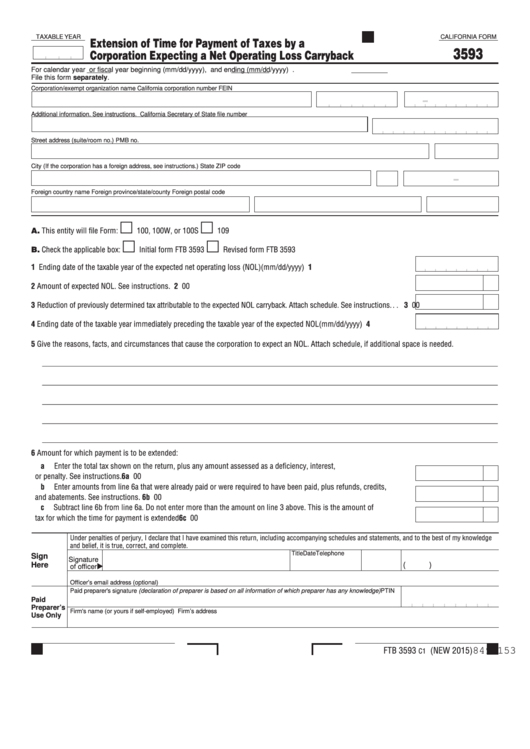

TAXABLE YEAR

CALIFORNIA FORM

Extension of Time for Payment of Taxes by a

3593

Corporation Expecting a Net Operating Loss Carryback

For calendar year

or fiscal year beginning (mm/dd/yyyy),

and ending (mm/dd/yyyy)

.

File this form separately.

Corporation/exempt organization name

California corporation number

FEIN

Additional information. See instructions.

California Secretary of State file number

Street address (suite/room no.)

PMB no.

City (If the corporation has a foreign address, see instructions.)

State

ZIP code

Foreign country name

Foreign province/state/county

Foreign postal code

A. This entity will file Form:

100, 100W, or 100S

109

B. Check the applicable box:

Initial form FTB 3593

Revised form FTB 3593

1 Ending date of the taxable year of the expected net operating loss (NOL) . . . . . . . . . . . . . . . . . . . . . . . . . (mm/dd/yyyy) 1

2 Amount of expected NOL . See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

00

3 Reduction of previously determined tax attributable to the expected NOL carryback . Attach schedule . See instructions . . . 3

00

4 Ending date of the taxable year immediately preceding the taxable year of the expected NOL . . . . . . . . . (mm/dd/yyyy) 4

5 Give the reasons, facts, and circumstances that cause the corporation to expect an NOL . Attach schedule, if additional space is needed .

_____________________________________________________________________________________________________________________

_____________________________________________________________________________________________________________________

_____________________________________________________________________________________________________________________

_____________________________________________________________________________________________________________________

_____________________________________________________________________________________________________________________

6 Amount for which payment is to be extended:

a Enter the total tax shown on the return, plus any amount assessed as a deficiency, interest,

or penalty . See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6a

00

b Enter amounts from line 6a that were already paid or were required to have been paid, plus refunds, credits,

and abatements . See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6b

00

c Subtract line 6b from line 6a . Do not enter more than the amount on line 3 above . This is the amount of

tax for which the time for payment is extended . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6c

00

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge

and belief, it is true, correct, and complete .

Title

Date

Telephone

Sign

Signature

Here

(

)

of officer

Officer’s email address (optional)

Paid preparer's signature (declaration of preparer is based on all information of which preparer has any knowledge)

PTIN

Paid

Preparer’s

Firm's name (or yours if self-employed)

Firm’s address

Use Only

FTB 3593

(NEW 2015)

8491153

C1

1

1 2

2