2

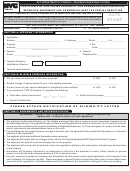

Form 5578 (Rev. 8-2013)

Page

General Instructions

A school is an educational organization

Section 4.02, Statement of Policy. Every

that normally maintains a regular faculty

school must include a statement of its

and curriculum and normally has a

racially nondiscriminatory policy as to

Section references are to the Internal Revenue

regularly enrolled body of pupils or

students in all its brochures and

Code unless otherwise noted.

students in attendance at the place where

catalogues dealing with student

Note. This form is open to public

its educational activities are regularly

admissions, programs, and scholarships. A

inspection.

carried on. The term includes primary,

statement substantially similar to the

secondary, preparatory, or high schools

Notice described in paragraph (a) of

Future Developments

and colleges and universities, whether

subsection 1 of section 4.03, infra, will be

For the latest information about

operated as a separate legal entity or as

acceptable for this purpose. Further, every

developments related to Form 5578 and its

an activity of a church or other

school must include a reference to its

instructions, such as legislation enacted

organization described in section 501(c)(3).

racially nondiscriminatory policy in other

after they were published, go to

The term also includes preschools and any

written advertising that it uses as a means

other organization that is a school as

of informing prospective students of its

defined in section 170(b)(1)(A)(ii).

programs. The following references will be

Purpose of Form

acceptable:

A central organization is an organization

Form 5578 may be used by organizations

that has one or more subordinates under

The (name) school admits students of

that operate tax-exempt private schools to

its general supervision or control. A

any race, color, and national or ethnic

provide the Internal Revenue Service with

subordinate is a chapter, local, post, or

origin.

the annual certification of racial

other unit of a central organization. A

Section 4.03, Publicity. The school must

nondiscrimination required by Rev. Proc.

central organization may also be a

make its racially nondiscriminatory policy

75-50 (the relevant part of which is

subordinate, as in the case of a state

known to all segments of the general

reproduced in these instructions).

organization that has subordinate units and

community served by the school.

is itself affiliated with a national

Who Must File

1. The school must use one of the

organization.

following two methods to satisfy this

Every organization that claims exemption

The group exemption number (GEN) is a

requirement:

from federal income tax under section

four-digit number issued to a central

501(c)(3) of the Internal Revenue Code and

(a) The school may publish a notice of

organization by the IRS. It identifies a

that operates, supervises, or controls a

its racially nondiscriminatory policy in a

central organization that has received a

private school(s) must file a certification of

newspaper of general circulation that

ruling from the IRS recognizing on a group

racial nondiscrimination. If an organization

serves all racial segments of the

basis the exemption from federal income

is required to file Form 990, Return of

community. This publication must be

tax of the central organization and its

Organization Exempt From Income Tax, or

repeated at least once annually during the

covered subordinates.

Form 990-EZ, Short Form Return of

period of the school’s solicitation for

Organization Exempt From Income Tax,

When To File

students or, in the absence of a solicitation

either as a separate return or as part of a

program, during the school’s registration

Under Rev. Proc. 75-50, a certification of

group return, the certification must be

period. Where more than one community is

racial nondiscrimination must be filed

made on Schedule E (Form 990 or

served by a school, the school may publish

annually by the 15th day of the 5th month

990-EZ), Schools, rather than on this form.

its notice in those newspapers that are

following the end of the organization’s

reasonably likely to be read by all racial

An authorized official of a central

calendar year or fiscal period.

segments of the communities that it

organization may file one form to certify for

serves. The notice must appear in a

the school activities of subordinate

Where To File

section of the newspaper likely to be read

organizations that would otherwise be

Mail Form 5578 to the Department of the

by prospective students and their families

required to file on an individual basis, but

Treasury, Internal Revenue Service Center,

and it must occupy at least three column

only if the central organization has enough

Ogden, UT 84201-0027.

inches. It must be captioned in at least 12

control over the schools listed on the form

point boldface type as a notice of

to ensure that the schools maintain a

Certification Requirement

nondiscriminatory policy as to students,

racially nondiscriminatory policy as to

and its text must be printed in at least 8

students.

Section 4.06 of Rev. Proc. 75-50 requires

point type. The following notice will be

an individual authorized to take official

Definitions

acceptable:

action on behalf of a school that claims to

be racially nondiscriminatory as to

A racially nondiscriminatory policy as to

Notice Of Nondiscriminatory

students to certify annually, under

students means that the school admits the

Policy As To Students

penalties of perjury, that to the best of his

students of any race to all the rights,

or her knowledge and belief the school has

privileges, programs, and activities

The (name) school admits students of any

satisfied the applicable requirements of

generally accorded or made available to

race, color, national and ethnic origin to all

sections 4.01 through 4.05 of the Revenue

students at that school and that the school

the rights, privileges, programs, and

Procedure, reproduced below:

does not discriminate on the basis of race

activities generally accorded or made

in the administration of its educational

available to students at the school. It does

Rev. Proc. 75-50

policies, admissions policies, scholarship

not discriminate on the basis of race, color,

and loan programs, and athletic and other

Section 4.01, Organizational

national and ethnic origin in administration

school-administered programs.

Requirements. A school must include a

of its educational policies, admissions

statement in its charter, bylaws, or other

policies, scholarship and loan programs,

The IRS considers discrimination on the

governing instrument, or in a resolution of

and athletic and other school-administered

basis of race to include discrimination on

its governing body, that it has a racially

programs.

the basis of color or national or ethnic

nondiscriminatory policy as to students

origin.

and therefore does not discriminate against

applicants and students on the basis of

race, color, and national or ethnic origin.

1

1 2

2 3

3 4

4