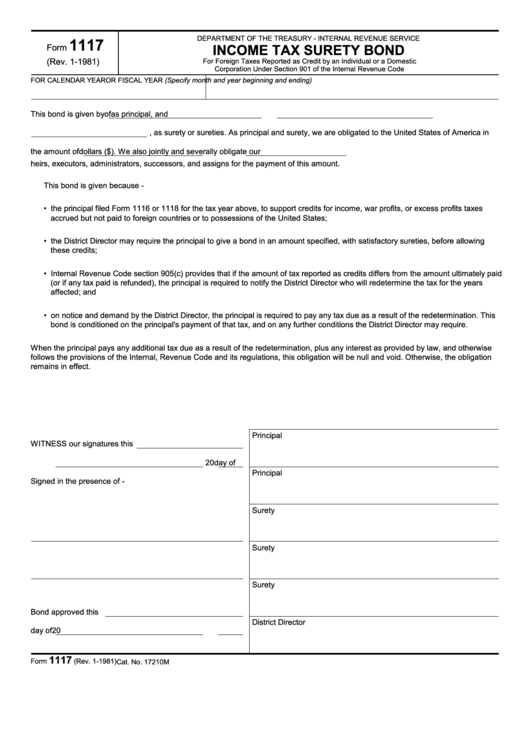

DEPARTMENT OF THE TREASURY - INTERNAL REVENUE SERVICE

1117

INCOME TAX SURETY BOND

Form

(Rev. 1-1981)

For Foreign Taxes Reported as Credit by an Individual or a Domestic

Corporation Under Section 901 of the Internal Revenue Code

FOR CALENDAR YEAR

OR FISCAL YEAR (Specify month and year beginning and ending)

This bond is given by

of

as principal, and

, as surety or sureties. As principal and surety, we are obligated to the United States of America in

the amount of

dollars ($

). We also jointly and severally obligate our

heirs, executors, administrators, successors, and assigns for the payment of this amount.

This bond is given because -

• the principal filed Form 1116 or 1118 for the tax year above, to support credits for income, war profits, or excess profits taxes

accrued but not paid to foreign countries or to possessions of the United States;

• the District Director may require the principal to give a bond in an amount specified, with satisfactory sureties, before allowing

these credits;

• Internal Revenue Code section 905(c) provides that if the amount of tax reported as credits differs from the amount ultimately paid

(or if any tax paid is refunded), the principal is required to notify the District Director who will redetermine the tax for the years

affected; and

• on notice and demand by the District Director, the principal is required to pay any tax due as a result of the redetermination. This

bond is conditioned on the principal's payment of that tax, and on any further conditions the District Director may require.

When the principal pays any additional tax due as a result of the redetermination, plus any interest as provided by law, and otherwise

follows the provisions of the Internal, Revenue Code and its regulations, this obligation will be null and void. Otherwise, the obligation

remains in effect.

Principal

WITNESS our signatures this

day of

20

Principal

Signed in the presence of -

Surety

Surety

Surety

Bond approved this

District Director

day of

20

1117

Form

(Rev. 1-1981)

Cat. No. 17210M

1

1