Form 4h - Wisconsin Corporation Declaration Of Inactivity - 2016 Page 2

ADVERTISEMENT

2 of 2

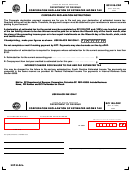

2016 Form 4H

Page

28 Person to contact concerning this return: Name

Telephone number ( )

Fax number ( )

I, the undersigned authorized officer, declare that the above named corporation has had no income or expense and has been completely

inactive for the entire taxable year shown above. I also declare that the above corporation balance sheets are true and correct.

Signature of Officer

Date

Title

Officer’s State of Residence

Mail to: Wisconsin Department of Revenue, PO Box 8908, Madison, WI 53708-8908.

Instructions for 2016 Form 4H

General Instructions

When to File

File Form 4H on or before the 15th day of the third month

Purpose of Form 4H

following the close of the taxable year. Any extension of

time allowed by either the Internal Revenue Service or

A corporation that has been completely inactive both

the Department of Revenue to file your return extends

in and outside Wisconsin for an entire taxable

the due date for filing Form 4H, provided you check line

year may file Form 4H instead of filing a corporate

C, enter the extended due date, and attach a copy of

franchise or income tax return. If the corporation is a

your extension to Form 4H. If Form 4H is not filed on

combined group member, it may file Form 4H instead

or before the due date or extended due date, a $150

of being included in the combined return . Thereafter,

late filing fee applies.

the corporation need not file a corporate franchise or

income tax return, be included in a combined return, or

file Form 4H for any subsequent year unless requested

Specific Instructions

to do so by the Department of Revenue or unless,

in a subsequent year, the corporation is activated or

Identifying Number: A1 and A2

reactivated .

Enter either of the following: federal employer

Note: By filing Form 4H, a corporation is relieved of the

identification number (EIN) or Wisconsin tax number

requirement to file an annual franchise or income tax

(WTN). A federal EIN is not required to file this form if

return with the Department of Revenue. This exemption

you have a WTN .

does not extend to reports required by other agencies.

In order for the corporation to continue in good standing,

it must continue to file a Wisconsin Corporation Annual

Balance Sheets

Report each year with the Corporations Bureau,

Division of Corporate and Consumer Services,

Complete the balance sheets for the first day and last

Wisconsin Department of Financial Institutions. Failure

day of the taxable year indicated at the top of Form 4H.

to file this report within a specified period of time may

If the corporation had no assets or liabilities and capital

subject the corporation to administrative dissolution.

on either the first day or the last day of the taxable year,

enter zero (0) on line 14 and on line 27 .

Who May Not File Form 4H

Signature on Form 4H

A corporation must file a corporate franchise or income

tax return instead of Form 4H in either of the following

The corporation president must sign Form 4H if the

cases:

president is a resident of Wisconsin. Otherwise, another

officer who is a Wisconsin resident should sign Form

• The corporation’s balance sheet for the end of the

4H. If none of the officers are residents of Wisconsin,

taxable year differs from its balance sheet for the

Form 4H may be signed by any duly authorized officer.

beginning of the taxable year .

• The corporation liquidates during the taxable year.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2