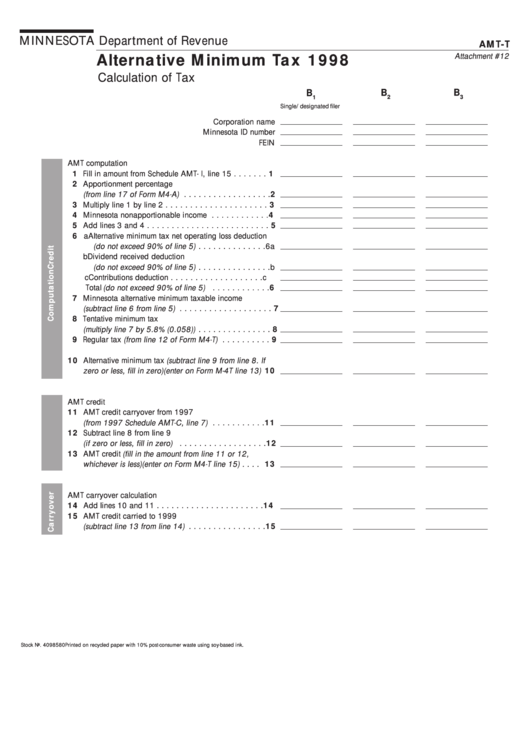

MINNESOTA Department of Revenue

AMT-T

Alternative Minimum Tax 1998

Attachment #12

Calculation of Tax

B

B

B

1

2

3

Single/designated filer

Corporation name

Minnesota ID number

FEIN

AMT computation

1 Fill in amount from Schedule AMT- I, line 15 . . . . . . . 1

2 Apportionment percentage

(from line 17 of Form M4-A) . . . . . . . . . . . . . . . . . . 2

3 Multiply line 1 by line 2 . . . . . . . . . . . . . . . . . . . . . 3

4 Minnesota nonapportionable income . . . . . . . . . . . . 4

5 Add lines 3 and 4 . . . . . . . . . . . . . . . . . . . . . . . . . 5

6 a Alternative minimum tax net operating loss deduction

(do not exceed 90% of line 5) . . . . . . . . . . . . . . 6a

b Dividend received deduction

(do not exceed 90% of line 5) . . . . . . . . . . . . . . . b

c Contributions deduction . . . . . . . . . . . . . . . . . . . c

Total (do not exceed 90% of line 5) . . . . . . . . . . . . 6

7 Minnesota alternative minimum taxable income

(subtract line 6 from line 5) . . . . . . . . . . . . . . . . . . . 7

8 Tentative minimum tax

(multiply line 7 by 5.8% (0.058)) . . . . . . . . . . . . . . . 8

9 Regular tax (from line 12 of Form M4-T) . . . . . . . . . . 9

10 Alternative minimum tax (subtract line 9 from line 8. If

zero or less, fill in zero)(enter on Form M-4T line 13) 10

AMT credit

11 AMT credit carryover from 1997

(from 1997 Schedule AMT-C, line 7) . . . . . . . . . . . 11

12 Subtract line 8 from line 9

(if zero or less, fill in zero) . . . . . . . . . . . . . . . . . . 12

13 AMT credit (fill in the amount from line 11 or 12,

whichever is less)(enter on Form M4-T line 15) . . . . 13

AMT carryover calculation

14 Add lines 10 and 11 . . . . . . . . . . . . . . . . . . . . . . 14

15 AMT credit carried to 1999

(subtract line 13 from line 14) . . . . . . . . . . . . . . . . 15

Stock No. 4098580

Printed on recycled paper with 10% post-consumer waste using soy-based ink.

1

1