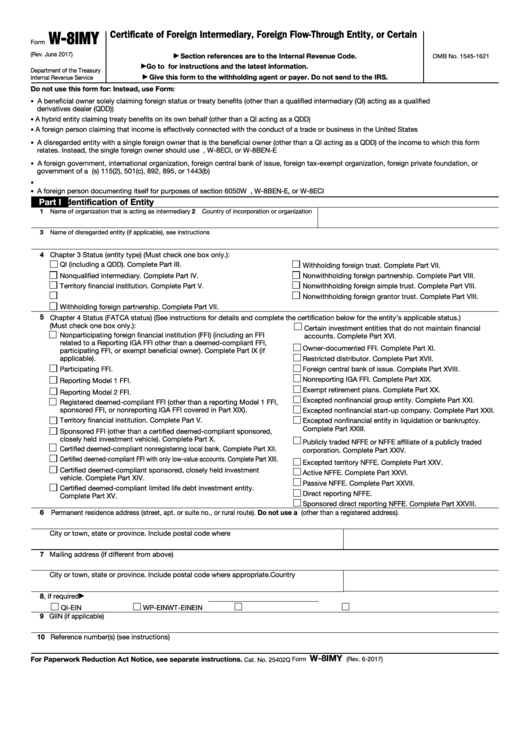

W-8IMY

Certificate of Foreign Intermediary, Foreign Flow-Through Entity, or Certain

Form

U.S. Branches for United States Tax Withholding and Reporting

(Rev. June 2017)

Section references are to the Internal Revenue Code.

OMB No. 1545-1621

▶

Go to for instructions and the latest information.

▶

Department of the Treasury

Give this form to the withholding agent or payer. Do not send to the IRS.

Internal Revenue Service

▶

Do not use this form for:

Instead, use Form:

A beneficial owner solely claiming foreign status or treaty benefits (other than a qualified intermediary (QI) acting as a qualified

•

derivatives dealer (QDD))

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

W-8BEN or W-8BEN-E

A hybrid entity claiming treaty benefits on its own behalf (other than a QI acting as a QDD) .

.

.

.

.

.

.

.

.

.

.

.

.

.

. W-8BEN-E

•

A foreign person claiming that income is effectively connected with the conduct of a trade or business in the United States

.

.

.

.

. W-8ECI

•

A disregarded entity with a single foreign owner that is the beneficial owner (other than a QI acting as a QDD) of the income to which this form

•

relates. Instead, the single foreign owner should use

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

. W-8BEN, W-8ECI, or W-8BEN-E

A foreign government, international organization, foreign central bank of issue, foreign tax-exempt organization, foreign private foundation, or

•

government of a U.S. possession claiming the applicability of section(s) 115(2), 501(c), 892, 895, or 1443(b) .

.

.

.

.

.

.

.

.

. W-8EXP

U.S. entity or U.S. citizen or resident .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

. W-9

•

A foreign person documenting itself for purposes of section 6050W .

.

.

.

.

.

.

.

.

.

.

.

.

.

W-8BEN, W-8BEN-E, or W-8ECI

•

Part I

Identification of Entity

1

Name of organization that is acting as intermediary

2

Country of incorporation or organization

3

Name of disregarded entity (if applicable), see instructions

4 Chapter 3 Status (entity type) (Must check one box only.):

QI (including a QDD). Complete Part III.

Withholding foreign trust. Complete Part VII.

Nonqualified intermediary. Complete Part IV.

Nonwithholding foreign partnership. Complete Part VIII.

Territory financial institution. Complete Part V.

Nonwithholding foreign simple trust. Complete Part VIII.

U.S. branch. Complete Part VI.

Nonwithholding foreign grantor trust. Complete Part VIII.

Withholding foreign partnership. Complete Part VII.

5 Chapter 4 Status (FATCA status) (See instructions for details and complete the certification below for the entity’s applicable status.)

(Must check one box only.):

Certain investment entities that do not maintain financial

Nonparticipating foreign financial institution (FFI) (including an FFI

accounts. Complete Part XVI.

related to a Reporting IGA FFI other than a deemed-compliant FFI,

Owner-documented FFI. Complete Part XI.

participating FFI, or exempt beneficial owner). Complete Part IX (if

applicable).

Restricted distributor. Complete Part XVII.

Participating FFI.

Foreign central bank of issue. Complete Part XVIII.

Nonreporting IGA FFI. Complete Part XIX.

Reporting Model 1 FFI.

Exempt retirement plans. Complete Part XX.

Reporting Model 2 FFI.

Excepted nonfinancial group entity. Complete Part XXI.

Registered deemed-compliant FFI (other than a reporting Model 1 FFI,

sponsored FFI, or nonreporting IGA FFI covered in Part XIX).

Excepted nonfinancial start-up company. Complete Part XXII.

Territory financial institution. Complete Part V.

Excepted nonfinancial entity in liquidation or bankruptcy.

Complete Part XXIII.

Sponsored FFI (other than a certified deemed-compliant sponsored,

closely held investment vehicle). Complete Part X.

Publicly traded NFFE or NFFE affiliate of a publicly traded

Certified deemed-compliant nonregistering local bank. Complete Part XII.

corporation. Complete Part XXIV.

Certified deemed-compliant FFI with only low-value accounts. Complete Part XIII.

Excepted territory NFFE. Complete Part XXV.

Certified deemed-compliant sponsored, closely held investment

Active NFFE. Complete Part XXVI.

vehicle. Complete Part XIV.

Passive NFFE. Complete Part XXVII.

Certified deemed-compliant limited life debt investment entity.

Direct reporting NFFE.

Complete Part XV.

Sponsored direct reporting NFFE. Complete Part XXVIII.

6

Permanent residence address (street, apt. or suite no., or rural route). Do not use a P.O. box or in-care-of address (other than a registered address).

City or town, state or province. Include postal code where appropriate.

Country

7 Mailing address (if different from above)

City or town, state or province. Include postal code where appropriate.

Country

8 U.S. taxpayer identification number, if required

▶

QI-EIN

WP-EIN

WT-EIN

EIN

9 GIIN (if applicable)

10 Reference number(s) (see instructions)

W-8IMY

For Paperwork Reduction Act Notice, see separate instructions.

Form

(Rev. 6-2017)

Cat. No. 25402Q

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8