City Of Saint Albans, West Virginia Business And Oggupation Tax Return- Quarterl Form

ADVERTISEMENT

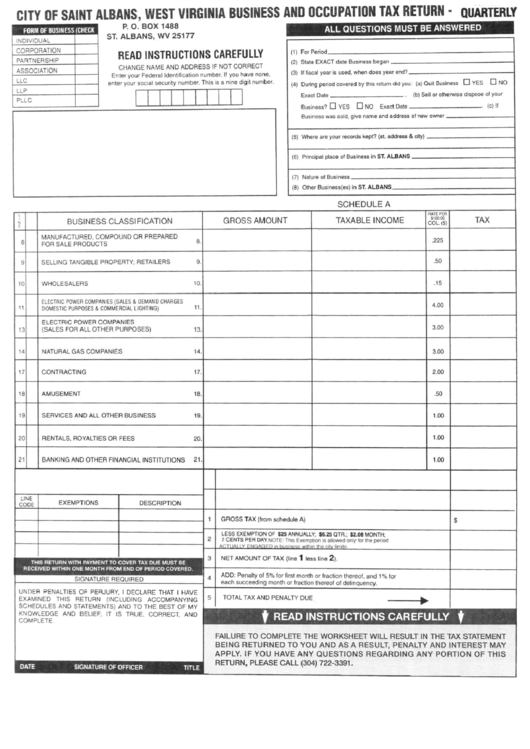

CITY OF SAINT ALBANS, WEST VIRGINIA BUSINESS AND OGGUPATION TAX RETURN- QUARTERLY

FORM OF BUSINESS (CHECK

INDIVIDUAL

CORPORATION

PARTNERSHIP

ASSOCIATION

LLC

LLP

PLLC

P. O. BOX 1488

ST. A L B A N S , WV 25177

READ INSTRUCTIONS CAREFULLY

C H A N G E NAME AND A D D R E S S IF NOT CORRECT

Enter your Federal Identification number. If you have none,

enter your social security number. This is a nine digit number.

ALL QUESTIONS MUST B E ANSWERED

(1)

For Period

•

(2)

State EXACT date Business began

(3)

If fiscal year is used, when does year end?

—

(4)

During period covered by this retum did you: (a) Quit Business

D YES

D NO

Exact Date

(b) Sell or otherwise dispose of your

Business? •

YES

•

NO

Exact Date

Business was sold, give name and address of new owner _

(c) If

(5)

Where are your records kept? (st. address & city)

(6)

Principal place of Business in ST. ALBANS

(7)

Nature of Business

(8)

Other Business(es) in ST. ALBANS.

S C H E D U L E A

N

E

B U S I N E S S CLASSIFICATION

G R O S S AMOUNT

TAXABLE INCOME

RATE P E R

SIOOOO

COL.

(5)

TAX

8

MANUFACTURED, C O M P O U N D OR PREPARED

FOR SALE PRODUCTS

^•

.225

9

SELLING TANGIBLE PROPERTY; RETAILERS

9.

.50

10

W H O L E S A L E R S

10.

.15

11

ELECTRIC POWER COMPANIES (SALES & DEMAND CHARGES

DOMESTIC PURPOSES & COMMERCIAL LIGHTING)

11-

4.00

13

ELECTRIC POWER COMPANIES

(SALES FOR ALL OTHER PURPOSES)

13.

3.00

14

NATURAL GAS COMPANIES

14.

3.00

17

C O N T R A C T I N G

17.

2.00

18

A M U S E M E N T

18.

.50

19

SERVICES AND ALL OTHER B U S I N E S S

19.

1.00

20

RENTALS, ROYALTIES OR FEES

2 0 .

1.00

21

BANKING AND OTHER FINANCIAL INSTITUTIONS

2 1 .

