Form Dr 0021d - Colorado Oil And Gas Severance Tax Schedule - 2008

ADVERTISEMENT

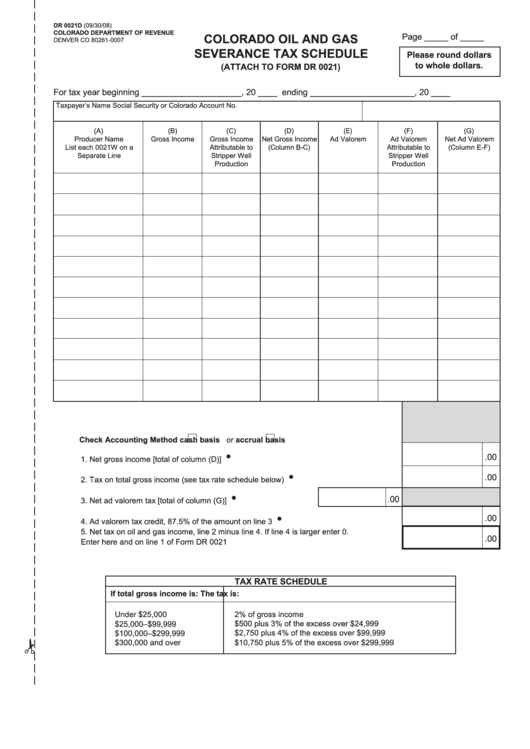

Dr 0021D (09/30/08)

coloraDo DEPartmEnt oF rEVEnuE

Page _____ of _____

coloraDo oil anD gas

DENVER CO 80261-0007

sEVErancE taX schEDulE

Please round dollars

to whole dollars.

(attach to Form Dr 0021)

For tax year beginning _____________________ , 20 ____ ending ______________________, 20 ____

Taxpayer’s Name

Social Security or Colorado Account No.

(A)

(B)

(C)

(D)

(E)

(F)

(G)

Producer Name

Gross Income

Gross Income

Net Gross Income

Ad Valorem

Ad Valorem

Net Ad Valorem

List each 0021W on a

Attributable to

(Column B-C)

Attributable to

(Column E-F)

Separate Line

Stripper Well

Stripper Well

Production

Production

check accounting method

cash basis or

accrual basis

•

..........................

.00

1. Net gross income [total of column (D)] ........................................

•

.00

..........................

2. Tax on total gross income (see tax rate schedule below) ............

•

.00

3. Net ad valorem tax [total of column (G)] ....................................

•

.00

..........................

4. Ad valorem tax credit, 87.5% of the amount on line 3 .................

5. Net tax on oil and gas income, line 2 minus line 4. If line 4 is larger enter 0.

.00

............................

Enter here and on line 1 of Form DR 0021 ..................................

taX ratE schEDulE

if total gross income is:

the tax is:

Under $25,000

2% of gross income

$25,000–$99,999

$500 plus 3% of the excess over $24,999

$2,750 plus 4% of the excess over $99,999

$100,000–$299,999

$300,000 and over

$10,750 plus 5% of the excess over $299,999

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1