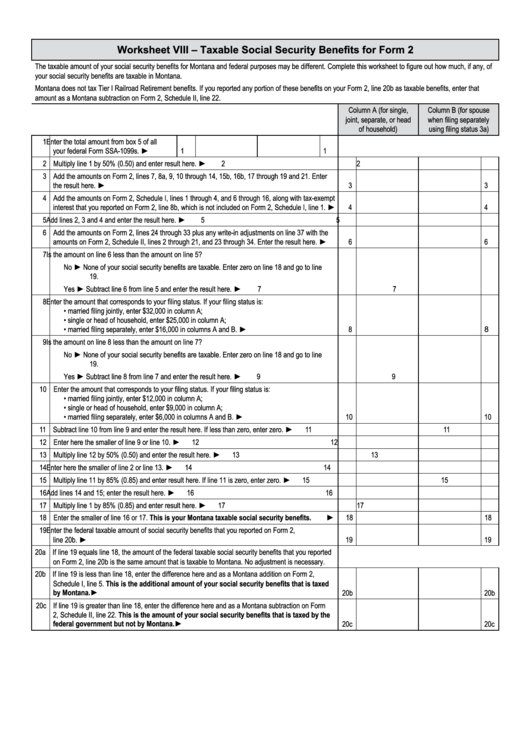

Worksheet VIII – Taxable Social Security Benefits for Form 2

The taxable amount of your social security benefits for Montana and federal purposes may be different. Complete this worksheet to figure out how much, if any, of

your social security benefits are taxable in Montana.

Montana does not tax Tier I Railroad Retirement benefits. If you reported any portion of these benefits on your Form 2, line 20b as taxable benefits, enter that

amount as a Montana subtraction on Form 2, Schedule II, line 22.

Column A (for single,

Column B (for spouse

joint, separate, or head

when filing separately

of household)

using filing status 3a)

1 Enter the total amount from box 5 of all

your federal Form SSA-1099s.

► 1

1

2 Multiply line 1 by 50% (0.50) and enter result here.

2

2

►

3 Add the amounts on Form 2, lines 7, 8a, 9, 10 through 14, 15b, 16b, 17 through 19 and 21. Enter

the result here.

3

3

►

4 Add the amounts on Form 2, Schedule I, lines 1 through 4, and 6 through 16, along with tax-exempt

interest that you reported on Form 2, line 8b, which is not included on Form 2, Schedule I, line 1. ►

4

4

5 Add lines 2, 3 and 4 and enter the result here.

5

5

►

6 Add the amounts on Form 2, lines 24 through 33 plus any write-in adjustments on line 37 with the

amounts on Form 2, Schedule II, lines 2 through 21, and 23 through 34. Enter the result here.

6

6

►

7 Is the amount on line 6 less than the amount on line 5?

No ► None of your social security benefits are taxable. Enter zero on line 18 and go to line

19.

Yes ► Subtract line 6 from line 5 and enter the result here.

7

7

►

8 Enter the amount that corresponds to your filing status. If your filing status is:

• married filing jointly, enter $32,000 in column A;

• single or head of household, enter $25,000 in column A;

• married filing separately, enter $16,000 in columns A and B.

8

►

8

9 Is the amount on line 8 less than the amount on line 7?

No ► None of your social security benefits are taxable. Enter zero on line 18 and go to line

19.

Yes ► Subtract line 8 from line 7 and enter the result here.

9

9

►

10 Enter the amount that corresponds to your filing status. If your filing status is:

• married filing jointly, enter $12,000 in column A;

• single or head of household, enter $9,000 in column A;

• married filing separately, enter $6,000 in columns A and B.

10

10

►

11 Subtract line 10 from line 9 and enter the result here. If less than zero, enter zero.

11

11

►

12 Enter here the smaller of line 9 or line 10.

12

12

►

13 Multiply line 12 by 50% (0.50) and enter the result here.

13

13

►

14 Enter here the smaller of line 2 or line 13.

14

14

►

15 Multiply line 11 by 85% (0.85) and enter result here. If line 11 is zero, enter zero.

15

15

►

16 Add lines 14 and 15; enter the result here.

16

16

►

17 Multiply line 1 by 85% (0.85) and enter result here.

17

17

►

18 Enter the smaller of line 16 or 17. This is your Montana taxable social security benefits.

18

18

►

19 Enter the federal taxable amount of social security benefits that you reported on Form 2,

line 20b.

19

19

►

20a If line 19 equals line 18, the amount of the federal taxable social security benefits that you reported

on Form 2, line 20b is the same amount that is taxable to Montana. No adjustment is necessary.

20b If line 19 is less than line 18, enter the difference here and as a Montana addition on Form 2,

Schedule I, line 5. This is the additional amount of your social security benefits that is taxed

by Montana.

20b

20b

►

20c If line 19 is greater than line 18, enter the difference here and as a Montana subtraction on Form

2, Schedule II, line 22. This is the amount of your social security benefits that is taxed by the

federal government but not by Montana.

20c

20c

►

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1