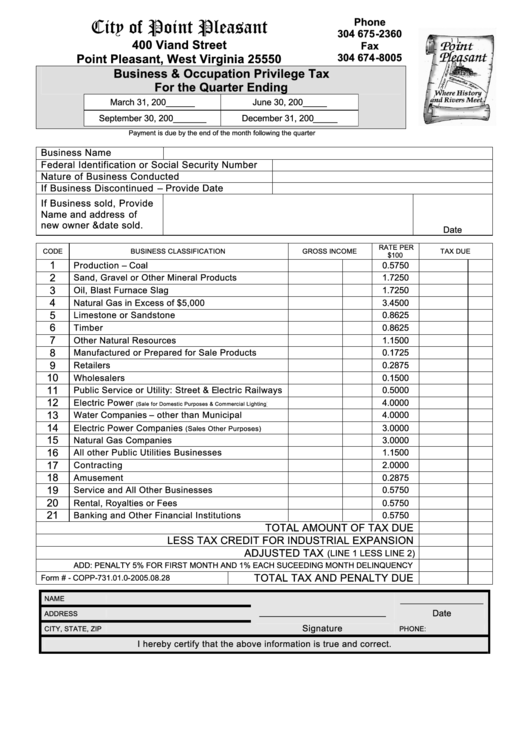

Business & Occupation Privilege Tax Fo The Quarter Ending - City Of Point Pleasant, West Virginia

ADVERTISEMENT

Phone

City of Point Pleasant

304 675-2360

400 Viand Street

Fax

Point Pleasant, West Virginia 25550

304 674-8005

Business & Occupation Privilege Tax

For the Quarter Ending

March 31, 200______

June 30, 200_____

September 30, 200_______

December 31, 200_____

Payment is due by the end of the month following the quarter

Business Name

Federal Identification or Social Security Number

Nature of Business Conducted

If Business Discontinued – Provide Date

If Business sold, Provide

Name and address of

new owner &date sold.

Date

RATE PER

CODE

BUSINESS CLASSIFICATION

GROSS INCOME

TAX DUE

$100

1

Production – Coal

0.5750

2

Sand, Gravel or Other Mineral Products

1.7250

3

Oil, Blast Furnace Slag

1.7250

4

Natural Gas in Excess of $5,000

3.4500

5

Limestone or Sandstone

0.8625

6

Timber

0.8625

7

Other Natural Resources

1.1500

8

Manufactured or Prepared for Sale Products

0.1725

9

Retailers

0.2875

10

Wholesalers

0.1500

11

Public Service or Utility: Street & Electric Railways

0.5000

12

Electric Power

4.0000

(Sale for Domestic Purposes & Commercial Lighting)

13

Water Companies – other than Municipal

4.0000

14

Electric Power Companies

3.0000

(Sales Other Purposes)

15

Natural Gas Companies

3.0000

16

All other Public Utilities Businesses

1.1500

17

Contracting

2.0000

18

Amusement

0.2875

19

Service and All Other Businesses

0.5750

20

Rental, Royalties or Fees

0.5750

21

Banking and Other Financial Institutions

0.5750

TOTAL AMOUNT OF TAX DUE

LESS TAX CREDIT FOR INDUSTRIAL EXPANSION

ADJUSTED TAX

(LINE 1 LESS LINE 2)

ADD: PENALTY 5% FOR FIRST MONTH AND 1% EACH SUCEEDING MONTH DELINQUENCY

TOTAL TAX AND PENALTY DUE

Form # - COPP-731.01.0-2005.08.28

NAME

___________________

_____________________________

Date

ADDRESS

Signature

CITY, STATE, ZIP

PHONE:

I hereby certify that the above information is true and correct.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1