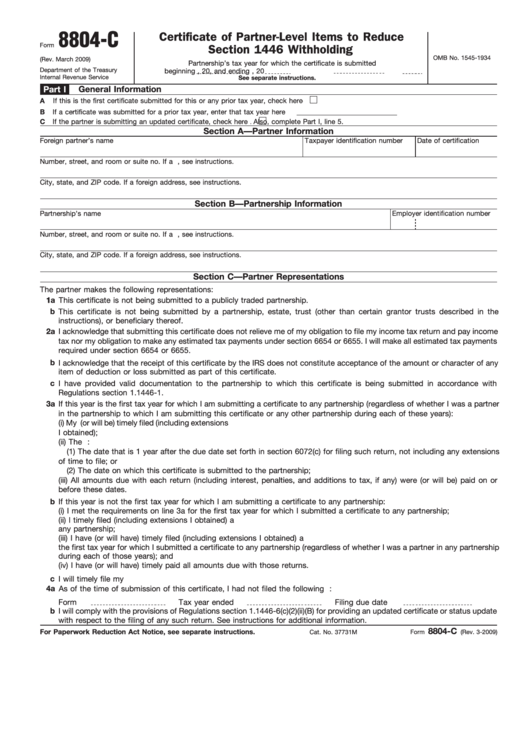

8804-C

Certificate of Partner-Level Items to Reduce

Form

Section 1446 Withholding

OMB No. 1545-1934

(Rev. March 2009)

Partnership’s tax year for which the certificate is submitted

Department of the Treasury

beginning

, 20

, and ending

, 20

Internal Revenue Service

See separate instructions.

General Information

Part I

.

A

If this is the first certificate submitted for this or any prior tax year, check here

B

If a certificate was submitted for a prior tax year, enter that tax year here

C

If the partner is submitting an updated certificate, check here

Also, complete Part I, line 5.

.

Section A—Partner Information

Foreign partner’s name

Taxpayer identification number

Date of certification

Number, street, and room or suite no. If a P.O. box, see instructions.

City, state, and ZIP code. If a foreign address, see instructions.

Section B—Partnership Information

Partnership’s name

Employer identification number

Number, street, and room or suite no. If a P.O. box, see instructions.

City, state, and ZIP code. If a foreign address, see instructions.

Section C—Partner Representations

The partner makes the following representations:

1a

1

This certificate is not being submitted to a publicly traded partnership.

b

This certificate is not being submitted by a partnership, estate, trust (other than certain grantor trusts described in the

instructions), or beneficiary thereof.

2a

I acknowledge that submitting this certificate does not relieve me of my obligation to file my income tax return and pay income

tax nor my obligation to make any estimated tax payments under section 6654 or 6655. I will make all estimated tax payments

required under section 6654 or 6655.

b

I acknowledge that the receipt of this certificate by the IRS does not constitute acceptance of the amount or character of any

item of deduction or loss submitted as part of this certificate.

c

I have provided valid documentation to the partnership to which this certificate is being submitted in accordance with

Regulations section 1.1446-1.

3a

If this year is the first tax year for which I am submitting a certificate to any partnership (regardless of whether I was a partner

in the partnership to which I am submitting this certificate or any other partnership during each of these years):

(i) My U.S. federal income tax return for the immediately preceding tax year has been (or will be) timely filed (including extensions

I obtained);

(ii) The U.S. federal income tax returns for the second and third preceding tax years were filed by the earlier of:

(1) The date that is 1 year after the due date set forth in section 6072(c) for filing such return, not including any extensions

of time to file; or

(2) The date on which this certificate is submitted to the partnership;

(iii) All amounts due with each return (including interest, penalties, and additions to tax, if any) were (or will be) paid on or

before these dates.

b

If this year is not the first tax year for which I am submitting a certificate to any partnership:

(i) I met the requirements on line 3a for the first tax year for which I submitted a certificate to any partnership;

(ii) I timely filed (including extensions I obtained) a U.S. federal income tax return for the first year I submitted a certificate to

any partnership;

(iii) I have (or will have) timely filed (including extensions I obtained) a U.S. federal income tax return for each tax year since

the first tax year for which I submitted a certificate to any partnership (regardless of whether I was a partner in any partnership

during each of those years); and

(iv) I have (or will have) timely paid all amounts due with those returns.

c

I will timely file my U.S. federal income tax return for the current tax year and timely pay all amounts due with that return.

4a

As of the time of submission of this certificate, I had not filed the following U.S. federal income tax return:

Form

Tax year ended

Filing due date

b

I will comply with the provisions of Regulations section 1.1446-6(c)(2)(ii)(B) for providing an updated certificate or status update

with respect to the filing of any such return. See instructions for additional information.

8804-C

For Paperwork Reduction Act Notice, see separate instructions.

Cat. No. 37731M

Form

(Rev. 3-2009)

1

1 2

2 3

3