Charity Gaming Qualification Application Instructions - Indiana Department Of Revenue

ADVERTISEMENT

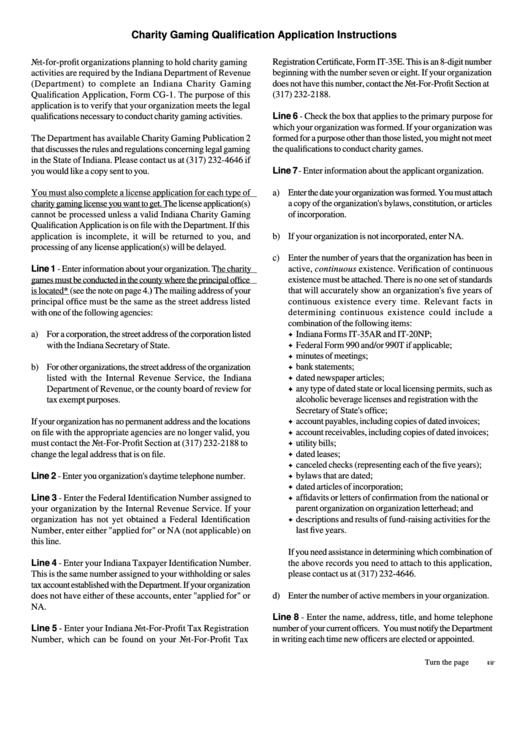

Charity Gaming Qualification Application Instructions

Registration Certificate, Form IT-35E. This is an 8-digit number

Not-for-profit organizations planning to hold charity gaming

activities are required by the Indiana Department of Revenue

beginning with the number seven or eight. If your organization

(Department) to complete an Indiana Charity Gaming

does not have this number, contact the Not-For-Profit Section at

(317) 232-2188.

Qualification Application, Form CG-1. The purpose of this

application is to verify that your organization meets the legal

Line 6 - Check the box that applies to the primary purpose for

qualifications necessary to conduct charity gaming activities.

which your organization was formed. If your organization was

The Department has available Charity Gaming Publication 2

formed for a purpose other than those listed, you might not meet

that discusses the rules and regulations concerning legal gaming

the qualifications to conduct charity games.

in the State of Indiana. Please contact us at (317) 232-4646 if

Line 7 - Enter information about the applicant organization.

you would like a copy sent to you.

You must also complete a license application for each type of

a) Enter the date your organization was formed. You must attach

charity gaming license you want to get. The license application(s)

a copy of the organization's bylaws, constitution, or articles

cannot be processed unless a valid Indiana Charity Gaming

of incorporation.

Qualification Application is on file with the Department. If this

b) If your organization is not incorporated, enter NA.

application is incomplete, it will be returned to you, and

processing of any license application(s) will be delayed.

c) Enter the number of years that the organization has been in

Line 1 - Enter information about your organization. The charity

active, continuous existence. Verification of continuous

existence must be attached. There is no one set of standards

games must be conducted in the county where the principal office

is located* (see the note on page 4. ) The mailing address of your

that will accurately show an organization's five years of

principal office must be the same as the street address listed

continuous existence every time. Relevant facts in

with one of the following agencies:

determining continuous existence could include a

combination of the following items:

Indiana Forms IT-35AR and IT-20NP;

a) For a corporation, the street address of the corporation listed

Federal Form 990 and/or 990T if applicable;

with the Indiana Secretary of State.

minutes of meetings;

b) For other organizations, the street address of the organization

bank statements;

dated newspaper articles;

listed with the Internal Revenue Service, the Indiana

any type of dated state or local licensing permits, such as

Department of Revenue, or the county board of review for

tax exempt purposes.

alcoholic beverage licenses and registration with the

Secretary of State's office;

If your organization has no permanent address and the locations

account payables, including copies of dated invoices;

on file with the appropriate agencies are no longer valid, you

account receivables, including copies of dated invoices;

utility bills;

must contact the Not-For-Profit Section at (317) 232-2188 to

dated leases;

change the legal address that is on file.

canceled checks (representing each of the five years);

Line 2 - Enter you organization's daytime telephone number.

bylaws that are dated;

dated articles of incorporation;

Line 3 - Enter the Federal Identification Number assigned to

affidavits or letters of confirmation from the national or

parent organization on organization letterhead; and

your organization by the Internal Revenue Service. If your

descriptions and results of fund-raising activities for the

organization has not yet obtained a Federal Identification

Number, enter either "applied for" or NA (not applicable) on

last five years.

this line.

If you need assistance in determining which combination of

Line 4 - Enter your Indiana Taxpayer Identification Number.

the above records you need to attach to this application,

This is the same number assigned to your withholding or sales

please contact us at (317) 232-4646.

tax account established with the Department. If your organization

does not have either of these accounts, enter "applied for" or

d) Enter the number of active members in your organization.

NA.

Line 8 - Enter the name, address, title, and home telephone

Line 5 - Enter your Indiana Not-For-Profit Tax Registration

number of your current officers. You must notify the Department

Number, which can be found on your Not-For-Profit Tax

in writing each time new officers are elected or appointed.

Turn the page

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2