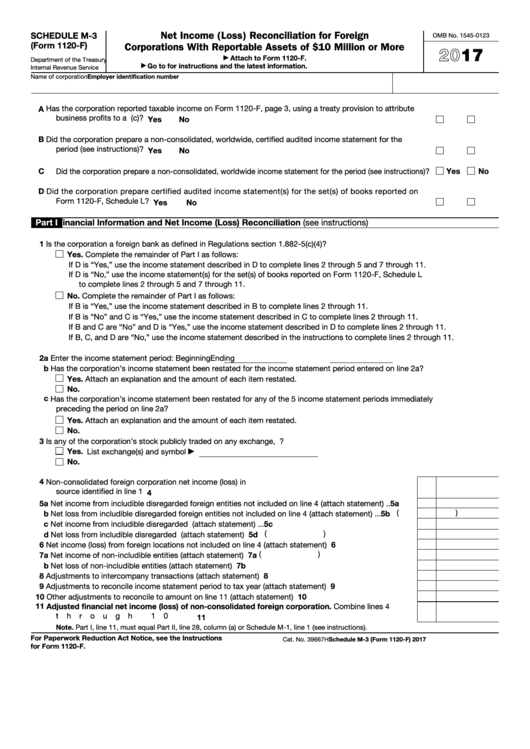

Net Income (Loss) Reconciliation for Foreign

SCHEDULE M-3

OMB No. 1545-0123

(Form 1120-F)

Corporations With Reportable Assets of $10 Million or More

2017

Attach to Form 1120-F.

▶

Department of the Treasury

Go to for instructions and the latest information.

▶

Internal Revenue Service

Name of corporation

Employer identification number

Has the corporation reported taxable income on Form 1120-F, page 3, using a treaty provision to attribute

A

business profits to a U.S. permanent establishment under rules other than section 864(c)? .

.

.

.

.

.

Yes

No

B

Did the corporation prepare a non-consolidated, worldwide, certified audited income statement for the

period (see instructions)?

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Yes

No

C

Did the corporation prepare a non-consolidated, worldwide income statement for the period (see instructions)?

Yes

No

D

Did the corporation prepare certified audited income statement(s) for the set(s) of books reported on

Form 1120-F, Schedule L? .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Yes

No

Part I

Financial Information and Net Income (Loss) Reconciliation (see instructions)

1

Is the corporation a foreign bank as defined in Regulations section 1.882-5(c)(4)?

Yes. Complete the remainder of Part I as follows:

If D is “Yes,” use the income statement described in D to complete lines 2 through 5 and 7 through 11.

If D is “No,” use the income statement(s) for the set(s) of books reported on Form 1120-F, Schedule L

to complete lines 2 through 5 and 7 through 11.

No. Complete the remainder of Part I as follows:

If B is “Yes,” use the income statement described in B to complete lines 2 through 11.

If B is “No” and C is “Yes,” use the income statement described in C to complete lines 2 through 11.

If B and C are “No” and D is “Yes,” use the income statement described in D to complete lines 2 through 11.

If B, C, and D are “No,” use the income statement described in the instructions to complete lines 2 through 11.

2a Enter the income statement period: Beginning

Ending

b Has the corporation’s income statement been restated for the income statement period entered on line 2a?

Yes. Attach an explanation and the amount of each item restated.

No.

c Has the corporation’s income statement been restated for any of the 5 income statement periods immediately

preceding the period on line 2a?

Yes. Attach an explanation and the amount of each item restated.

No.

3

Is any of the corporation’s stock publicly traded on any exchange, U.S. or foreign?

Yes. List exchange(s) and symbol

▶

No.

4

Non-consolidated foreign corporation net income (loss) in U.S. dollars from the income statement

source identified in line 1 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

4

5a Net income from includible disregarded foreign entities not included on line 4 (attach statement) .

.

5a

5b (

)

b Net loss from includible disregarded foreign entities not included on line 4 (attach statement) .

.

.

c Net income from includible disregarded U.S. entities not included on line 4 (attach statement) .

.

.

5c

5d (

)

d Net loss from includible disregarded U.S. entities not included on line 4 (attach statement) .

.

.

.

6

Net income (loss) from foreign locations not included on line 4 (attach statement) .

.

.

.

.

.

.

6

7a (

)

7a Net income of non-includible entities (attach statement)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

b Net loss of non-includible entities (attach statement)

7b

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

8

Adjustments to intercompany transactions (attach statement)

.

.

.

.

.

.

.

.

.

.

.

.

.

8

9

Adjustments to reconcile income statement period to tax year (attach statement) .

.

.

.

.

.

.

9

10

10

Other adjustments to reconcile to amount on line 11 (attach statement)

.

.

.

.

.

.

.

.

.

.

11

Adjusted financial net income (loss) of non-consolidated foreign corporation. Combine lines 4

through 10

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

11

Note. Part I, line 11, must equal Part II, line 28, column (a) or Schedule M-1, line 1 (see instructions).

For Paperwork Reduction Act Notice, see the Instructions

Cat. No. 39667H

Schedule M-3 (Form 1120-F) 2017

for Form 1120-F.

1

1 2

2 3

3 4

4