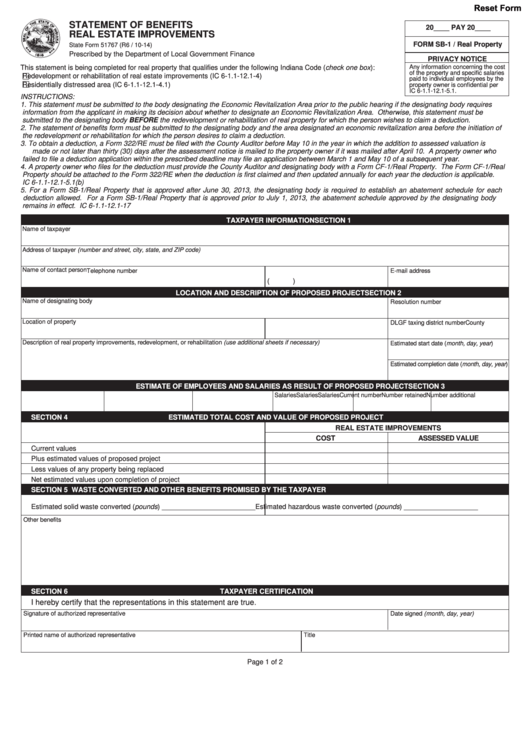

Reset Form

STATEMENT OF BENEFITS

20____ PAY 20____

REAL ESTATE IMPROVEMENTS

FORM SB-1 / Real Property

State Form 51767 (R6 / 10-14)

Prescribed by the Department of Local Government Finance

PRIVACY NOTICE

Any information concerning the cost

This statement is being completed for real property that qualifies under the following Indiana Code (check one box):

of the property and specific salaries

Redevelopment or rehabilitation of real estate improvements (IC 6-1.1-12.1-4)

paid to individual employees by the

Residentially distressed area (IC 6-1.1-12.1-4.1)

property owner is confidential per

IC 6-1.1-12.1-5.1.

INSTRUCTIONS:

1. This statement must be submitted to the body designating the Economic Revitalization Area prior to the public hearing if the designating body requires

information from the applicant in making its decision about whether to designate an Economic Revitalization Area. Otherwise, this statement must be

submitted to the designating body BEFORE the redevelopment or rehabilitation of real property for which the person wishes to claim a deduction.

2. The statement of benefits form must be submitted to the designating body and the area designated an economic revitalization area before the initiation of

the redevelopment or rehabilitation for which the person desires to claim a deduction.

3. To obtain a deduction, a Form 322/RE must be filed with the County Auditor before May 10 in the year in which the addition to assessed valuation is

made or not later than thirty (30) days after the assessment notice is mailed to the property owner if it was mailed after April 10. A property owner who

failed to file a deduction application within the prescribed deadline may file an application between March 1 and May 10 of a subsequent year.

4. A property owner who files for the deduction must provide the County Auditor and designating body with a Form CF-1/Real Property. The Form CF-1/Real

Property should be attached to the Form 322/RE when the deduction is first claimed and then updated annually for each year the deduction is applicable.

IC 6-1.1-12.1-5.1(b)

5. For a Form SB-1/Real Property that is approved after June 30, 2013, the designating body is required to establish an abatement schedule for each

deduction allowed. For a Form SB-1/Real Property that is approved prior to July 1, 2013, the abatement schedule approved by the designating body

remains in effect. IC 6-1.1-12.1-17

SECTION 1

TAXPAYER INFORMATION

Name of taxpayer

Address of taxpayer (number and street, city, state, and ZIP code)

Name of contact person

T elephone number

E-mail address

(

)

SECTION 2

LOCATION AND DESCRIPTION OF PROPOSED PROJECT

Name of designating body

Resolution number

Location of property

County

DLGF taxing district number

Description of real property improvements, redevelopment, or rehabilitation (use additional sheets if necessary)

Estimated start date (month, day, year)

Estimated completion date (month, day, year)

SECTION 3

ESTIMATE OF EMPLOYEES AND SALARIES AS RESULT OF PROPOSED PROJECT

Current number

Salaries

Number retained

Salaries

Number additional

Salaries

SECTION 4

ESTIMATED TOTAL COST AND VALUE OF PROPOSED PROJECT

REAL ESTATE IMPROVEMENTS

COST

ASSESSED VALUE

Current values

Plus estimated values of proposed project

Less values of any property being replaced

Net estimated values upon completion of project

SECTION 5

WASTE CONVERTED AND OTHER BENEFITS PROMISED BY THE TAXPAYER

Estimated solid waste converted (pounds) ________________________

Estimated hazardous waste converted (pounds) ___________________

Other benefits

SECTION 6

TAXPAYER CERTIFICATION

I hereby certify that the representations in this statement are true.

Signature of authorized representative

Date signed (month, day, year)

Printed name of authorized representative

Title

Page 1 of 2

1

1 2

2