Form Rct-102 - File With Form Rct-101 - Capital Stock Tax Manufacturing Exemption Schedule - Pa Department Of Revenue

ADVERTISEMENT

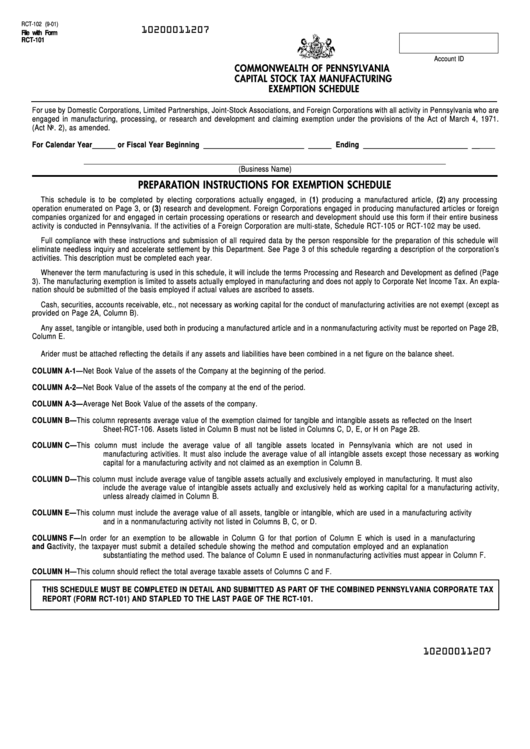

RCT-102 (9-01)

10200011207

File with Form

RCT-101

Account ID

COMMONWEALTH OF PENNSYLVANIA

CAPITAL STOCK TAX MANUFACTURING

EXEMPTION SCHEDULE

For use by Domestic Corporations, Limited Partnerships, Joint-Stock Associations, and Foreign Corporations with all activity in Pennsylvania who are

engaged in manufacturing, processing, or research and development and claiming exemption under the provisions of the Act of March 4, 1971.

P.L. 6 (Act No. 2), as amended.

For Calendar Year______ or Fiscal Year Beginning __________________________ ______ Ending ___________________________ ______

(Business Name)

PREPARATION INSTRUCTIONS FOR EXEMPTION SCHEDULE

This schedule is to be completed by electing corporations actually engaged, in (1) producing a manufactured article, (2) any processing

operation enumerated on Page 3, or (3) research and development. Foreign Corporations engaged in producing manufactured articles or foreign

companies organized for and engaged in certain processing operations or research and development should use this form if their entire business

activity is conducted in Pennsylvania. If the activities of a Foreign Corporation are multi-state, Schedule RCT-105 or RCT-102 may be used.

Full compliance with these instructions and submission of all required data by the person responsible for the preparation of this schedule will

eliminate needless inquiry and accelerate settlement by this Department. See Page 3 of this schedule regarding a description of the corporation’s

activities. This description must be completed each year.

Whenever the term manufacturing is used in this schedule, it will include the terms Processing and Research and Development as defined (Page

3). The manufacturing exemption is limited to assets actually employed in manufacturing and does not apply to Corporate Net Income Tax. An expla-

nation should be submitted of the basis employed if actual values are ascribed to assets.

Cash, securities, accounts receivable, etc., not necessary as working capital for the conduct of manufacturing activities are not exempt (except as

provided on Page 2A, Column B).

Any asset, tangible or intangible, used both in producing a manufactured article and in a nonmanufacturing activity must be reported on Page 2B,

Column E.

A rider must be attached reflecting the details if any assets and liabilities have been combined in a net figure on the balance sheet.

COLUMN A-1

—

Net Book Value of the assets of the Company at the beginning of the period.

COLUMN A-2

—

Net Book Value of the assets of the company at the end of the period.

COLUMN A-3

—

Average Net Book Value of the assets of the company.

COLUMN B

—

This column represents average value of the exemption claimed for tangible and intangible assets as reflected on the Insert

Sheet-RCT-106. Assets listed in Column B must not be listed in Columns C, D, E, or H on Page 2B.

COLUMN C

—

This column must include the average value of all tangible assets located in Pennsylvania which are not used in

manufacturing activities. It must also include the average value of all intangible assets except those necessary as working

capital for a manufacturing activity and not claimed as an exemption in Column B.

COLUMN D

—

This column must include average value of tangible assets actually and exclusively employed in manufacturing. It must also

include the average value of intangible assets actually and exclusively held as working capital for a manufacturing activity,

unless already claimed in Column B.

COLUMN E

—

This column must include the average value of all assets, tangible or intangible, which are used in a manufacturing activity

and in a nonmanufacturing activity not listed in Columns B, C, or D.

COLUMNS F

—

In order for an exemption to be allowable in Column G for that portion of Column E which is used in a manufacturing

and G

activity, the taxpayer must submit a detailed schedule showing the method and computation employed and an explanation

substantiating the method used. The balance of Column E used in nonmanufacturing activities must appear in Column F.

COLUMN H

—

This column should reflect the total average taxable assets of Columns C and F.

THIS SCHEDULE MUST BE COMPLETED IN DETAIL AND SUBMITTED AS PART OF THE COMBINED PENNSYLVANIA CORPORATE TAX

REPORT (FORM RCT-101) AND STAPLED TO THE LAST PAGE OF THE RCT-101.

10200011207

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2