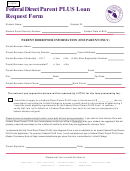

Federal Direct Parent Loan (Plus) Request Form And Procedures Page 2

ADVERTISEMENT

FEDERAL DIRECT PARENT PLUS LOAN INFORMATION

Complete the Free Application for Federal Student Aid (FAFSA) prior to requesting a Federal Direct Parent PLUS

loan. The FAFSA can be filed on-line by going to

A first-time Federal Direct Parent PLUS loan borrower must complete the Federal Direct Parent PLUS Master

Promissory Note (MPN) at using the FSAID assigned to the borrower. The borrower can

create or retrieve their FSAID at https://studentaid.ed.gov/sa/fafsa/filling-out/fsaid.

Federal Direct Parent PLUS loan borrowers must complete the Federal Direct PLUS Loan credit check at

by selecting Request Direct PLUS Loan.

Submit the completed Direct Parent PLUS Loan Request Form to the Financial Aid Office at least 30 days prior to

the time loan funds are needed.

IMPORTANT NOTES

1. The Parent PLUS loan will be accruing interest once the loan disburses and repayment will begin

approximately two months after the full loan disburses. If uneven loan amounts are requested in fall and

spring semesters, repayment will begin earlier. Parent PLUS loan borrowers have the option of deferring

repayment until after the student ceases to be enrolled half time (6 credit hours). This deferment may be

extended into the 6-month period after the student ceases to be enrolled at least half time. Parent borrowers

must call the Direct Loan Servicing Center (DLSC) at 800-848-0979 to request a deferment.

2. Please note that the Bipartisan Student Loan Certainty Act of 2013 implemented variable-fixed interest rates

on newly originated Parent PLUS loans effective July 1, 2013. Interest rates are determined annually based

on the Final Auction of the 10-year U.S. Treasury Bills prior to June 1

and are not the exceed 10.50%.

st

3. The Parent PLUS MPN must be completed for the initial Parent PLUS loan, but not for subsequent loans.

However, if the Parent PLUS borrower changes, the new borrower must complete a master promissory note

using their assigned PIN and the required credit check.

4. The FAFSA and Parent PLUS Loan Application must be completed each year.

5. Approval or denial of the Parent PLUS Loan is given by Direct Loans and not Paul D. Camp.

6. If the Parent PLUS loan is denied and the parent does not wish to seek an endorser, a student may request

an additional unsubsidized loan in their name by completing the Federal Direct Student Loan Request Form at

(insert web address). If the parent receives an endorser, the parent must complete a new master promissory

note after the endorser completes the endorser addendum.

7. All requirements must be complete before the Parent PLUS Loan funds can be disbursed. Failure to complete

all requirements will result in a delay in loan disbursements and possible cancellations of the loan. Students

can check for processing requirements through their My PDCC student accounts.

8. Parents have the right to cancel all or part of the Parent PLUS loan prior to the first day of the semester or

within 14 days of notification of the loan or within 30 days of disbursement. Parents may also reduce the

amount of the PLUS loan or cancel a future disbursement by submitting a written statement to the Financial

Aid Office as soon as possible before disbursement.

9/21/2017: Federal Direct Parent Loan (PLUS)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2