1.00

LINE

CODE

EXEMPTIONS

DESCRIPTION

1

G R O S S TAX (from schedule A)

$

1

G R O S S TAX (from schedule A)

$

2

LESS EXEMPTION OF $25 ANNUALLY; $6.25 QTR.; $2.08 MONTH;

7 CENTS PER DAY.NOTE: This Exemption is allowed only lor the period

A C T U A l IY FNfiAfiFn in hiisines.s within the citv limits

2

LESS EXEMPTION OF $25 ANNUALLY; $6.25 QTR.; $2.08 MONTH;

7 CENTS PER DAY.NOTE: This Exemption is allowed only lor the period

A C T U A l IY FNfiAfiFn in hiisines.s within the citv limits

3

NET A M O U N T OF TAX (line 1 less line 2).

c

T H I S R E T U R N WITH P A Y M E N T T O C O V E R TAX D U E M U S T B E

3

NET A M O U N T OF TAX (line 1 less line 2).

4

ADD:

Penalty of 5 % for first month or fraction thereof, and 1 % for

each succeeding month or fraction thereof of delinquency.

SIGNATURE REQUIRED

4

ADD:

Penalty of 5 % for first month or fraction thereof, and 1 % for

each succeeding month or fraction thereof of delinquency.

UNDER PENALTIES OF PERJURY, 1 D E C L A R E THAT 1 HAVE

EXAMINED

THIS

RETURN

(INCLUDING

A C C O M P A N Y I N G

SCHEDULES AND STATEMENTS) AND T O T H E BEST O F MY

K N O W L E D G E

A N D BELIEF, IT IS T R U E , CORRECT, A N D

C O M P L E T E .

4

ADD:

Penalty of 5 % for first month or fraction thereof, and 1 % for

each succeeding month or fraction thereof of delinquency.

UNDER PENALTIES OF PERJURY, 1 D E C L A R E THAT 1 HAVE

EXAMINED

THIS

RETURN

(INCLUDING

A C C O M P A N Y I N G

SCHEDULES AND STATEMENTS) AND T O T H E BEST O F MY

K N O W L E D G E

A N D BELIEF, IT IS T R U E , CORRECT, A N D

C O M P L E T E .

5

TOTAL TAX AND PENALTY DUE

^

UNDER PENALTIES OF PERJURY, 1 D E C L A R E THAT 1 HAVE

EXAMINED

THIS

RETURN

(INCLUDING

A C C O M P A N Y I N G

SCHEDULES AND STATEMENTS) AND T O T H E BEST O F MY

K N O W L E D G E

A N D BELIEF, IT IS T R U E , CORRECT, A N D

C O M P L E T E .

1 READ INSTRUCTIONS C A R E F U L L Y

f

UNDER PENALTIES OF PERJURY, 1 D E C L A R E THAT 1 HAVE

EXAMINED

THIS

RETURN

(INCLUDING

A C C O M P A N Y I N G

SCHEDULES AND STATEMENTS) AND T O T H E BEST O F MY

K N O W L E D G E

A N D BELIEF, IT IS T R U E , CORRECT, A N D

C O M P L E T E .

FAILURE TO COMPLbl h THE WORKSHEET WILL RESULT IN THE TAX STATEMENT

BEING R E T U R N E D TO YOU AND AS A RESULT, PENALTY AND I N T E R E S T MAY

APPLY. IF YOU HAVE ANY Q U E S T I O N S R E G A R D I N G ANY PORTION O F THIS

RETURN, PLEASE CALL (304) 722-3391.

DATE

SIGNATURE O F O F F I C E R

TITLE

FAILURE TO COMPLbl h THE WORKSHEET WILL RESULT IN THE TAX STATEMENT

BEING R E T U R N E D TO YOU AND AS A RESULT, PENALTY AND I N T E R E S T MAY

APPLY. IF YOU HAVE ANY Q U E S T I O N S R E G A R D I N G ANY PORTION O F THIS

RETURN, PLEASE CALL (304) 722-3391.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1