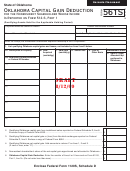

Form 561 Draft - Oklahoma Capital Gain Deduction For Residents - 2013 Page 2

ADVERTISEMENT

Draft

2013 Form 561 - Page 2

Barcode

Placeholder

6/13/13

Oklahoma Capital Gain Deduction

for Residents Filing Form 511

68 Oklahoma Statutes (OS) Sec. 2358 and Rule 710:50-15-48

Worksheets -

(Enclose with Form 561)

Name(s) as Shown on Return

Social Security Number

Form 561 Worksheet for (check one):

Line 3

or

Line 5

Complete a separate worksheet for each piece of property sold. Enclose a copy of the Federal Schedule K-1.

Name of pass-through entity: _____________________________________________________________________

Description of property sold: ______________________________________________________________________

Location of property: ____________________________________________________________________________

Date acquired: ______________________________________ Date sold: __________________________________

Date(s) you acquired ownership in the pass-through entity: ______________________________________________

Form 561 Worksheet for Line 9

Refer to the instructions for Form 511, line 4 and Form 511, Schedule 511-B, line 2 to determine

what gains and losses are considered “out-of-state”. (Generally, sale of an intangible, such as stock, is

not considered out-of-state.)

A

Net Short-Term Capital Gain (or loss) from Federal Schedule D, line 7

+

B

Add Out-of-State Capital Losses included in line A above

-

C

Subtract Out-of-State Capital Gains included in line A above

D

Net Oklahoma Short-Term Capital Loss

(if greater than zero, enter “0”)

E

Net Long-Term Capital Gain (or loss) from Federal Schedule D, line 15

+

F

Add Out-of-State Capital Losses included in line E above

G

Subtract Out-of-State Capital Gains included in line E above

-

H

Net Oklahoma Long-Term Capital Gains

(if less than zero, enter “0”)

I

Oklahoma Net Capital Gain - Enter on the front of form on line 9

(combine lines H and D)

(if less than zero, enter “0”)

Note: For U.S. Government and municipal bonds, which are exempt from Oklahoma tax, include any capital gain on the

Out-of-State Capital Gains line (Line C or G) and any capital loss on the Out-of-State Capital Losses line (Line B or F).

General Information

Individual taxpayers can deduct qualifying gains receiving capital gain treatment which are included in Federal adjusted

gross income. “Qualifying gains receiving capital treatment” means the amount of net capital gains, as defined under

Internal Revenue Code Section 1222(11). The qualifying gain must result from:

1. the sale of real or tangible personal property located within Oklahoma that has been owned for at least five

uninterrupted years prior to the date of the transaction that gave rise to the capital gain;

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3