Telecommunications Relay Service Surcharge Instructions

ADVERTISEMENT

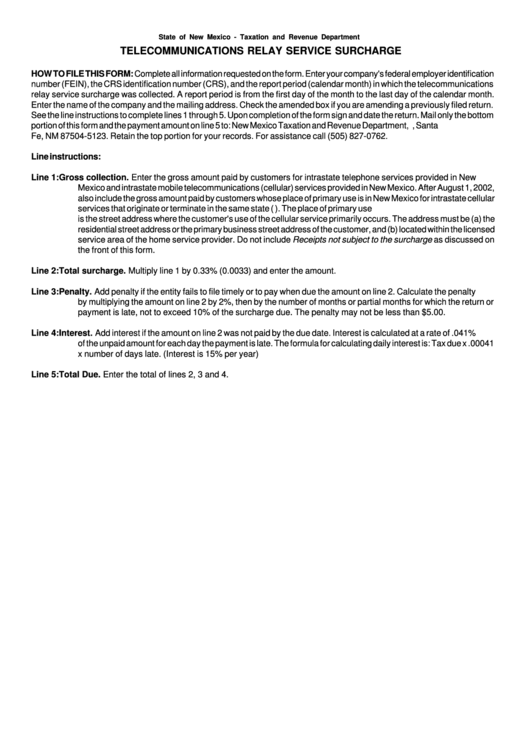

State of New Mexico - Taxation and Revenue Department

TELECOMMUNICATIONS RELAY SERVICE SURCHARGE

HOW TO FILE THIS FORM: Complete all information requested on the form. Enter your company's federal employer identification

number (FEIN), the CRS identification number (CRS), and the report period (calendar month) in which the telecommunications

relay service surcharge was collected. A report period is from the first day of the month to the last day of the calendar month.

Enter the name of the company and the mailing address. Check the amended box if you are amending a previously filed return.

See the line instructions to complete lines 1 through 5. Upon completion of the form sign and date the return. Mail only the bottom

portion of this form and the payment amount on line 5 to: New Mexico Taxation and Revenue Department, P.O. Box 25123, Santa

Fe, NM 87504-5123. Retain the top portion for your records. For assistance call (505) 827-0762.

Line instructions:

Line 1:

Gross collection. Enter the gross amount paid by customers for intrastate telephone services provided in New

Mexico and intrastate mobile telecommunications (cellular) services provided in New Mexico. After August 1, 2002,

also include the gross amount paid by customers whose place of primary use is in New Mexico for intrastate cellular

services that originate or terminate in the same state (i.e. New Mexico or any other state). The place of primary use

is the street address where the customer's use of the cellular service primarily occurs. The address must be (a) the

residential street address or the primary business street address of the customer, and (b) located within the licensed

service area of the home service provider. Do not include Receipts not subject to the surcharge as discussed on

the front of this form.

Line 2:

Total surcharge. Multiply line 1 by 0.33% (0.0033) and enter the amount.

Line 3:

Penalty. Add penalty if the entity fails to file timely or to pay when due the amount on line 2. Calculate the penalty

by multiplying the amount on line 2 by 2%, then by the number of months or partial months for which the return or

payment is late, not to exceed 10% of the surcharge due. The penalty may not be less than $5.00.

Line 4:

Interest. Add interest if the amount on line 2 was not paid by the due date. Interest is calculated at a rate of .041%

of the unpaid amount for each day the payment is late. The formula for calculating daily interest is: Tax due x .00041

x number of days late. (Interest is 15% per year)

Line 5:

Total Due. Enter the total of lines 2, 3 and 4.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1