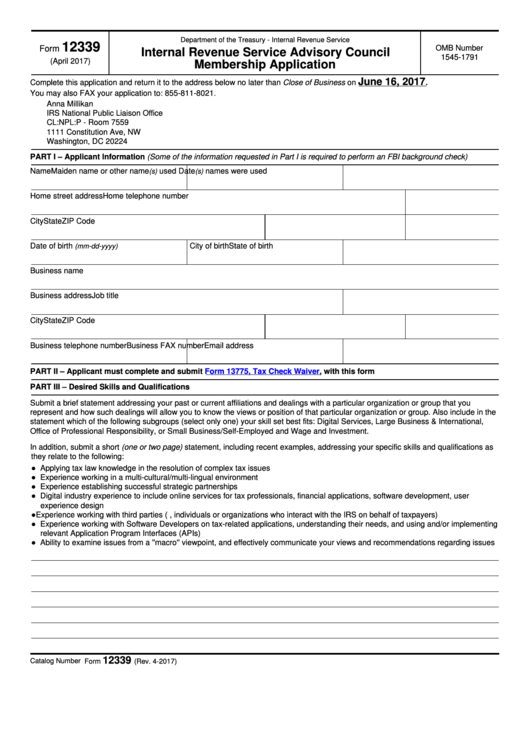

Department of the Treasury - Internal Revenue Service

12339

OMB Number

Form

Internal Revenue Service Advisory Council

1545-1791

(April 2017)

Membership Application

June 16, 2017.

Complete this application and return it to the address below no later than Close of Business on

You may also FAX your application to: 855-811-8021.

Anna Millikan

IRS National Public Liaison Office

CL:NPL:P - Room 7559

1111 Constitution Ave, NW

Washington, DC 20224

PART I – Applicant Information (Some of the information requested in Part I is required to perform an FBI background check)

Name

Maiden name or other name

used

Date

names were used

(s)

(s)

Home street address

Home telephone number

City

State

ZIP Code

Date of birth

City of birth

State of birth

(mm-dd-yyyy)

Business name

Business address

Job title

City

State

ZIP Code

Business telephone number

Business FAX number

Email address

PART II – Applicant must complete and submit

Form 13775, Tax Check

Waiver, with this form

PART III – Desired Skills and Qualifications

Submit a brief statement addressing your past or current affiliations and dealings with a particular organization or group that you

represent and how such dealings will allow you to know the views or position of that particular organization or group. Also include in the

statement which of the following subgroups (select only one) your skill set best fits: Digital Services, Large Business & International,

Office of Professional Responsibility, or Small Business/Self-Employed and Wage and Investment.

In addition, submit a short (one or two page) statement, including recent examples, addressing your specific skills and qualifications as

they relate to the following:

● Applying tax law knowledge in the resolution of complex tax issues

● Experience working in a multi-cultural/multi-lingual environment

● Experience establishing successful strategic partnerships

● Digital industry experience to include online services for tax professionals, financial applications, software development, user

experience design

● Experience working with third parties (i.e., individuals or organizations who interact with the IRS on behalf of taxpayers)

● Experience working with Software Developers on tax-related applications, understanding their needs, and using and/or implementing

relevant Application Program Interfaces (APIs)

● Ability to examine issues from a ''macro'' viewpoint, and effectively communicate your views and recommendations regarding issues

12339

Catalog Number 28320P

Form

(Rev. 4-2017)

1

1 2

2