HELP

Complete and use the button at the end to print for mailing.

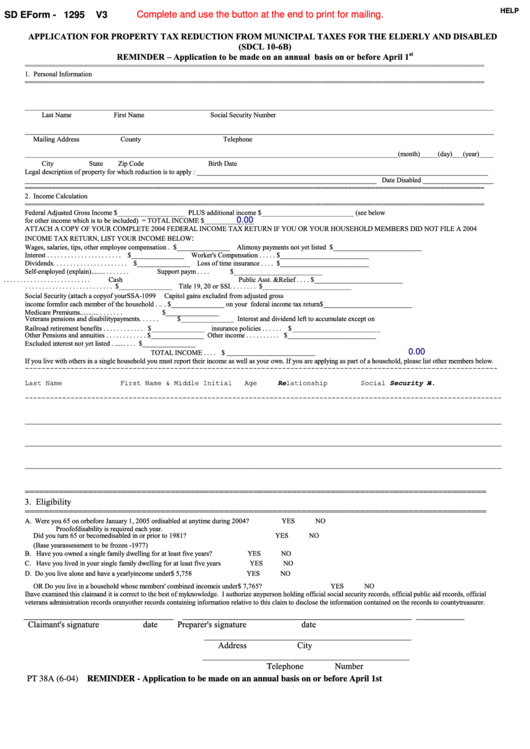

SD EForm - 1295

V3

APPLICATION FOR PROPERTY TAX REDUCTION FROM MUNICIPAL TAXES FOR THE ELDERLY AND DISABLED

(SDCL 10-6B)

st

REMINDER – Application to be made on an annual basis on or before April 1

======================================================================================================================

1. Personal Information

======================================================================================================================

____________________________________________________________________________________________________________________________________

Last Name

First Name

Social Security Number

____________________________________________________________________________________________________________________________________

Mailing Address

County

Telephone

_________________________________________________________________________________________________________(month)_____ (day)___

(year)____

City

State

Zip Code

Birth Date

Legal description of property for which reduction is to apply : __________________________________________________________________________________

___________________________________________________________________________________________________ Date Disabled ____________________

======================================================================================================================

2. Income Calculation

======================================================================================================================

Federal Adjusted Gross Income $___________________ PLUS additional income $__________________________ (see below

0.00

for other income which is to be included) = TOTAL INCOME $______________

ATTACH A COPY OF YOUR COMPLETE 2004 FEDERAL INCOME TAX RETURN IF YOU OR YOUR HOUSEHOLD MEMBERS DID NOT FILE A 2004

:

INCOME TAX RETURN, LIST YOUR INCOME BELOW

Wages, salaries, tips, other employee compensation .

$_______________ Alimony payments not yet listed $_________________________

Interest . . . . . . . . . . . . . . . . . . . . . .

$_______________ Worker's Compensation . . . . .

$_________________________

Dividends. . . . . . . . . . . . . . . . . . . . . .

$_______________ Loss of time insurance . . . .

$_________________________

Self-employed (explain). . . . . . . . . . . . . . .

Support payments. . . . . . .

$_________________________

. . . . . . . . . . . . . . . . . . . . . . . . . .

Cash Public Asst. & Relief . . . . $_________________________

. . . . . . . . . . . . . . . . . . . . . . . . . .

$_______________ Title 19, 20 or SSI . . . . . . . .

$_________________________

Social Security (attach a copy of your SSA-1099

Capitol gains excluded from adjusted gross

income form for each member of the household . . . .

$_______________ on your federal income tax return$_________________________

Medicare Premiums. . . . . . . . . . . . . . . . . .

$_______________

Veterans pensions and disability payments. . . . . .

$_______________ Interest and dividend left to accumulate except on

Railroad retirement benefits . . . . . . . . . . . .

$_______________ insurance policies . . . . . .

$_________________________

Other Pensions and annuities . . . . . . . . . . . .

$_______________ Other income . . . . . . . . . .

$_________________________

Excluded interest not yet listed . . . . . . . . . .

$_______________

0.00

TOTAL INCOME. . . . . . . . . . $ _________________________

If you live with others in a single household you must report their income as well as your own. If you are applying as part of a household, please list other members below.

------------------------------------------------------------------------------------------------------------------

Last Name

First Name & Middle Initial

Age

Social Security No.

Relationship

-------------------------------------------------------------------------------------------------------------------

___________________________________________________________________________________________________________________

___________________________________________________________________________________________________________________

___________________________________________________________________________________________________________________

===============================================================================================

3. Eligibility

===============================================================================================

A. Were you 65 on or before January 1, 2005 or disabled at anytime during 2004?

YES

NO

Proof of disability is required each year.

Did you turn 65 or become disabled in or prior to 1981?

YES

NO

(Base year assessment to be frozen - 1977)

B. Have you owned a single family dwelling for at least five years?

YES

NO

C. Have you lived in your single family dwelling for at least five years

YES

NO

D. Do you live alone and have a yearly income under $ 5,758

YES

NO

OR Do you live in a household whose members' combined income is under $ 7,765?

YES

NO

I have examined this claim and it is correct to the best of my knowledge. I authorize any person holding official social security records, official public aid records, official

veterans administration records or any other records containing information relative to this claim to disclose the information contained on the records to county treasurer.

__________________________________ _______________

_____________________________________ ___________

Claimant's signature

date

Preparer's signature

date

_______________________________________________

Address

City

_______________________________________________

Telephone

Number

PT 38A (6-04) REMINDER - Application to be made on an annual basis on or before April 1st

1

1 2

2