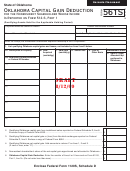

Form 561 Draft - Oklahoma Capital Gain Deduction For Residents - 2013 Page 3

ADVERTISEMENT

2013 Form 561 - Page 3

Oklahoma Capital Gain Deduction for Residents Filing Form 511

68 OS Sec. 2358 and Rule 710:50-15-48

Draft

General Information - continued

6/13/13

2. the sale of stock or an ownership interest in an Oklahoma company, limited liability company, or partnership

where such stock or ownership interest has been owned for at least two uninterrupted years prior to the date

of the transaction that gave rise to the capital gain; or

3. the sale of real property, tangible personal property or intangible personal property located within Oklahoma

as part of the sale of all or substantially all of the assets of an Oklahoma company, limited liability company, or

partnership or an Oklahoma proprietorship business enterprise where such property has been owned by such

entity or business enterprise or owned by the owners of such entity or business enterprise for a period of at

least two uninterrupted years prior to the date of the transaction that gave rise to the capital gain.

An Oklahoma company, limited liability company, partnership or proprietorship business enterprise is an entity whose

primary headquarters has been located in Oklahoma for at least three uninterrupted years prior to the date of sale.

A capital loss carryover from qualified property reduces the current year gains from eligible property.

Pass-through entities...

Capital gain from qualifying property, as described above, held by a pass-through entity is eligible for the Oklahoma capi-

tal gain deduction, provided the individual has been a member of the pass-through entity for an uninterrupted period of

the applicable two or five years and the pass-through entity has held the asset for not less than the applicable two or five

uninterrupted years prior to the date of the transaction that created the capital gain. The type of asset sold, as shown in

1-3 above, determines whether the applicable number of uninterrupted years is two or five. The pass-through entity must

provide supplemental information to the individual identifying the pass-through of qualifying capital gains.

Installment sales...

Qualifying gains included in an individual taxpayer’s Federal adjusted gross income for the current year which are derived

from installment sales are eligible for exclusion, provided the appropriate holding periods are met.

Specific Instructions

Line 1: List qualifying Oklahoma capital gains and losses from Federal Form(s) 8949, Part II. In Column A, line A1 enter

the description of the property as shown in Federal Form 8949, Column a. On line A2 enter either the Oklahoma location/

address of the real or tangible personal property sold or the Federal Identification Number of the company, limited liability

company or partnership whose stock or ownership interest was sold. Complete Columns B through E using the informa-

tion from Federal Form 8949, Columns b through g. In Column B, enter the date the property was acquired. If you entered

“VARIOUS” or “INHERITED” on your Federal Form 8949, enter the date you actually acquired the property. For Column F

combine Columns D and E. Do not include gains and losses reported on Form 561 lines 2 through 5.

Line 2: If Federal Form 6252 was used to report the installment method for gain on the sale of eligible property on the

Federal return, compute the capital gain deduction using the current year’s taxable portion of the installment payment.

Enclose Federal Form 6252. Capital gain from an installment sale is eligible for the Oklahoma capital gain deduction pro-

vided the property was held for the appropriate holding period as of the date sold.

Line 3: Enter the qualifying Oklahoma net capital gain, reported on Federal Schedule D, from the Federal Form 4797.

Enclose a copy of the Federal Form 4797. If reporting a gain/loss from a Federal Schedule K-1, complete the worksheet

on page 2 and enclose a copy of the Federal Schedule K-1.

Line 4: Enter other qualifying Oklahoma capital gains reported on Federal Schedule D, line 11. Enclose the applicable

Federal form(s). If not shown on the Federal form, enclose a schedule identifying the type and location of the property

sold, the date of the sale, and the date the property was acquired.

Line 5: Enter qualifying Oklahoma net capital gain or loss from partnerships, S corporations, trusts and estates. Complete

the worksheet on page 2 and enclose a copy of the Federal Schedule K-1.

Line 7: Enter the total qualifying Oklahoma capital loss carryover from the prior year’s return.

Line 9: The Oklahoma capital gain deduction may not exceed the Oklahoma net capital gain included in Federal adjusted

gross income. To determine the Oklahoma net capital gain, complete the worksheet on page 2.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3