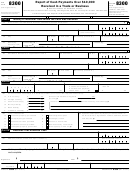

IRS Form 8300

2

FinCEN Form 8300

(Rev. 8-2014)

Page

(Rev. 8-2014)

Multiple Parties

(Complete applicable parts below if box 2 or 15 on page 1 is checked.)

Continued—Complete if box 2 on page 1 is checked

Part I

3

Last name

4 First name

5 M.I.

6 Taxpayer identification number

8 Date of birth .

.

.

7

Address (number, street, and apt. or suite no.)

M

M

D

D

Y

Y

Y

Y

▶

(see instructions)

9

City

10 State

11 ZIP code

12 Country (if not U.S.)

13 Occupation, profession, or business

a Describe ID

b Issued by

14

Identifying

▶

▶

document (ID)

c Number

▶

4 First name

3

5 M.I.

6 Taxpayer identification number

Last name

8 Date of birth .

.

.

7

Address (number, street, and apt. or suite no.)

▶

M

M

D

D

Y

Y

Y

Y

(see instructions)

9

City

10 State

11 ZIP code

12 Country (if not U.S.)

13 Occupation, profession, or business

14

Identifying

a Describe ID

b Issued by

▶

▶

document (ID)

c Number

▶

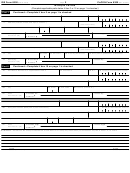

Continued—Complete if box 15 on page 1 is checked

Part II

16

17 First name

18 M.I.

19 Taxpayer identification number

Individual’s last name or organization’s name

20

Doing business as (DBA) name (see instructions)

Employer identification number

21

Address (number, street, and apt. or suite no.)

22 Occupation, profession, or business

23

24 State

25 ZIP code

26 Country (if not U.S.)

City

27

a Describe ID

b Issued by

Alien

▶

▶

identification (ID)

c Number

▶

16

Individual’s last name or organization’s name

17 First name

18 M.I.

19 Taxpayer identification number

20

Doing business as (DBA) name (see instructions)

Employer identification number

22 Occupation, profession, or business

21

Address (number, street, and apt. or suite no.)

23

City

24 State

25 ZIP code

26 Country (if not U.S.)

27

Alien

a Describe ID

b Issued by

▶

▶

identification (ID)

c Number

▶

Comments – Please use the lines provided below to comment on or clarify any information you entered on any line in Parts I, II, III, and IV

8300

8300

IRS Form

(Rev. 8-2014)

FinCEN Form

(Rev. 8-2014)

1

1 2

2 3

3 4

4 5

5