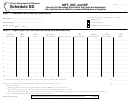

Schedule E - Form Rmft-10 Instructions Page 2

ADVERTISEMENT

Line 12 - If you are filing only one Schedule E, enter the

amount from Line 11 on Line 12.

If you are reporting

• gasoline products and

• MFT-paid only, also enter this amount on Form RMFT‑5,

Lines 2b and 17, Column 1.

• UST-/EIF-paid only, also enter this amount on

Form RMFT‑5‑US, Lines 2b and 12, Column 1.

• both MFT- and UST-/EIF-paid, also enter this amount

on Form RMFT‑5, Lines 2b and 17, Column 1, and

Form RMFT‑5‑US, Lines 2b and 12, Column 1.

•

combustible gases, alcohol, other related products and

• MFT-paid only, also enter this amount on Form RMFT‑5,

Line 17, Column 1.

• UST-/EIF-paid only, also enter this amount on

Form RMFT‑5‑US, Line 12, Column 1.

• both MFT- and UST-/EIF-paid, also enter this amount on

Form RMFT‑5, Line 17, Column 1, and Form RMFT‑5‑US,

Line 12, Column 1.

If you are filing more than one Schedule E, group together all

Schedules E that report

•

gasoline products and MFT‑paid only. This is group “A.”

•

gasoline products and UST‑/EIF‑paid only. This is group “B.”

•

gasoline products and both MFT‑ and UST‑/EIF‑paid.

This is group “C.”

•

combustible gases, alcohol, other related

products, and MFT‑paid only. This is group “D.”

•

combustible gases, alcohol, other related

products, and UST‑/EIF‑paid only. This is group “E.”

•

combustible gases, alcohol, other related

products, and both MFT‑ and UST‑/EIF‑paid.

This is group “F.”

Add Lines 11 from each group, and enter the total amount on

Line 12 of the last page of each group. Then add Line 12 from

•

groups A and C, and enter this amount on

Form RMFT‑5, Lines 2b and 17, Column 1.

•

groups B and C, and enter this amount on

Form RMFT‑5‑US, Lines 2b and 12, Column 1.

•

groups D and F, and enter this amount on

Form RMFT‑5, Line 17, Column 1.

•

groups E and F, and enter this amount on

Form RMFT‑5‑US, Line 12, Column 1.

RMFT‑10 Instructions Back (R‑6/17)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2