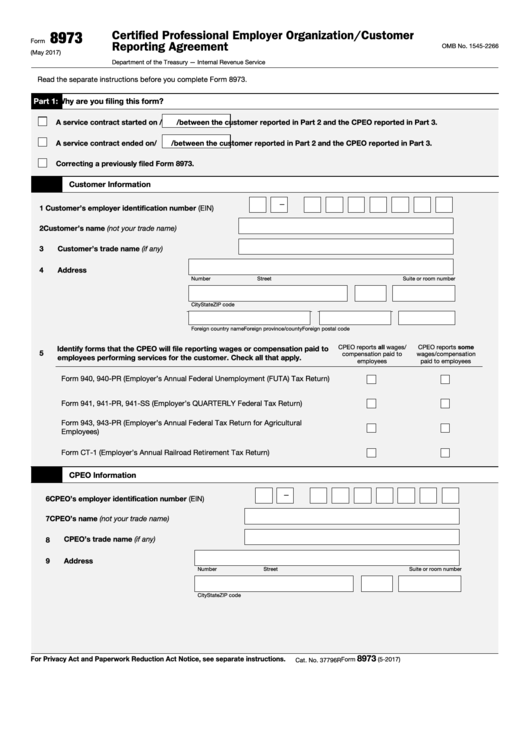

Certified Professional Employer Organization Customer Reporting Agreement

ADVERTISEMENT

8973

Certified Professional Employer Organization/Customer

Form

Reporting Agreement

OMB No. 1545-2266

(May 2017)

Department of the Treasury — Internal Revenue Service

Read the separate instructions before you complete Form 8973.

Part 1:

Why are you filing this form?

A service contract started on

/

/

between the customer reported in Part 2 and the CPEO reported in Part 3.

A service contract ended on

/

/

between the customer reported in Part 2 and the CPEO reported in Part 3.

Correcting a previously filed Form 8973.

Part 2:

Customer Information

—

1

Customer’s employer identification number (EIN)

2

Customer’s name (not your trade name)

Customer’s trade name (if any)

3

4

Address

Number

Street

Suite or room number

City

State

ZIP code

Foreign country name

Foreign province/county

Foreign postal code

CPEO reports all wages/

CPEO reports some

Identify forms that the CPEO will file reporting wages or compensation paid to

5

compensation paid to

wages/compensation

employees performing services for the customer. Check all that apply.

employees

paid to employees

Form 940, 940-PR (Employer’s Annual Federal Unemployment (FUTA) Tax Return)

Form 941, 941-PR, 941-SS (Employer’s QUARTERLY Federal Tax Return)

Form 943, 943-PR (Employer’s Annual Federal Tax Return for Agricultural

Employees)

Form CT-1 (Employer’s Annual Railroad Retirement Tax Return)

Part 3:

CPEO Information

—

6

CPEO’s employer identification number (EIN)

7

CPEO’s name (not your trade name)

CPEO’s trade name (if any)

8

9

Address

Number

Street

Suite or room number

City

State

ZIP code

8973

For Privacy Act and Paperwork Reduction Act Notice, see separate instructions.

Form

(5-2017)

Cat. No. 37796R

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3