Form R - Income Tax Return

ADVERTISEMENT

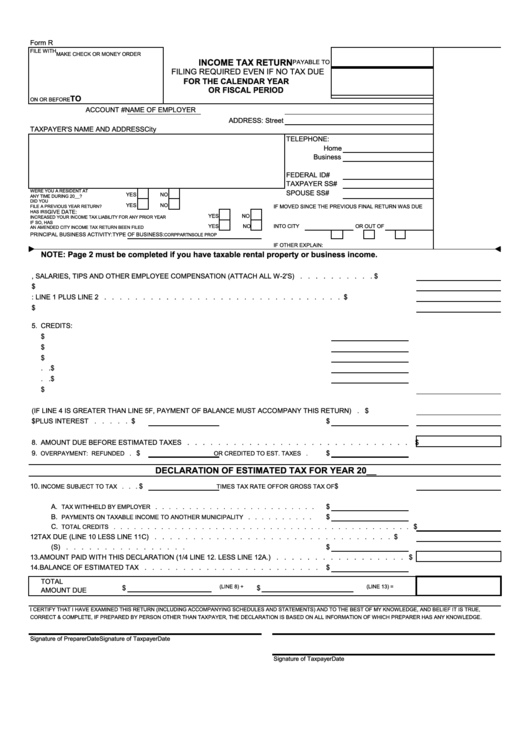

Form R

FILE WITH

MAKE CHECK OR MONEY ORDER

INCOME TAX RETURN

PAYABLE TO

FILING REQUIRED EVEN IF NO TAX DUE

FOR THE CALENDAR YEAR

OR FISCAL PERIOD

TO

ON OR BEFORE

ACCOUNT #

NAME OF EMPLOYER

ADDRESS: Street

TAXPAYER'S NAME AND ADDRESS

City

TELEPHONE:

Home

Business

FEDERAL ID#

TAXPAYER SS#

WERE YOU A RESIDENT AT

SPOUSE SS#

YES

NO

ANY TIME DURING 20__?

DID YOU

YES

NO

IF MOVED SINCE THE PREVIOUS FINAL RETURN WAS DUE

FILE A PREVIOUS YEAR RETURN?

HAS IRS

GIVE DATE:

YES

NO

INCREASED YOUR INCOME TAX LIABILITY FOR ANY PRIOR YEAR

IF SO, HAS

YES

NO

INTO CITY

OR OUT OF

AN AMENDED CITY INCOME TAX RETURN BEEN FILED

PRINCIPAL BUSINESS ACTIVITY:

TYPE OF BUSINESS:

CORP

PARTN

SOLE PROP

IF OTHER EXPLAIN:

NOTE: Page 2 must be completed if you have taxable rental property or business income.

1. WAGES, SALARIES, TIPS AND OTHER EMPLOYEE COMPENSATION (ATTACH ALL W-2'S) . . . . . . . . . . $

2. OTHER TAXABLE INCOME OR DEDUCTIONS FROM PAGE 2 . . . . . . . . . . . . . . . . . . . . . .

$

3. TAXABLE INCOME: LINE 1 PLUS LINE 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

4. MUNICIPAL TAX

OF LINE 3 . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

5. CREDITS:

A. TAX WITHHELD BY EMPLOYER . . . . . . . . . . . . . . . . . . .

.

$

B. ESTIMATED TAX PAID . . . . . . . . . . . . . . . . . . . . . . .

.

$

C. CREDIT FOR TAXES PAID TO OTHER CITIES . . . . . . . . . . . . . .

.

$

D. PRIOR YEAR OVERPAYMENTS . . . . . . . . . . . . . . . . . . . . .

$

E. OTHER CREDITS . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

F. TOTAL CREDITS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

6. TAX DUE (IF LINE 4 IS GREATER THAN LINE 5F, PAYMENT OF BALANCE MUST ACCOMPANY THIS RETURN) .

$

7. PENALTY . . . . . . . .

$

PLUS INTEREST . . . . .

$

$

8. AMOUNT DUE BEFORE ESTIMATED TAXES . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

9.

$

$

OVERPAYMENT: REFUNDED .

OR CREDITED TO EST. TAXES .

DECLARATION OF ESTIMATED TAX FOR YEAR 20__

10.

$

$

INCOME SUBJECT TO TAX . . .

TIMES TAX RATE OF

FOR GROSS TAX OF

11. LESS EXPECTED TAX CREDITS.

A.

$

TAX WITHHELD BY EMPLOYER . . . . . . . . . . . . . . . . . . . . . . . .

B.

$

PAYMENTS ON TAXABLE INCOME TO ANOTHER MUNICIPALITY . . . . . . . . . .

C.

$

TOTAL CREDITS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12. NET TAX DUE (LINE 10 LESS LINE 11C) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

A. OVERPAYMENT FROM PRIOR YEAR(S) . . . . . . . . . . . . . . . .

$

13. AMOUNT PAID WITH THIS DECLARATION (1/4 LINE 12. LESS LINE 12A.) . . . . . . . . . . . . . . . . .

$

14. BALANCE OF ESTIMATED TAX . . . . . . . . . . . . . . . . . . . . . . .

$

TOTAL

$

(LINE 8) +

$

(LINE 13) =

AMOUNT DUE

I CERTIFY THAT I HAVE EXAMINED THIS RETURN (INCLUDING ACCOMPANYING SCHEDULES AND STATEMENTS) AND TO THE BEST OF MY KNOWLEDGE, AND BELIEF IT IS TRUE,

CORRECT & COMPLETE, IF PREPARED BY PERSON OTHER THAN TAXPAYER, THE DECLARATION IS BASED ON ALL INFORMATION OF WHICH PREPARER HAS ANY KNOWLEDGE.

Signature of Preparer

Date

Signature of Taxpayer

Date

Signature of Taxpayer

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4