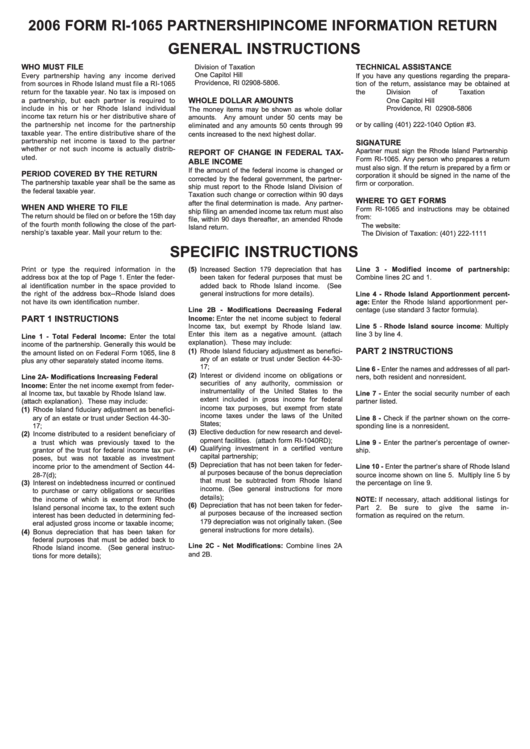

Form Ri-1065 - Partnership Income Information Return - General Instructions - 2006

ADVERTISEMENT

2006 FORM RI-1065 PARTNERSHIP INCOME INFORMATION RETURN

GENERAL INSTRUCTIONS

WHO MUST FILE

Division of Taxation

TECHNICAL ASSISTANCE

One Capitol Hill

Every partnership having any income derived

If you have any questions regarding the prepara-

Providence, RI 02908-5806.

from sources in Rhode Island must file a RI-1065

tion of the return, assistance may be obtained at

return for the taxable year. No tax is imposed on

the

Division of Taxation

a partnership, but each partner is required to

WHOLE DOLLAR AMOUNTS

One Capitol Hill

include in his or her Rhode Island individual

Providence, RI 02908-5806

The money items may be shown as whole dollar

income tax return his or her distributive share of

amounts. Any amount under 50 cents may be

the partnership net income for the partnership

or by calling (401) 222-1040 Option #3.

eliminated and any amounts 50 cents through 99

taxable year. The entire distributive share of the

cents increased to the next highest dollar.

partnership net income is taxed to the partner

SIGNATURE

whether or not such income is actually distrib-

A partner must sign the Rhode Island Partnership

REPORT OF CHANGE IN FEDERAL TAX-

uted.

Form RI-1065. Any person who prepares a return

ABLE INCOME

must also sign. If the return is prepared by a firm or

If the amount of the federal income is changed or

PERIOD COVERED BY THE RETURN

corporation it should be signed in the name of the

corrected by the federal government, the partner-

The partnership taxable year shall be the same as

firm or corporation.

ship must report to the Rhode Island Division of

the federal taxable year.

Taxation such change or correction within 90 days

WHERE TO GET FORMS

after the final determination is made. Any partner-

WHEN AND WHERE TO FILE

Form RI-1065 and instructions may be obtained

ship filing an amended income tax return must also

The return should be filed on or before the 15th day

from:

file, within 90 days thereafter, an amended Rhode

of the fourth month following the close of the part-

The website:

Island return.

nership’s taxable year. Mail your return to the:

The Division of Taxation: (401) 222-1111

SPECIFIC INSTRUCTIONS

Print or type the required information in the

(5) Increased Section 179 depreciation that has

Line 3 - Modified income of partnership:

address box at the top of Page 1. Enter the feder-

been taken for federal purposes that must be

Combine lines 2C and 1.

al identification number in the space provided to

added back to Rhode Island income.

(See

the right of the address box--Rhode Island does

general instructions for more details).

Line 4 - Rhode Island Apportionment percent-

not have its own identification number.

age: Enter the Rhode Island apportionment per-

Line 2B - Modifications Decreasing Federal

centage (use standard 3 factor formula).

PART 1 INSTRUCTIONS

Income: Enter the net income subject to federal

Income tax, but exempt by Rhode Island law.

Line 5 - Rhode Island source income: Multiply

Enter this item as a negative amount. (attach

line 3 by line 4.

Line 1 - Total Federal Income: Enter the total

explanation). These may include:

income of the partnership. Generally this would be

(1) Rhode Island fiduciary adjustment as benefici-

PART 2 INSTRUCTIONS

the amount listed on on Federal Form 1065, line 8

ary of an estate or trust under Section 44-30-

plus any other separately stated income items.

17;

Line 6 - Enter the names and addresses of all part-

(2) Interest or dividend income on obligations or

Line 2A - Modifications Increasing Federal

ners, both resident and nonresident.

securities of any authority, commission or

Income: Enter the net income exempt from feder-

instrumentality of the United States to the

al Income tax, but taxable by Rhode Island law.

Line 7 - Enter the social security number of each

extent included in gross income for federal

(attach explanation). These may include:

partner listed.

income tax purposes, but exempt from state

(1) Rhode Island fiduciary adjustment as benefici-

income taxes under the laws of the United

ary of an estate or trust under Section 44-30-

Line 8 - Check if the partner shown on the corre-

States;

17;

sponding line is a nonresident.

(3) Elective deduction for new research and devel-

(2) Income distributed to a resident beneficiary of

opment facilities. (attach form RI-1040RD);

a trust which was previously taxed to the

Line 9 - Enter the partner’s percentage of owner-

(4) Qualifying investment in a certified venture

grantor of the trust for federal income tax pur-

ship.

capital partnership;

poses, but was not taxable as investment

(5) Depreciation that has not been taken for feder-

income prior to the amendment of Section 44-

Line 10 - Enter the partner’s share of Rhode Island

al purposes because of the bonus depreciation

28-7(d);

source income shown on line 5. Multiply line 5 by

that must be subtracted from Rhode Island

(3) Interest on indebtedness incurred or continued

the percentage on line 9.

income. (See general instructions for more

to purchase or carry obligations or securities

details);

the income of which is exempt from Rhode

NOTE: If necessary, attach additional listings for

(6) Depreciation that has not been taken for feder-

Island personal income tax, to the extent such

Part

2.

Be

sure

to

give

the

same

in-

al purposes because of the increased section

interest has been deducted in determining fed-

formation as required on the return.

179 depreciation was not originally taken. (See

eral adjusted gross income or taxable income;

general instructions for more details).

(4) Bonus depreciation that has been taken for

federal purposes that must be added back to

Line 2C - Net Modifications: Combine lines 2A

Rhode Island income. (See general instruc-

and 2B.

tions for more details);

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1