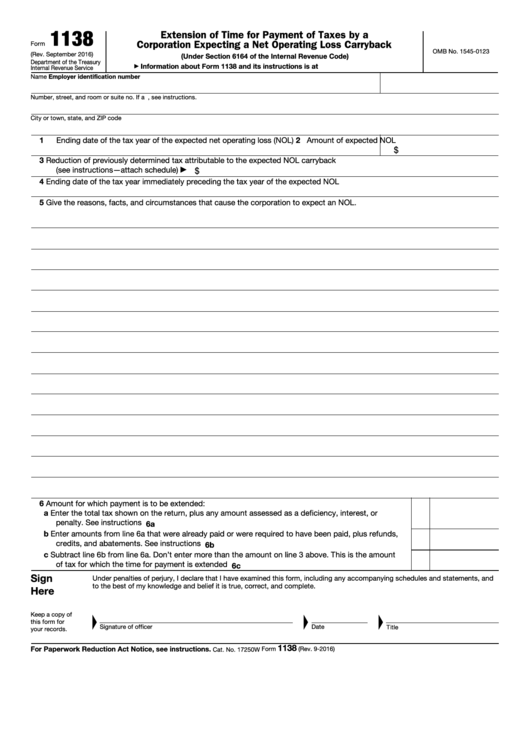

1138

Extension of Time for Payment of Taxes by a

Corporation Expecting a Net Operating Loss Carryback

Form

OMB No. 1545-0123

(Rev. September 2016)

(Under Section 6164 of the Internal Revenue Code)

Department of the Treasury

Information about Form 1138 and its instructions is at

Internal Revenue Service

▶

Name

Employer identification number

Number, street, and room or suite no. If a P.O. box, see instructions.

City or town, state, and ZIP code

1

Ending date of the tax year of the expected net operating loss (NOL)

2 Amount of expected NOL

$

3

Reduction of previously determined tax attributable to the expected NOL carryback

(see instructions—attach schedule)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

$

▶

4

Ending date of the tax year immediately preceding the tax year of the expected NOL

5

Give the reasons, facts, and circumstances that cause the corporation to expect an NOL.

6

Amount for which payment is to be extended:

a Enter the total tax shown on the return, plus any amount assessed as a deficiency, interest, or

penalty. See instructions .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

6a

b Enter amounts from line 6a that were already paid or were required to have been paid, plus refunds,

credits, and abatements. See instructions .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

6b

c Subtract line 6b from line 6a. Don’t enter more than the amount on line 3 above. This is the amount

of tax for which the time for payment is extended

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

6c

Sign

Under penalties of perjury, I declare that I have examined this form, including any accompanying schedules and statements, and

to the best of my knowledge and belief it is true, correct, and complete.

Here

Keep a copy of

this form for

Signature of officer

Date

Title

your records.

1138

For Paperwork Reduction Act Notice, see instructions.

Form

(Rev. 9-2016)

Cat. No. 17250W

1

1 2

2