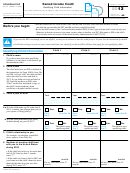

SCHEDULE 8812

OMB No. 1545-0074

Child Tax Credit

1040

◀

(Form 1040A or 1040)

2017

1040A

1040NR

Attach to Form 1040, Form 1040A, or Form 1040NR.

▶

8812

▶

Go to for instructions and the latest

Attachment

Department of the Treasury

47

Sequence No.

Internal Revenue Service (99)

information.

Name(s) shown on return

Your social security number

Part I

Filers Who Have Certain Child Dependent(s) with an Individual Taxpayer Identification Number (ITIN)

▲

!

Complete this part only for each dependent who has an ITIN and for whom you are claiming the child tax credit.

If your dependent is not a qualifying child for the credit, you cannot include that dependent in the calculation of this credit.

CAUTION

Answer the following questions for each dependent listed on Form 1040, line 6c; Form 1040A, line 6c; or Form 1040NR, line 7c, who has an

Individual Taxpayer Identification Number (ITIN) and that you indicated is a qualifying child for the child tax credit by checking column (4) for that

dependent.

A

For the first dependent identified with an ITIN and listed as a qualifying child for the child tax credit, did this child meet the substantial

presence test? See separate instructions.

Yes

No

B

For the second dependent identified with an ITIN and listed as a qualifying child for the child tax credit, did this child meet the substantial

presence test? See separate instructions.

No

Yes

C

For the third dependent identified with an ITIN and listed as a qualifying child for the child tax credit, did this child meet the substantial

presence test? See separate instructions.

Yes

No

D

For the fourth dependent identified with an ITIN and listed as a qualifying child for the child tax credit, did this child meet the substantial

presence test? See separate instructions.

Yes

No

Note: If you have more than four dependents identified with an ITIN and listed as a qualifying child for the child tax credit, see separate instructions

and check here .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

▶

}

Part II

Additional Child Tax Credit Filers

1

If you file Form 2555 or 2555-EZ, stop here; you cannot claim the additional child tax credit.

If you are required to use the worksheet in Pub. 972, enter the amount from line 8 of the Child Tax

Credit Worksheet in the publication. Otherwise:

1

Enter the amount from line 6 of your Child Tax Credit Worksheet (see the

1040 filers:

instructions for Form 1040, line 52).

1040A filers:

Enter the amount from line 6 of your Child Tax Credit Worksheet (see the

instructions for Form 1040A, line 35).

1040NR filers: Enter the amount from line 6 of your Child Tax Credit Worksheet (see the

instructions for Form 1040NR, line 49).

2

2

Enter the amount from Form 1040, line 52; Form 1040A, line 35; or Form 1040NR, line 49

.

.

.

.

.

3

Subtract line 2 from line 1. If zero, stop here; you cannot claim this credit .

.

.

.

.

.

.

.

.

.

.

3

4a

Earned income (see separate instructions)

.

.

.

.

.

.

.

.

.

.

.

4a

b Nontaxable combat pay (see separate

4b

instructions)

.

.

.

.

.

.

.

.

.

.

.

5

Is the amount on line 4a more than $3,000?

No. Leave line 5 blank and enter -0- on line 6.

Yes. Subtract $3,000 from the amount on line 4a. Enter the result .

5

.

.

6

Multiply the amount on line 5 by 15% (0.15) and enter the result .

.

.

.

.

.

.

.

.

.

.

.

.

.

6

Next. Do you have three or more qualifying children?

No. If line 6 is zero, stop here; you cannot claim this credit. Otherwise, skip Part III and enter the

smaller of line 3 or line 6 on line 13.

Yes. If line 6 is equal to or more than line 3, skip Part III and enter the amount from line 3 on line 13.

Otherwise, go to line 7.

For Paperwork Reduction Act Notice, see your tax return instructions.

Cat. No. 59761M

Schedule 8812 (Form 1040A or 1040) 2017

1

1 2

2