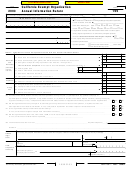

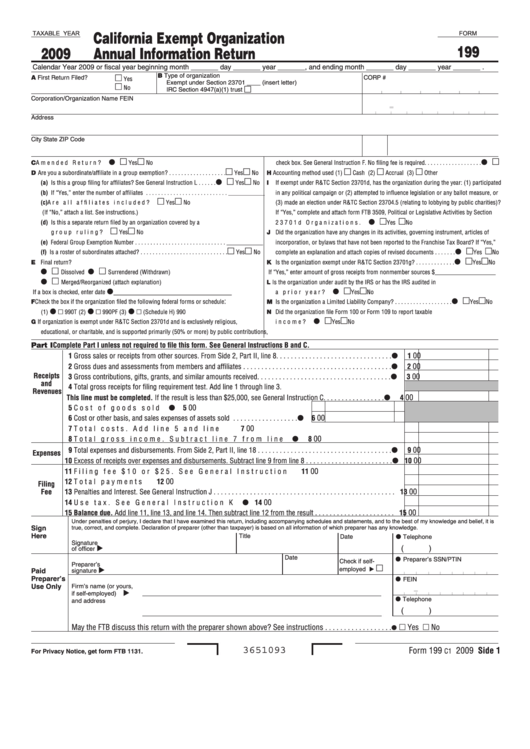

California Exempt Organization

TAXABLE YEAR

FORM

199

2009

Annual Information Return

Calendar Year 2009 or fiscal year beginning month _______ day _______ year _______, and ending month _______ day _______ year _______ .

B Type of organization

A First Return Filed?

CORP #

Yes

Exempt under Section 23701 ____ (insert letter)

No

IRC Section 4947(a)(1) trust

Corporation/Organization Name

FEIN

-

Address

City

State

ZIP Code

C Amended Return? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

check box. See General Instruction F. No filing fee is required. . . . . . . . . . . . . . . . . . .

D Are you a subordinate/affiliate in a group exemption? . . . . . . . . . . . . . . . . . . .

Yes

No

H Accounting method used (1)

Cash (2)

Accrual (3)

Other

(a) Is this a group filing for affiliates? See General Instruction L . . . . . .

Yes

No

If exempt under R&TC Section 23701d, has the organization during the year: (1) participated

I

(b) If “Yes,” enter the number of affiliates . . . . . . . . . . . . . . . . . . . . . . . . . . . ____________

in any political campaign or (2) attempted to influence legislation or any ballot measure, or

(c) Are all affiliates included? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

(3) made an election under R&TC Section 23704.5 (relating to lobbying by public charities)?

(If “No,” attach a list. See instructions.)

If “Yes,” complete and attach form FTB 3509, Political or Legislative Activities by Section

(d) Is this a separate return filed by an organization covered by a

23701d Organizations. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

group ruling? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

J Did the organization have any changes in its activities, governing instrument, articles of

(e) Federal Group Exemption Number . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ____________

incorporation, or bylaws that have not been reported to the Franchise Tax Board? If “Yes,”

(f) Is a roster of subordinates attached? . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

complete an explanation and attach copies of revised documents . . . . . . .

Yes

No

E Final return?

K Is the organization exempt under R&TC Section 23701g? . . . . . . . . . . . . .

Yes

No

Dissolved

Surrendered (Withdrawn)

If “Yes,” enter amount of gross receipts from nonmember sources $____________________

Merged/Reorganized (attach explanation)

L Is the organization under audit by the IRS or has the IRS audited in

___________________________

If a box is checked, enter date

a prior year? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

:

Check the box if the organization filed the following federal forms or schedule

M Is the organization a Limited Liability Company? . . . . . . . . . . . . . . . . . . .

Yes

No

F

(1)

990T (2)

990PF (3)

(Schedule H) 990

N Did the organization file Form 100 or Form 109 to report taxable

G If organization is exempt under R&TC Section 23701d and is exclusively religious,

income? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

educational, or charitable, and is supported primarily (50% or more) by public contributions,

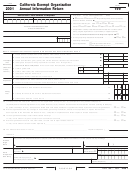

Part I Complete Part I unless not required to file this form. See General Instructions B and C.

1 Gross sales or receipts from other sources. From Side 2, Part II, line 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

00

00

2 Gross dues and assessments from members and affiliates . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

Receipts

00

3 Gross contributions, gifts, grants, and similar amounts received. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

and

4 Total gross receipts for filing requirement test. Add line 1 through line 3.

Revenues

00

This line must be completed. If the result is less than $25,000, see General Instruction C. . . . . . . . . . . . . . . . .

4

00

5 Cost of goods sold . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

00

6 Cost or other basis, and sales expenses of assets sold . . . . . . . . . . . . . . . . . .

6

00

7 Total costs. Add line 5 and line 6. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

00

8 Total gross income. Subtract line 7 from line 4. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

9 Total expenses and disbursements. From Side 2, Part II, line 18 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

00

Expenses

00

10 Excess of receipts over expenses and disbursements. Subtract line 9 from line 8 . . . . . . . . . . . . . . . . . . . . . . . .

10

11 Filing fee $10 or $25. See General Instruction F . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11

00

00

12 Total payments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12

Filing

Fee

00

13 Penalties and Interest. See General Instruction J . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13

00

14 Use tax. See General Instruction K . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14

00

15 Balance due. Add line 11, line 13, and line 14. Then subtract line 12 from the result . . . . . . . . . . . . . . . . . . . . . .

15

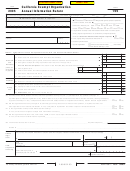

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is

Sign

true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Here

Title

Date

Telephone

Signature

(

)

of officer

Date

Preparer’s SSN/PTIN

Check if self-

Preparer’s

employed

Paid

signature

Preparer’s

FEIN

-

Use Only

Firm’s name (or yours,

if self-employed)

Telephone

and address

(

)

May the FTB discuss this return with the preparer shown above? See instructions . . . . . . . . . . . . . . . . . .

Yes No

3651093

Form 199

2009 Side 1

C1

For Privacy Notice, get form FTB 1131.

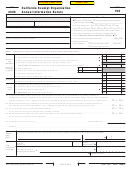

1

1 2

2