Form 2006-C - Certification Of Inactivity - Division Of Taxation Of State Of New Jersey

ADVERTISEMENT

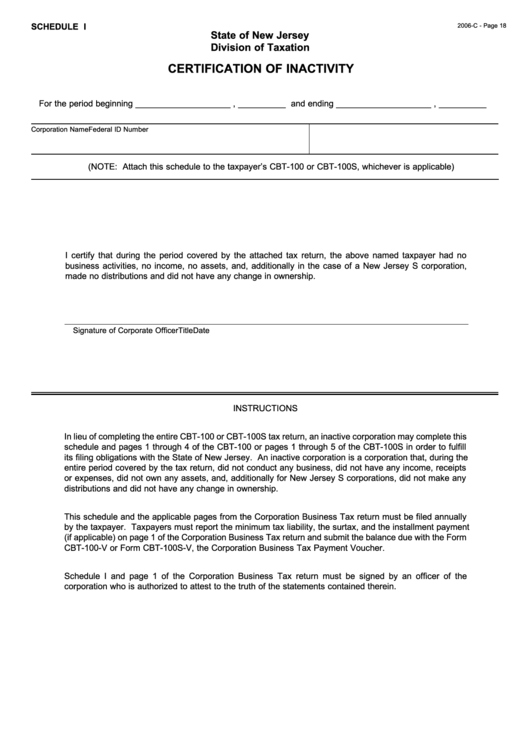

SCHEDULE I

2006-C - Page 18

State of New Jersey

Division of Taxation

CERTIFICATION OF INACTIVITY

For the period beginning ____________________ , __________ and ending ____________________ , __________

Corporation Name

Federal ID Number

(NOTE: Attach this schedule to the taxpayer’s CBT-100 or CBT-100S, whichever is applicable)

I certify that during the period covered by the attached tax return, the above named taxpayer had no

business activities, no income, no assets, and, additionally in the case of a New Jersey S corporation,

made no distributions and did not have any change in ownership.

Signature of Corporate Officer

Title

Date

INSTRUCTIONS

In lieu of completing the entire CBT-100 or CBT-100S tax return, an inactive corporation may complete this

schedule and pages 1 through 4 of the CBT-100 or pages 1 through 5 of the CBT-100S in order to fulfill

its filing obligations with the State of New Jersey. An inactive corporation is a corporation that, during the

entire period covered by the tax return, did not conduct any business, did not have any income, receipts

or expenses, did not own any assets, and, additionally for New Jersey S corporations, did not make any

distributions and did not have any change in ownership.

This schedule and the applicable pages from the Corporation Business Tax return must be filed annually

by the taxpayer. Taxpayers must report the minimum tax liability, the surtax, and the installment payment

(if applicable) on page 1 of the Corporation Business Tax return and submit the balance due with the Form

CBT-100-V or Form CBT-100S-V, the Corporation Business Tax Payment Voucher.

Schedule I and page 1 of the Corporation Business Tax return must be signed by an officer of the

corporation who is authorized to attest to the truth of the statements contained therein.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1