2

Schedule 8812 (Form 1040A or 1040) 2017

Page

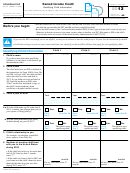

Part III

Certain Filers Who Have Three or More Qualifying Children

7

Withheld social security, Medicare, and Additional Medicare taxes from

Form(s) W-2, boxes 4 and 6. If married filing jointly, include your spouse’s

amounts with yours. If your

employer withheld or you paid Additional

}

7

Medicare Tax or tier 1 RRTA taxes, see separate instructions .

.

.

.

.

.

8

1040 filers:

Enter the total of the amounts from Form 1040, lines

27 and 58, plus any taxes that you identified using code

“UT” and entered on line 62.

1040A filers:

8

Enter -0-.

1040NR filers: Enter the total of the amounts from Form 1040NR,

lines 27 and 56, plus any taxes that you identified using

code “UT” and entered on line 60.

}

9

Add lines 7 and 8 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

9

10

1040 filers:

Enter the total of the amounts from Form 1040, lines

66a and 71.

1040A filers:

Enter the total of the amount from Form 1040A, line

10

42a, plus any excess social security and tier 1 RRTA

taxes withheld that you entered to the left of line 46

(see separate instructions).

1040NR filers: Enter the amount from Form 1040NR, line 67.

11

11

Subtract line 10 from line 9. If zero or less, enter -0-

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

12

Enter the larger of line 6 or line 11

12

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Next, enter the smaller of line 3 or line 12 on line 13.

Part IV

Additional Child Tax Credit

13

This is your additional child tax credit .

13

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Enter this amount on

1040

Form 1040, line 67,

Form 1040A, line 43, or

1040A

Form 1040NR, line 64.

1040NR ◀

Schedule 8812 (Form 1040A or 1040) 2017

1

1 2

2