State Form 43709 - Statement Of Mortgage Or Contract Indebtedness For Deduction From Assessed Valuation - 2003

ADVERTISEMENT

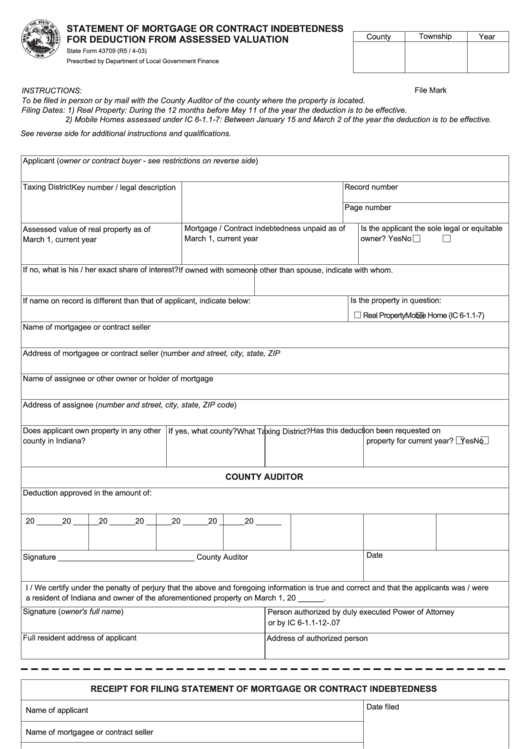

STATEMENT OF MORTGAGE OR CONTRACT INDEBTEDNESS

Township

County

Year

FOR DEDUCTION FROM ASSESSED VALUATION

State Form 43709 (R5 / 4-03)

Prescribed by Department of Local Government Finance

INSTRUCTIONS:

File Mark

To be filed in person or by mail with the County Auditor of the county where the property is located.

Filing Dates: 1) Real Property: During the 12 months before May 11 of the year the deduction is to be effective.

2) Mobile Homes assessed under IC 6-1.1-7: Between January 15 and March 2 of the year the deduction is to be effective.

See reverse side for additional instructions and qualifications.

Applicant (owner or contract buyer - see restrictions on reverse side)

Taxing District

Record number

Key number / legal description

Page number

Mortgage / Contract indebtedness unpaid as of

Is the applicant the sole legal or equitable

Assessed value of real property as of

March 1, current year

owner?

Yes

No

March 1, current year

If no, what is his / her exact share of interest?

If owned with someone other than spouse, indicate with whom.

Is the property in question:

If name on record is different than that of applicant, indicate below:

Real Property

Mobile Home (IC 6-1.1-7)

Name of mortgagee or contract seller

Address of mortgagee or contract seller (number and street, city, state, ZIP

Name of assignee or other owner or holder of mortgage

Address of assignee (number and street, city, state, ZIP code)

Does applicant own property in any other

Has this deduction been requested on

If yes, what county?

What Taxing District?

county in Indiana?

property for current year?

Yes

No

COUNTY AUDITOR

Deduction approved in the amount of:

20 ______

20 ______

20 ______

20 ______

20 ______

20 ______

20 ______

Date

Signature ________________________________ County Auditor

I / We certify under the penalty of perjury that the above and foregoing information is true and correct and that the applicants was / were

a resident of Indiana and owner of the aforementioned property on March 1, 20 ______.

Signature (owner's full name)

Person authorized by duly executed Power of Attorney

or by IC 6-1.1-12-.07

Full resident address of applicant

Address of authorized person

RECEIPT FOR FILING STATEMENT OF MORTGAGE OR CONTRACT INDEBTEDNESS

Date filed

Name of applicant

Name of mortgagee or contract seller

Amount of indebtedness

Taxing District

Key number / legal description

Signature ____________________________ County Auditor

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1