Sales-Lodging Tax Return Instructions

ADVERTISEMENT

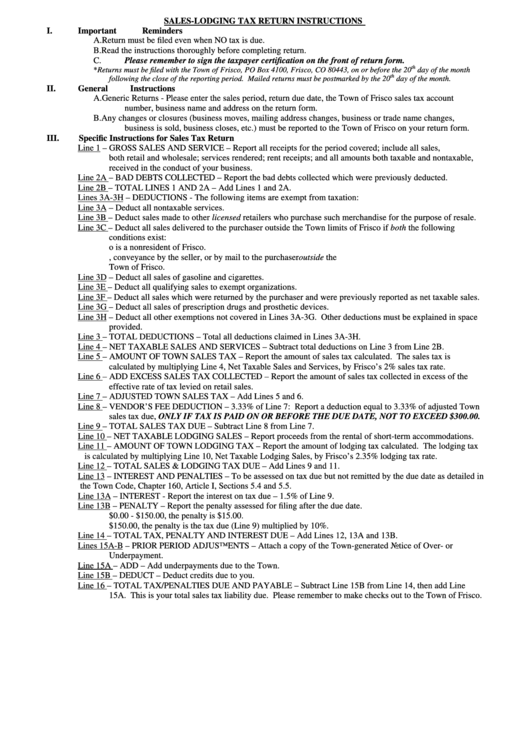

SALES-LODGING TAX RETURN INSTRUCTIONS

I.

Important Reminders

A.

Return must be filed even when NO tax is due.

B.

Read the instructions thoroughly before completing return.

C.

Please remember to sign the taxpayer certification on the front of return form.

th

*Returns must be filed with the Town of Frisco, PO Box 4100, Frisco, CO 80443, on or before the 20

day of the month

th

following the close of the reporting period. Mailed returns must be postmarked by the 20

day of the month.

II.

General Instructions

A.

Generic Returns - Please enter the sales period, return due date, the Town of Frisco sales tax account

number, business name and address on the return form.

B.

Any changes or closures (business moves, mailing address changes, business or trade name changes,

business is sold, business closes, etc.) must be reported to the Town of Frisco on your return form.

III.

Specific Instructions for Sales Tax Return

Line 1 – GROSS SALES AND SERVICE – Report all receipts for the period covered; include all sales,

both retail and wholesale; services rendered; rent receipts; and all amounts both taxable and nontaxable,

received in the conduct of your business.

Line 2A – BAD DEBTS COLLECTED – Report the bad debts collected which were previously deducted.

Line 2B – TOTAL LINES 1 AND 2A – Add Lines 1 and 2A.

Lines 3A-3H – DEDUCTIONS - The following items are exempt from taxation:

Line 3A – Deduct all nontaxable services.

Line 3B – Deduct sales made to other licensed retailers who purchase such merchandise for the purpose of resale.

Line 3C – Deduct all sales delivered to the purchaser outside the Town limits of Frisco if both the following

conditions exist:

1.The sale is to a purchaser who is a nonresident of Frisco.

2.Delivery is made by common carrier, conveyance by the seller, or by mail to the purchaser outside the

Town of Frisco.

Line 3D – Deduct all sales of gasoline and cigarettes.

Line 3E – Deduct all qualifying sales to exempt organizations.

Line 3F – Deduct all sales which were returned by the purchaser and were previously reported as net taxable sales.

Line 3G – Deduct all sales of prescription drugs and prosthetic devices.

Line 3H – Deduct all other exemptions not covered in Lines 3A-3G. Other deductions must be explained in space

provided.

Line 3 – TOTAL DEDUCTIONS – Total all deductions claimed in Lines 3A-3H.

Line 4 – NET TAXABLE SALES AND SERVICES – Subtract total deductions on Line 3 from Line 2B.

Line 5 – AMOUNT OF TOWN SALES TAX – Report the amount of sales tax calculated. The sales tax is

calculated by multiplying Line 4, Net Taxable Sales and Services, by Frisco’s 2% sales tax rate.

Line 6 – ADD EXCESS SALES TAX COLLECTED – Report the amount of sales tax collected in excess of the

effective rate of tax levied on retail sales.

Line 7 – ADJUSTED TOWN SALES TAX – Add Lines 5 and 6.

Line 8 – VENDOR’S FEE DEDUCTION – 3.33% of Line 7: Report a deduction equal to 3.33% of adjusted Town

sales tax due, ONLY IF TAX IS PAID ON OR BEFORE THE DUE DATE, NOT TO EXCEED $300.00.

Line 9 – TOTAL SALES TAX DUE – Subtract Line 8 from Line 7.

Line 10 – NET TAXABLE LODGING SALES – Report proceeds from the rental of short-term accommodations.

Line 11 – AMOUNT OF TOWN LODGING TAX – Report the amount of lodging tax calculated. The lodging tax

is calculated by multiplying Line 10, Net Taxable Lodging Sales, by Frisco’s 2.35% lodging tax rate.

Line 12 – TOTAL SALES & LODGING TAX DUE – Add Lines 9 and 11.

Line 13 – INTEREST AND PENALTIES – To be assessed on tax due but not remitted by the due date as detailed in

the Town Code, Chapter 160, Article I, Sections 5.4 and 5.5.

Line 13A – INTEREST - Report the interest on tax due – 1.5% of Line 9.

Line 13B – PENALTY – Report the penalty assessed for filing after the due date.

1.If the tax due is $0.00 - $150.00, the penalty is $15.00.

2.If the tax due is greater than $150.00, the penalty is the tax due (Line 9) multiplied by 10%.

Line 14 – TOTAL TAX, PENALTY AND INTEREST DUE – Add Lines 12, 13A and 13B.

Lines 15A-B – PRIOR PERIOD ADJUSTMENTS – Attach a copy of the Town-generated Notice of Over- or

Underpayment.

Line 15A – ADD – Add underpayments due to the Town.

Line 15B – DEDUCT – Deduct credits due to you.

Line 16 – TOTAL TAX/PENALTIES DUE AND PAYABLE – Subtract Line 15B from Line 14, then add Line

15A. This is your total sales tax liability due. Please remember to make checks out to the Town of Frisco.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1