Instructions For Schedule It-40nol - Individual Income Tax Net Operating Loss Computation - Indiana Department Of Revenue

ADVERTISEMENT

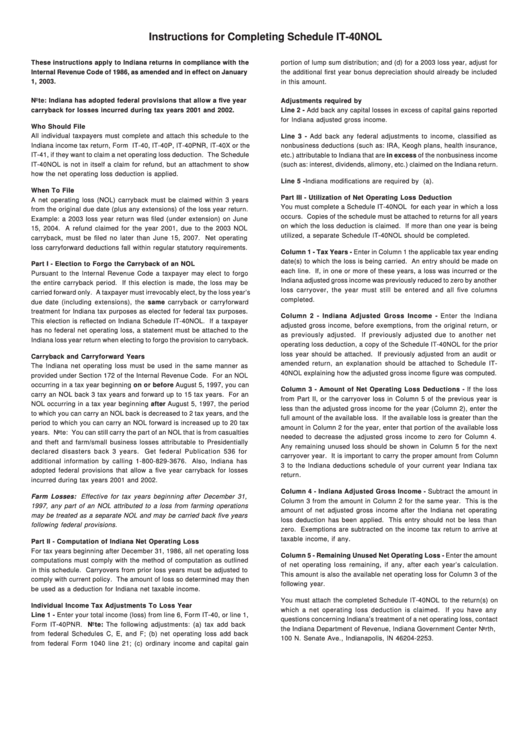

Instructions for Completing Schedule IT-40NOL

These instructions apply to Indiana returns in compliance with the

portion of lump sum distribution; and (d) for a 2003 loss year, adjust for

Internal Revenue Code of 1986, as amended and in effect on January

the additional first year bonus depreciation should already be included

1, 2003.

in this amount.

Note: Indiana has adopted federal provisions that allow a five year

Adjustments required by I.R.C. Section 172

carryback for losses incurred during tax years 2001 and 2002.

Line 2 - Add back any capital losses in excess of capital gains reported

for Indiana adjusted gross income.

Who Should File

All individual taxpayers must complete and attach this schedule to the

Line 3 - Add back any federal adjustments to income, classified as

Indiana income tax return, Form IT-40, IT-40P, IT-40PNR, IT-40X or the

nonbusiness deductions (such as: IRA, Keogh plans, health insurance,

IT-41, if they want to claim a net operating loss deduction. The Schedule

etc.) attributable to Indiana that are in excess of the nonbusiness income

IT-40NOL is not in itself a claim for refund, but an attachment to show

(such as: interest, dividends, alimony, etc.) claimed on the Indiana return.

how the net operating loss deduction is applied.

Line 5 - Indiana modifications are required by I.C. 6-3-1-3.5(a).

When To File

Part III - Utilization of Net Operating Loss Deduction

A net operating loss (NOL) carryback must be claimed within 3 years

You must complete a Schedule IT-40NOL for each year in which a loss

from the original due date (plus any extensions) of the loss year return.

occurs. Copies of the schedule must be attached to returns for all years

Example: a 2003 loss year return was filed (under extension) on June

on which the loss deduction is claimed. If more than one year is being

15, 2004. A refund claimed for the year 2001, due to the 2003 NOL

utilized, a separate Schedule IT-40NOL should be completed.

carryback, must be filed no later than June 15, 2007. Net operating

loss carryforward deductions fall within regular statutory requirements.

Column 1 - Tax Years - Enter in Column 1 the applicable tax year ending

date(s) to which the loss is being carried. An entry should be made on

Part I - Election to Forgo the Carryback of an NOL

each line. If, in one or more of these years, a loss was incurred or the

Pursuant to the Internal Revenue Code a taxpayer may elect to forgo

Indiana adjusted gross income was previously reduced to zero by another

the entire carryback period. If this election is made, the loss may be

loss carryover, the year must still be entered and all five columns

carried forward only. A taxpayer must irrevocably elect, by the loss year’s

completed.

due date (including extensions), the same carryback or carryforward

treatment for Indiana tax purposes as elected for federal tax purposes.

Column 2 - Indiana Adjusted Gross Income - Enter the Indiana

This election is reflected on Indiana Schedule IT-40NOL. If a taxpayer

adjusted gross income, before exemptions, from the original return, or

has no federal net operating loss, a statement must be attached to the

as previously adjusted. If previously adjusted due to another net

Indiana loss year return when electing to forgo the provision to carryback.

operating loss deduction, a copy of the Schedule IT-40NOL for the prior

loss year should be attached. If previously adjusted from an audit or

Carryback and Carryforward Years

amended return, an explanation should be attached to Schedule IT-

The Indiana net operating loss must be used in the same manner as

40NOL explaining how the adjusted gross income figure was computed.

provided under Section 172 of the Internal Revenue Code. For an NOL

occurring in a tax year beginning on or before August 5, 1997, you can

Column 3 - Amount of Net Operating Loss Deductions - If the loss

carry an NOL back 3 tax years and forward up to 15 tax years. For an

from Part II, or the carryover loss in Column 5 of the previous year is

NOL occurring in a tax year beginning after August 5, 1997, the period

less than the adjusted gross income for the year (Column 2), enter the

to which you can carry an NOL back is decreased to 2 tax years, and the

full amount of the available loss. If the available loss is greater than the

period to which you can carry an NOL forward is increased up to 20 tax

amount in Column 2 for the year, enter that portion of the available loss

years. Note: You can still carry the part of an NOL that is from casualties

needed to decrease the adjusted gross income to zero for Column 4.

and theft and farm/small business losses attributable to Presidentially

Any remaining unused loss should be shown in Column 5 for the next

declared disasters back 3 years. Get federal Publication 536 for

carryover year. It is important to carry the proper amount from Column

additional information by calling 1-800-829-3676. Also, Indiana has

3 to the Indiana deductions schedule of your current year Indiana tax

adopted federal provisions that allow a five year carryback for losses

return.

incurred during tax years 2001 and 2002.

Column 4 - Indiana Adjusted Gross Income - Subtract the amount in

Farm Losses: Effective for tax years beginning after December 31,

Column 3 from the amount in Column 2 for the same year. This is the

1997, any part of an NOL attributed to a loss from farming operations

amount of net adjusted gross income after the Indiana net operating

may be treated as a separate NOL and may be carried back five years

loss deduction has been applied. This entry should not be less than

following federal provisions.

zero. Exemptions are subtracted on the income tax return to arrive at

taxable income, if any.

Part II - Computation of Indiana Net Operating Loss

For tax years beginning after December 31, 1986, all net operating loss

Column 5 - Remaining Unused Net Operating Loss - Enter the amount

computations must comply with the method of computation as outlined

of net operating loss remaining, if any, after each year’s calculation.

in this schedule. Carryovers from prior loss years must be adjusted to

This amount is also the available net operating loss for Column 3 of the

comply with current policy. The amount of loss so determined may then

following year.

be used as a deduction for Indiana net taxable income.

You must attach the completed Schedule IT-40NOL to the return(s) on

Individual Income Tax Adjustments To Loss Year

which a net operating loss deduction is claimed. If you have any

Line 1 - Enter your total income (loss) from line 6, Form IT-40, or line 1,

questions concerning Indiana’s treatment of a net operating loss, contact

Form IT-40PNR. Note: The following adjustments: (a) tax add back

the Indiana Department of Revenue, Indiana Government Center North,

from federal Schedules C, E, and F; (b) net operating loss add back

100 N. Senate Ave., Indianapolis, IN 46204-2253.

from federal Form 1040 line 21; (c) ordinary income and capital gain

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1