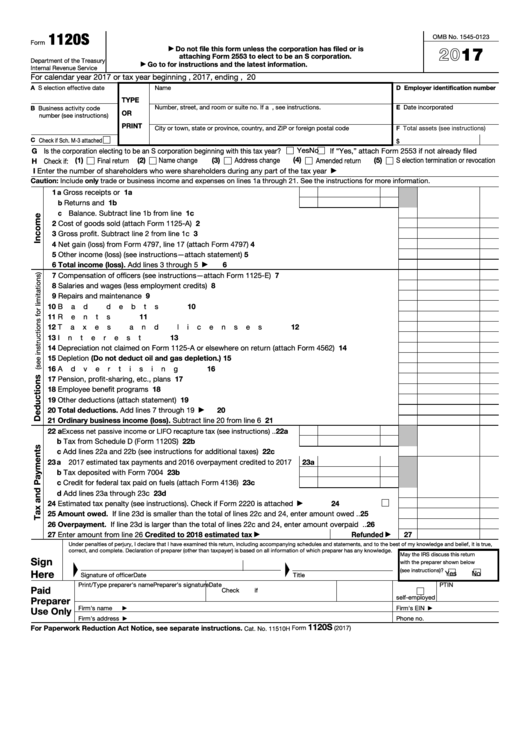

Form 1120s

What Is Form 1120s?

Form 1120S, U.S. Income Tax Return for an S Corporation is a tax form used to report the income, losses, and dividends of S corporation shareholders. In short, Form 1120S is an S corporation or small business corporation tax return. Corporations are not allowed to file this form unless they have filed or are attaching Form 2553 to be elected as an S corporation.

The latest fillable version of the form can be downloaded below.

IRS Form 1120s Instructions

The following information is necessary to complete Form 1120S:

- Election date. S corporations must be elected no later than 2 months and 15 days prior to the due date for filing Form 1120S.

- Business activity code. This code should reflect the type of industry that your business falls into.

- Products or services. All S corporations should be ready to indicate the products or services they generate most of their revenue from.

- The number of shareholders. List the total number of shareholders in the business.

- Employer Identification Number. The EIN or the Tax ID is a nine-digit number assigned to any business for the purpose of reporting taxes.

- Date of Incorporation. The date your business was incorporated.

- First year filing as an S corporation? If so, indicate yes in this question in Form 1120S.

- Profit and Loss statement. Prepare a financial report that summarizes your income and expenses for the tax year in question.

- Balance Sheet. This annual report reviews all liabilities, assets, and equity.

- Method of accounting. The two accounting methods are either cash-based or accrual-based.

- Independent contract payments. You must be ready to report any payments of $600 or more maid to independent contractors.

Form 1120s Mailing Address

If the corporation's principal business, office, or agency is located in Connecticut, Delaware, District of Columbia, Florida, Indiana, Maine, Maryland, Massachusetts, New Hampshire, New Jersey, New York, North Carolina, Ohio, Pennsylvania, Rhode Island, South Carolina, Vermont, Virginia, West Virginia and their total assets at the end of the tax year are less than $10 million, they must report to the IRS center in Cincinnati, OH 45999-0013.

The IRS center for corporations, whose principal business is located in Georgia, Illinois, Kentucky, Michigan, Tennessee, Wisconsin and whose total yearly assets are less than $10 million is located in Kansas City, MO 64999-0013.

An S corporation with principal business, office, or agency located in any other state, a foreign country or if the total assets at the end of the tax year exceed $10 million reports to the IRS center located in Ogden, UT 84201-0013.

Form 1120s Due Date

In most cases, S corporations must file Form 1120S by the 15th day of the 3rd month after the end of their tax year. For calendar year corporations, the due date for Form 1120S is March 15. Dissolved corporations must file by the 15th day of the 3rd month after the date of dissolution.

If the due date is on a Saturday, Sunday, or legal holiday, S corporations must file on the next day that is not a Saturday, Sunday, or legal holiday.

Corporations may File Form 7004, Application for Automatic Extension of Time To File Certain Business Income Tax, Information, and Other Returns, to request a 6-month extension of time to file. Form 7004 must be filed by the regular due date of the return, that being March 15. The address for filing Form 7004 has changed for some entities located in Georgia, Illinois, Kentucky, Michigan, Tennessee, and Wisconsin and is now located at the Internal Revenue Service Center in Kansas City, MO 64999-0019.

Form 1120s Templates